- United States

- /

- Medical Equipment

- /

- NasdaqCM:SMTI

Sanara MedTech (SMTI): Fresh Focus on Surgical Business Prompts New Look at Valuation After Earnings Beat and Business Shift

Reviewed by Simply Wall St

Sanara MedTech (SMTI) has caught investor attention after announcing plans to discontinue its Tissue Health Plus segment in addition to reporting strong third quarter earnings results. The company is refocusing resources on its core surgical business.

See our latest analysis for Sanara MedTech.

Sanara MedTech’s announcement to exit the Tissue Health Plus business and focus on its surgical division arrived after a volatile stretch for shareholders. Despite last week’s sharp one-day share price gain of 9.8% after earnings, the stock remains down nearly 35% year-to-date on a price basis. It has recorded a 37.8% total shareholder return loss over the past year, reflecting pressures from both the broader small-cap market and company-specific transitions. Momentum has picked up since the earnings report, but recovery will depend on how effectively Sanara pivots towards growth in its surgical business.

If Sanara’s moves have you wondering what else is shaking up healthcare, take the next step and discover See the full list for free.

With Sanara’s valuation still lagging after recent gains and analyst targets suggesting significant upside, investors are left to decide if challenges are already accounted for or if the latest turnaround marks a genuine buying opportunity.

Most Popular Narrative: 47.5% Undervalued

With the narrative pointing to a fair value nearly double Sanara MedTech’s last close, investors are grappling with a valuation gap that suggests hidden growth drivers could be at play. The market’s rebound could hinge on whether this outlook proves justified as the company pivots away from digital health and sharpens its focus on surgical innovation.

Successful execution of clinical evidence expansion and the ongoing adoption of flagship products CellerateRx and BIASURGE, backed by improved surgeon engagement and cross-specialty adoption, position Sanara to not only increase sales volume but also achieve higher net margins as proprietary, high-value solutions represent a larger share of revenues in a market demanding advanced and outcomes-driven wound care.

What is the financial engine behind such an aggressive assessment? It’s all about a big bet on margin expansion and future recurring revenues. The real shock comes from just how high the implied profit multiple is, and the ambitious revenue climb that justifies this high target. Want to uncover which numbers drive this bold thesis? Read on for all the details inside the narrative.

Result: Fair Value of $41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in digital health profitability or continued net losses could quickly undermine this optimistic view. This could challenge Sanara’s turnaround thesis in the near term.

Find out about the key risks to this Sanara MedTech narrative.

Another View: Market-Based Valuation Tells a Different Story

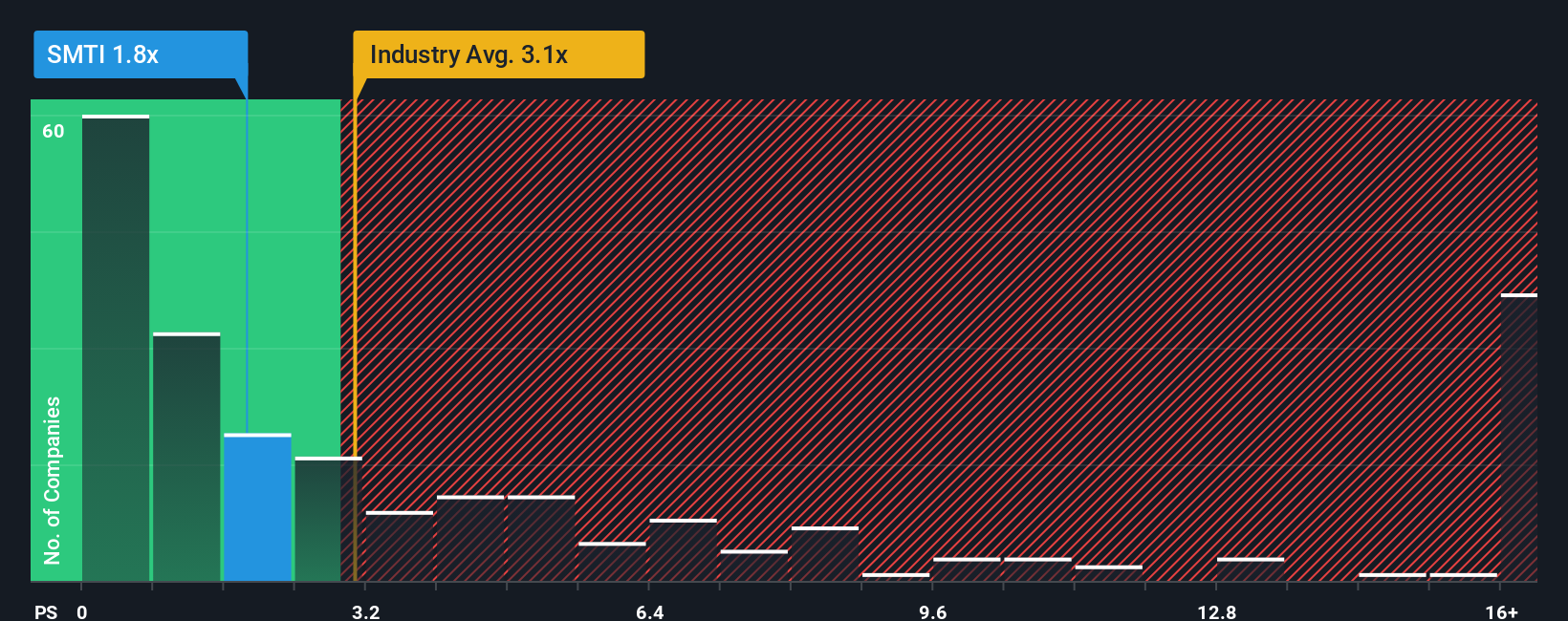

While the narrative sees Sanara as significantly undervalued, a look at the price-to-sales ratio paints a less bullish picture. Sanara trades at 1.9x sales, which is not much higher than peers at 1.7x, but well below the industry average of 3.1x. Intriguingly, the fair ratio sits at 3.8x, suggesting a potential upside if the market recognizes the company’s growth potential. Does this gap signal an overlooked opportunity, or does it reflect real risks the market cannot ignore?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sanara MedTech Narrative

If this perspective does not quite resonate or you want to run the numbers your own way, you can craft a personalized story for Sanara in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Sanara MedTech.

Looking for More Smart Investment Ideas?

Don’t put your portfolio on autopilot when there are thousands of unique companies making big moves every week. Let’s put your money to work smarter by starting your research right now:

- Capture big yields and add income power to your portfolio by scanning these 16 dividend stocks with yields > 3% returning over 3%.

- Ride the next wave of artificial intelligence by tracking market movers among these 24 AI penny stocks leading the charge in this fast-evolving sector.

- Uncover hidden gems trading at bargain prices with these 874 undervalued stocks based on cash flows based on future cash flows and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMTI

Sanara MedTech

A medical technology company, develops, markets, and distributes surgical, wound, and skincare products and services to physicians, hospitals, clinics, and post-acute care settings in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives