- United States

- /

- Healthcare Services

- /

- NasdaqCM:TOI

Investors Give The Oncology Institute, Inc. (NASDAQ:TOI) Shares A 29% Hiding

The Oncology Institute, Inc. (NASDAQ:TOI) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 1,932% in the last year.

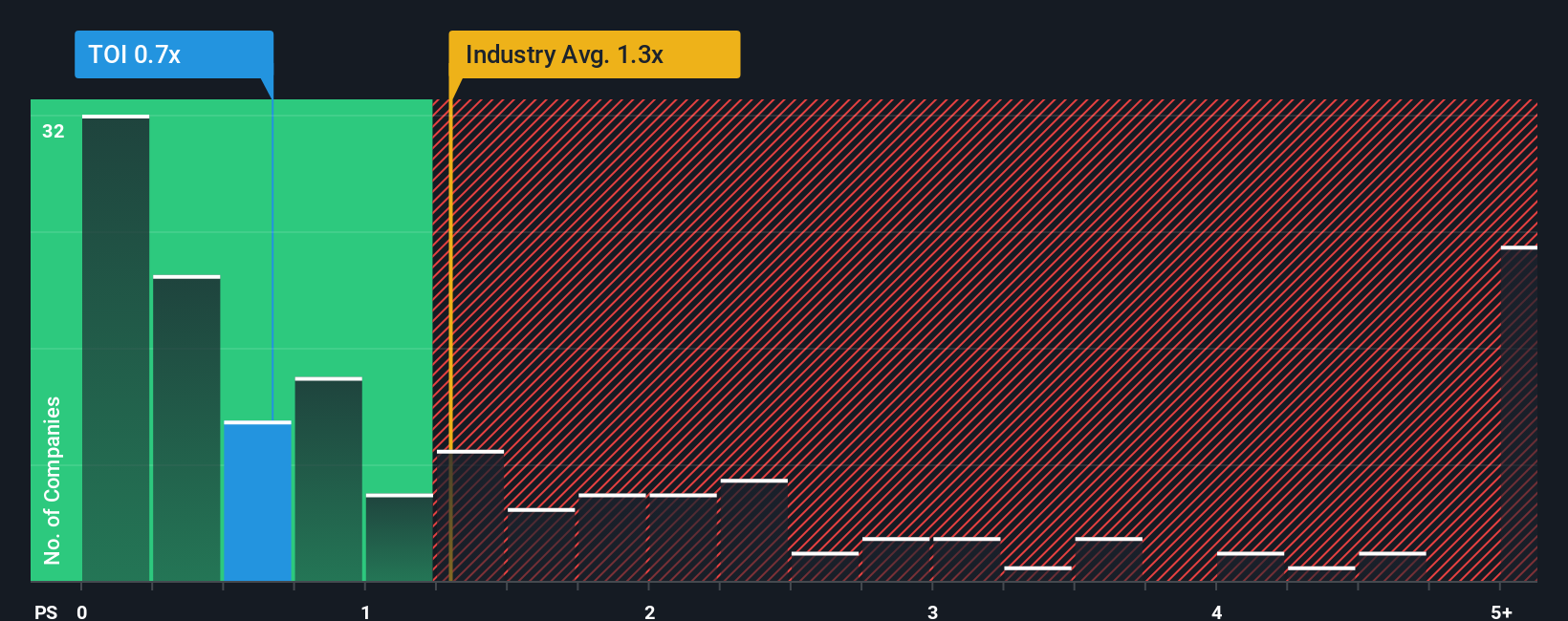

Since its price has dipped substantially, when close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Oncology Institute as an enticing stock to check out with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Oncology Institute

What Does Oncology Institute's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Oncology Institute has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Oncology Institute's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Oncology Institute would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The strong recent performance means it was also able to grow revenue by 98% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.4%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Oncology Institute's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Oncology Institute's P/S?

The southerly movements of Oncology Institute's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Oncology Institute's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 4 warning signs for Oncology Institute (2 are significant!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TOI

Oncology Institute

An oncology company, provides various medical oncology services in the United States.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives