- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

Why TransMedics Group (TMDX) Is Up After Raising 2025 Revenue Outlook and Posting Strong Q3 Results

Reviewed by Sasha Jovanovic

- TransMedics Group reported strong third quarter financial results, with revenue for the period ending September 30, 2025 reaching US$143.82 million and net income of US$24.32 million.

- The company also raised its full-year 2025 revenue guidance mid-point, reflecting management's confidence in ongoing adoption of its transplant technology across key markets.

- We’ll explore how TransMedics’ upgraded revenue outlook may influence analyst expectations for the company’s longer-term earnings growth.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

TransMedics Group Investment Narrative Recap

To be a shareholder in TransMedics Group, you have to believe in the ongoing expansion of advanced organ transplant technology, driven by secular growth in transplant demand and clinical adoption of the company’s OCS platform. The latest upgrade to full-year revenue guidance after a robust third quarter builds confidence around near-term revenue catalysts, though the biggest risk, competition and regulatory scrutiny on organ procurement practices, remains largely unchanged by these results.

Among several recent company moves, the conditional FDA approval to initiate the next-generation OCS ENHANCE Heart trial stands out. This development is directly relevant to the business’s catalysts, supporting both product innovation and future expansion of the total addressable market, which are central to TransMedics’ long-term earnings story.

However, in contrast to accelerating growth, the evolving regulatory environment for organ procurement still poses a material risk investors should keep front-of-mind...

Read the full narrative on TransMedics Group (it's free!)

TransMedics Group's narrative projects $890.5 million in revenue and $155.9 million in earnings by 2028. This requires 18.8% yearly revenue growth and an $84.2 million increase in earnings from $71.7 million today.

Uncover how TransMedics Group's forecasts yield a $141.91 fair value, a 16% upside to its current price.

Exploring Other Perspectives

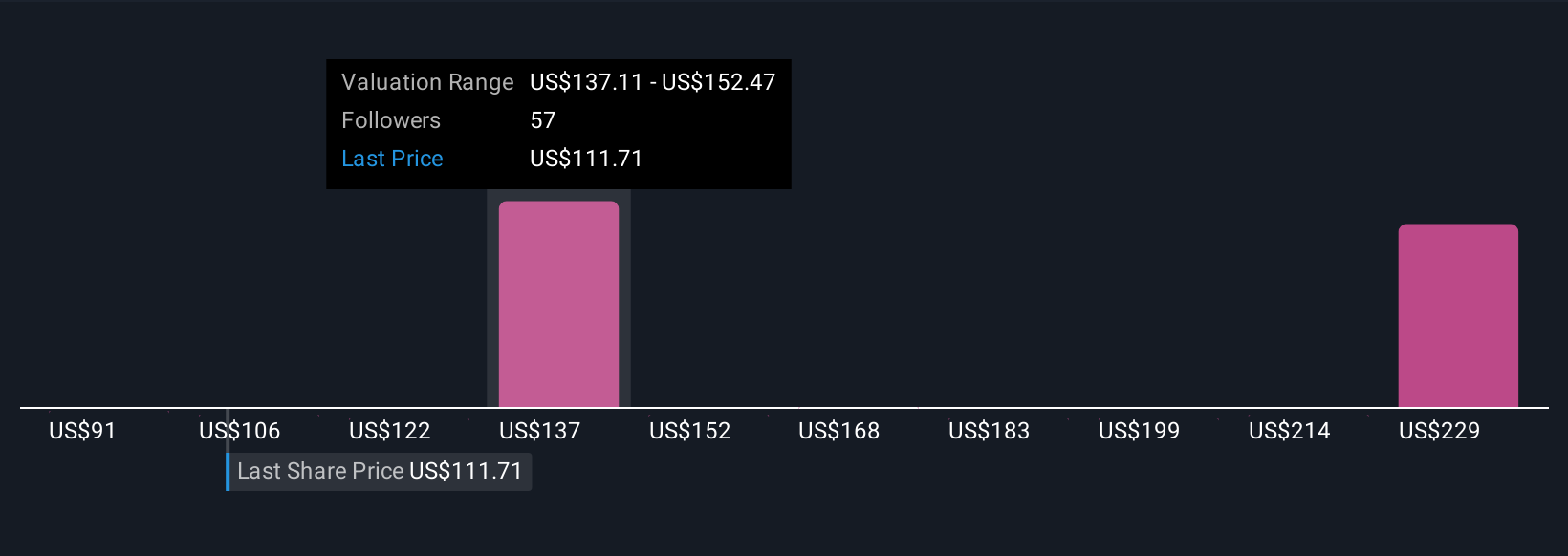

Eight Simply Wall St Community fair value estimates for TransMedics span from US$114 to US$231, indicating substantial differences in perceived potential. Despite this spread, ongoing clinical innovation remains essential to sustaining long-term growth and market leadership, consider how widely opinions differ when evaluating the company’s future earnings profile.

Explore 8 other fair value estimates on TransMedics Group - why the stock might be worth 7% less than the current price!

Build Your Own TransMedics Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransMedics Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TransMedics Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransMedics Group's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives