- United States

- /

- Medical Equipment

- /

- NasdaqGM:STAA

STAAR Surgical (STAA): A Fresh Look at Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for STAAR Surgical.

After a strong rally in the first quarter, STAAR Surgical’s share price momentum has cooled, with a 7% slide over the past month and a 4.8% dip just in the last trading session. While recent performance has lagged, with the 1-year total shareholder return down nearly 20%, the sharp 49% share price rebound over the past 90 days hints that investor sentiment is beginning to shift, even as longer-term holders remain under water.

If healthcare trends or medical device stories like STAAR’s interest you, you can spot emerging ideas by browsing the See the full list for free..

With shares down for the year but coming off a rapid rebound, the central question for investors is clear: Is STAAR Surgical undervalued at current levels, or has the market already priced in the company’s future growth prospects?

Most Popular Narrative: 30% Undervalued

Compared to its recent closing price of $25.80, the most widely followed narrative suggests STAAR Surgical could be trading well below fair value, largely due to upcoming catalysts. With expectations set for market expansion and new product launches, the future growth story remains front and center.

STAAR Surgical is experiencing ongoing challenges in China due to weak consumer confidence and macroeconomic conditions, but anticipates a rebound in the second half of 2025, driven by government stimulus and pent-up consumer demand. This is expected to impact revenue growth positively.

What is fueling that fair value number? Strong top line recovery, margin improvement, and ambitious analyst assumptions on profitability. There is a bold growth target baked into this scenario, but the real surprises are in the details. Wondering which leap-of-faith assumptions are driving the price well above today’s market? Find out why this narrative has everyone talking.

Result: Fair Value of $25.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sizeable risks remain. These include weak demand in China and the company’s dependence on a single distributor, both of which could limit recovery.

Find out about the key risks to this STAAR Surgical narrative.

Another View: What About Price-to-Sales?

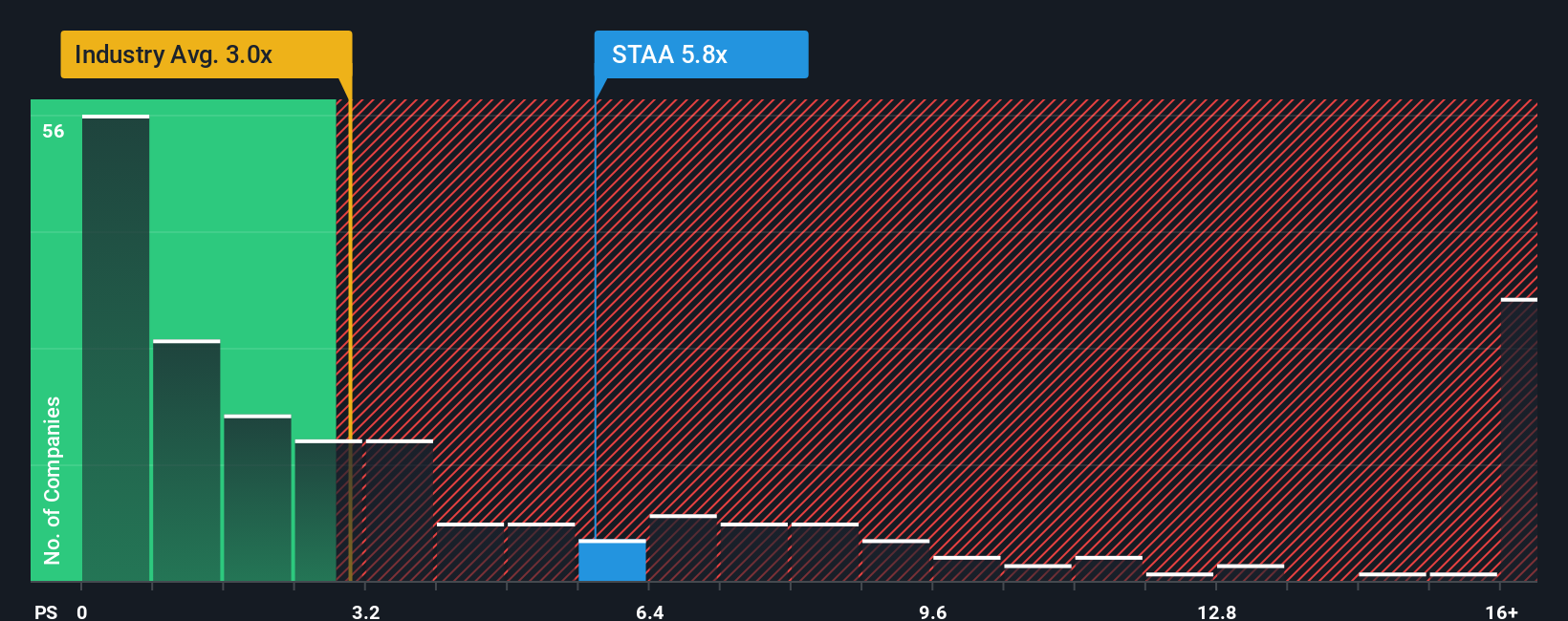

Looking beyond fair value estimates, the price-to-sales ratio shows STAAR Surgical trading at 5.7 times sales. This is nearly double both the US Medical Equipment industry average of 2.8x and the peer average of 3x. Compared to the fair ratio of 3.7x, this suggests the stock might be expensive by sales metrics. This raises the question: is the market overestimating future growth, or is something unique at play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STAAR Surgical Narrative

If you prefer to dive into the numbers personally or challenge the consensus, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your STAAR Surgical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Ideas?

Don’t wait on just one opportunity. Use Simply Wall Street’s powerful Screener to uncover stocks shaking up tomorrow’s markets and set your portfolio apart from the crowd.

- Kickstart your search for high potential growth with these 3576 penny stocks with strong financials, which are making headlines for robust financials and big upside potential.

- Capture gains in the AI revolution by targeting these 24 AI penny stocks, which are leading innovations in automation, machine learning, and future-focused tech.

- Cement your portfolio's stability with income from these 20 dividend stocks with yields > 3%, offering attractive yields and reliable cash returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:STAA

STAAR Surgical

Designs, develops, manufactures, and sells implantable lenses for the eye and accessory delivery systems to deliver the lenses into the eye.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives