- United States

- /

- Specialty Stores

- /

- NasdaqCM:EM

Smart Share Global And 2 Other Compelling Penny Stocks To Watch

Reviewed by Simply Wall St

In the last week, the market has stayed flat, though it is up 7.2% over the past year and earnings are forecast to grow by 14% annually. Penny stocks may be a throwback term, but they still represent intriguing opportunities for investors seeking growth at lower price points. By focusing on companies with strong balance sheets and solid fundamentals, investors can uncover potential hidden gems that offer upside without many of the risks typically associated with this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.42 | $366.95M | ✅ 4 ⚠️ 3 View Analysis > |

| IDenta (OTCPK:IDTA) | $0.324 | $1.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.32 | $1.41B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.924 | $18.31M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.30 | $9.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.58 | $46.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.605 | $91.54M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.8424 | $5.94M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.23 | $77.55M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8269 | $72.57M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 763 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Smart Share Global (NasdaqCM:EM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Smart Share Global Limited is a consumer tech company that offers mobile device charging services in the People's Republic of China, with a market cap of $268.75 million.

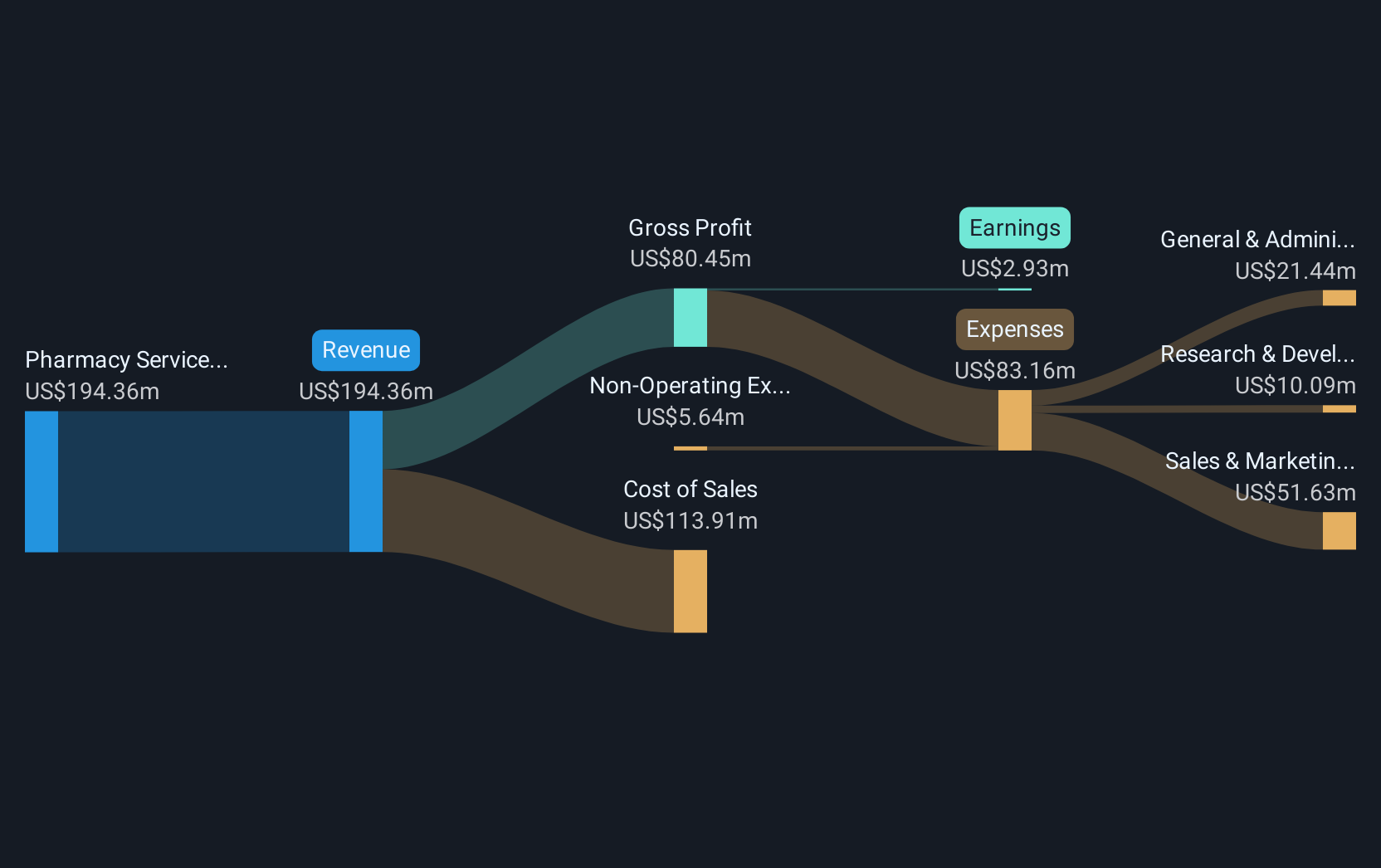

Operations: The company's revenue is derived from two main segments: Mobile Device Charging, generating CN¥1.41 billion, and Pv Business, contributing CN¥479.85 million.

Market Cap: $268.75M

Smart Share Global is navigating financial challenges, with its recent earnings report showing a decline in revenue to CN¥1.89 billion from CN¥2.96 billion the previous year and a net loss of CN¥13.53 million compared to a net income of CN¥88.74 million last year. Despite being unprofitable, the company has reduced its losses over five years by 57.7% annually and maintains strong liquidity, with short-term assets exceeding liabilities significantly and no debt burden. The management team is experienced, contributing to stability as they leverage their cash runway projected for over three years at current free cash flow levels.

- Dive into the specifics of Smart Share Global here with our thorough balance sheet health report.

- Evaluate Smart Share Global's prospects by accessing our earnings growth report.

Talkspace (NasdaqCM:TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States, with a market cap of approximately $526.37 million.

Operations: Talkspace, Inc. does not report distinct revenue segments.

Market Cap: $526.37M

Talkspace, Inc. has shown financial improvement, reporting a net income of US$0.318 million for Q1 2025 compared to a loss last year and achieving profitability over the past year. The company’s recent partnership with Bark Technologies aims to address the growing mental health needs of teens by integrating its services into Bark's platforms, potentially expanding its user base. Talkspace is debt-free with strong liquidity, as short-term assets significantly exceed liabilities, and it trades below estimated fair value. Despite past volatility in returns and low return on equity, analysts expect substantial revenue growth this fiscal year.

- Get an in-depth perspective on Talkspace's performance by reading our balance sheet health report here.

- Gain insights into Talkspace's outlook and expected performance with our report on the company's earnings estimates.

Adagene (NasdaqGM:ADAG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Adagene Inc. is a clinical-stage biotechnology company focused on researching, developing, and producing monoclonal antibody drugs for cancer treatment in China, with a market cap of $76.32 million.

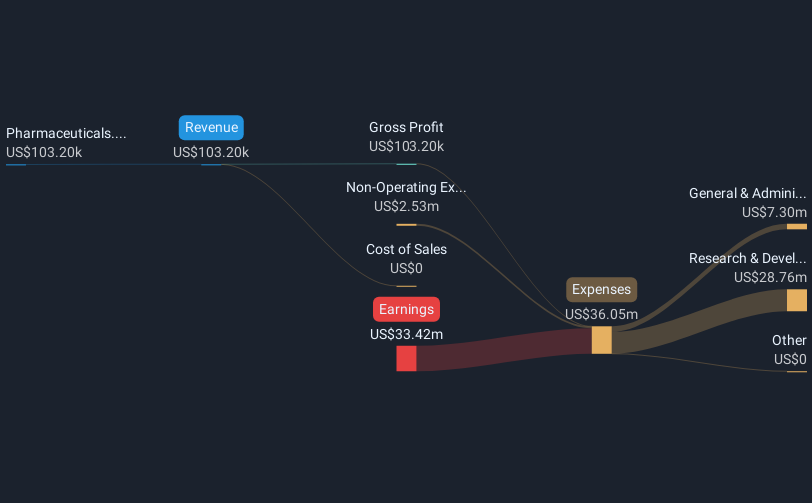

Operations: Adagene generates its revenue primarily from its pharmaceuticals segment, amounting to $0.10 million.

Market Cap: $76.32M

Adagene Inc., a clinical-stage biotech firm, remains pre-revenue with only US$103K in revenue and is not expected to achieve profitability in the next three years. Despite trading at 92% below estimated fair value, its debt-to-equity ratio has increased significantly over five years. The company reported a net loss of US$33.42 million for 2024, up from the previous year. However, Adagene's seasoned management and board provide stability, while its short-term assets cover both short- and long-term liabilities comfortably. The recent initiation of a Phase 2 trial for ADG126 highlights ongoing efforts in therapeutic development despite financial challenges.

- Click here to discover the nuances of Adagene with our detailed analytical financial health report.

- Examine Adagene's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Investigate our full lineup of 763 US Penny Stocks right here.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EM

Smart Share Global

A consumer tech company, provides mobile device charging services through online and offline network in the People's Republic of China.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives