- United States

- /

- Medical Equipment

- /

- NasdaqCM:SMLR

Can Semler Scientific's (SMLR) Dual Leadership Structure Sustain Long-Term Management Credibility?

Reviewed by Sasha Jovanovic

- On October 16, 2025, Semler Scientific, Inc. announced that Chief Financial Officer Renae Cormier resigned to pursue another opportunity, effective October 30, 2025, with CEO Dr. Douglas Murphy-Chutorian appointed as interim CFO in addition to his current roles.

- This executive reorganization places both the chief executive and financial oversight responsibilities with one individual, which can draw investor scrutiny regarding management continuity and internal controls.

- We'll examine how the appointment of the CEO as interim CFO may influence Semler Scientific’s investment narrative and perceived leadership stability.

Find companies with promising cash flow potential yet trading below their fair value.

Semler Scientific Investment Narrative Recap

To be a shareholder of Semler Scientific, investors generally need confidence in the company’s ability to execute its dual strategy: stabilizing healthcare revenues and leveraging its Bitcoin treasury approach. The recent CFO resignation and interim appointment of the CEO is unlikely to materially impact the short-term catalysts, such as the CardioVanta cardiac device initiative, or the most significant risk, which remains heavy exposure to declining healthcare revenues and volatile Bitcoin holdings.

Among recent announcements, the $29.75 million settlement with the DOJ over alleged Medicare billing violations is highly relevant, coming just before the CFO transition. This legal resolution removes a key overhang but offsetting reimbursement and device usage headwinds continue to pressure Semler’s core business. Maintaining investor confidence during an executive leadership shift may therefore be closely tied to the ability to mitigate recurring revenue declines and legal risk exposure.

In contrast, the leadership transition highlights one potential blind spot that investors should closely monitor regarding internal controls and operational risk…

Read the full narrative on Semler Scientific (it's free!)

Semler Scientific's narrative projects $28.8 million revenue and $4.8 million earnings by 2028. This requires a 12.5% yearly revenue decline and a $32.2 million decrease in earnings from $37.0 million today.

Uncover how Semler Scientific's forecasts yield a $75.33 fair value, a 140% upside to its current price.

Exploring Other Perspectives

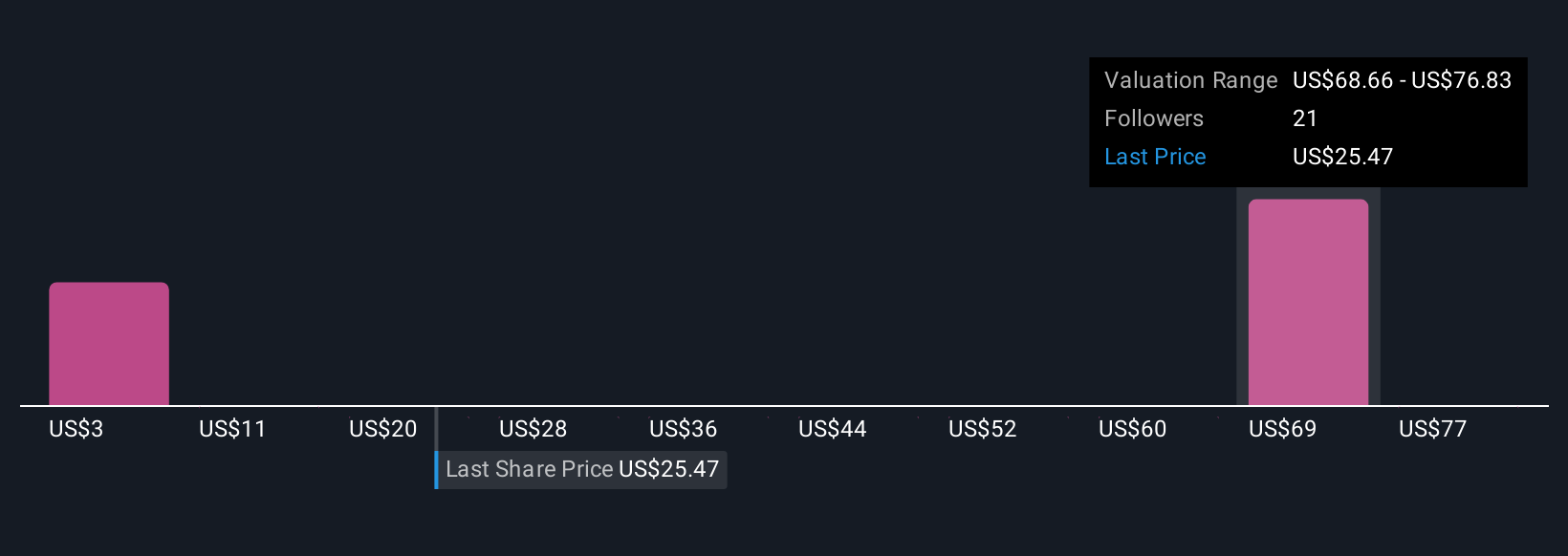

Four Simply Wall St Community fair value estimates for Semler Scientific span from US$3.32 to US$75.33 per share, with more than a tenfold difference in expectations. While many are focused on growth potential in new markets, sharp volatility in healthcare revenue and Bitcoin exposure remains front of mind for some, showing just how widely opinions differ on what could shape future performance.

Explore 4 other fair value estimates on Semler Scientific - why the stock might be worth less than half the current price!

Build Your Own Semler Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Semler Scientific research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Semler Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Semler Scientific's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMLR

Semler Scientific

Provides technology solutions to enhance the clinical effectiveness and efficiency of healthcare providers in the United States.

Proven track record with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion