- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

Tandem Diabetes Care (TNDM) Is Up 31.5% After FDA Clears Android App for Insulin Management – What's Changed

Reviewed by Sasha Jovanovic

- Tandem Diabetes Care announced that the U.S. FDA has cleared the Android version of its Tandem Mobi mobile app, enabling Android smartphone users to manage insulin delivery with the company's automated insulin pump system.

- This approval significantly broadens access to Tandem's technology ecosystem and streamlines diabetes management by allowing users to operate the device from a wider selection of smartphones.

- We'll explore how FDA clearance for Android compatibility could broaden Tandem’s addressable market and influence its long-term investment story.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tandem Diabetes Care Investment Narrative Recap

To be a shareholder of Tandem Diabetes Care, one must have confidence that the company’s product innovation and broader technology integration will drive user adoption and recurring revenue, outpacing competitive threats and execution risks. The recent FDA clearance for the Android version of the Tandem Mobi app expands access and could act as a near-term catalyst by supporting pump adoption rates, but it does not entirely eliminate the ongoing risk from increased competition, especially as rivals with larger sales forces intensify their efforts in the U.S. market.

Among recent developments, the October integration of Tandem's t:slim X2 with the Abbott FreeStyle Libre 3 Plus sensor stands out for its relevance to ecosystem expansion and device connectivity. This technological step hints at Tandem’s response to evolving user expectations, supporting a key catalyst: attracting new customers and reinforcing recurring high-margin revenue streams through enhanced system compatibility.

By contrast, investors should also be aware of the persistent risk that larger and more aggressive competitors could quickly change the growth outlook if new pump starts fail to keep pace with...

Read the full narrative on Tandem Diabetes Care (it's free!)

Tandem Diabetes Care's outlook anticipates $1.2 billion in revenue and $14.4 million in earnings by 2028. Achieving these targets will require annual revenue growth of 7.5% and an earnings increase of $219.9 million from the current earnings of -$205.5 million.

Uncover how Tandem Diabetes Care's forecasts yield a $20.64 fair value, a 18% upside to its current price.

Exploring Other Perspectives

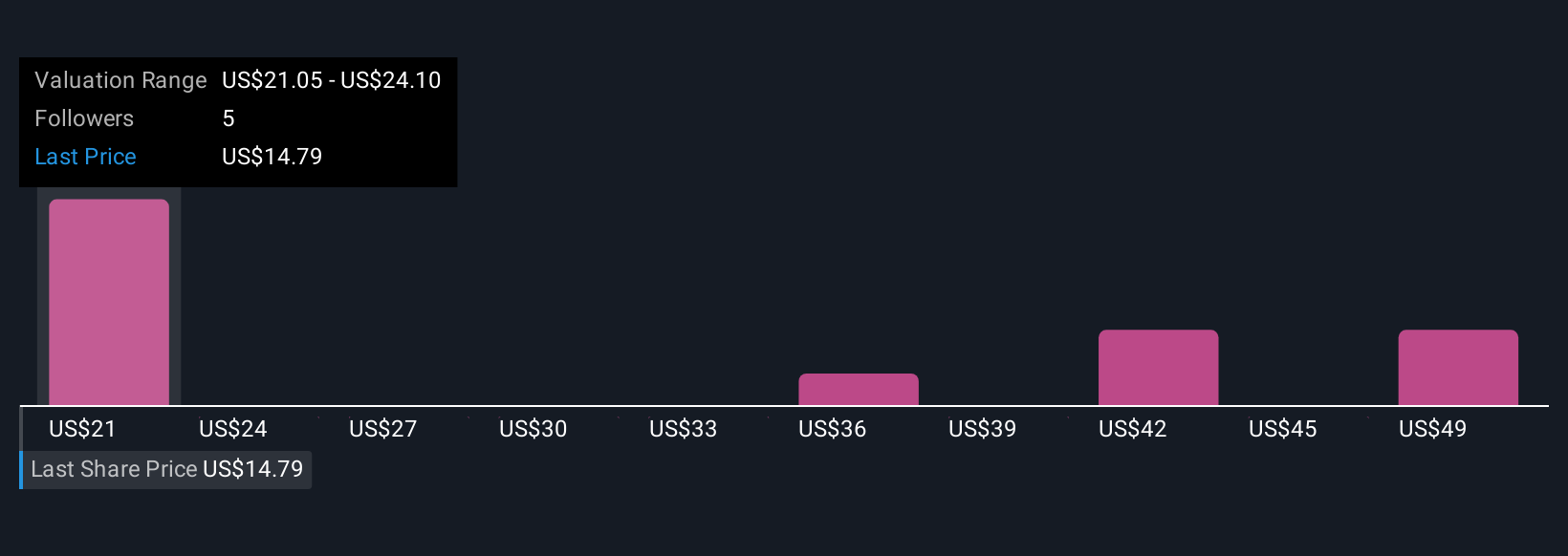

Five different Simply Wall St Community fair value estimates for Tandem Diabetes Care range widely from US$20.64 to US$52.72. As you consider your own outlook, keep in mind that broader pharmacy channel expansion is expected to boost adoption and recurring revenue, but market conditions remain highly competitive.

Explore 5 other fair value estimates on Tandem Diabetes Care - why the stock might be worth just $20.64!

Build Your Own Tandem Diabetes Care Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tandem Diabetes Care research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Tandem Diabetes Care research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tandem Diabetes Care's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TNDM

Tandem Diabetes Care

Designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives