- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

Does New Leadership and Revenue Update Shift the Bull Case for Surgery Partners (SGRY)?

Reviewed by Sasha Jovanovic

- In November 2025, Surgery Partners announced the appointment of Justin Oppenheimer as Chief Operating Officer and National Group President, alongside the release of third quarter earnings showing year-over-year sales growth and a narrower quarterly net loss.

- The company also provided updated full-year 2025 revenue guidance, giving stakeholders clearer insight into management’s expectations and operational outlook for the remainder of the year.

- With fresh leadership and new revenue projections in place, we'll examine how these developments influence Surgery Partners’ investment narrative and earnings expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Surgery Partners Investment Narrative Recap

To own Surgery Partners stock, an investor must have confidence in the continued migration of high-acuity surgical cases to outpatient settings, and the company’s ability to capture volume through physician recruitment and facility investments. The recent appointment of Justin Oppenheimer as Chief Operating Officer and National Group President provides experienced leadership but does not materially change the near-term catalyst: accelerating revenue from higher-acuity procedures. However, the elevated risk of rising interest expenses, stemming from expiring fixed-rate swaps and exposure to floating rates, remains a key short-term concern that the leadership update does not directly resolve.

Among recent announcements, the updated full-year 2025 revenue guidance, now projected between US$3.275 billion and US$3.30 billion, stands out. This projection gives shareholders a more precise view of management’s outlook and operational confidence, directly informing expectations around the ability to scale revenue through new procedures and facility efficiency, both crucial facing the catalysts and headwinds outlined above. It will be important to monitor how well the company manages both operational execution and financial discipline as new leadership comes on board for 2026.

In contrast, investors should also consider the significant impact that higher cash outflows from increasing debt service costs could have on earnings, especially if interest rates remain elevated or swap expirations...

Read the full narrative on Surgery Partners (it's free!)

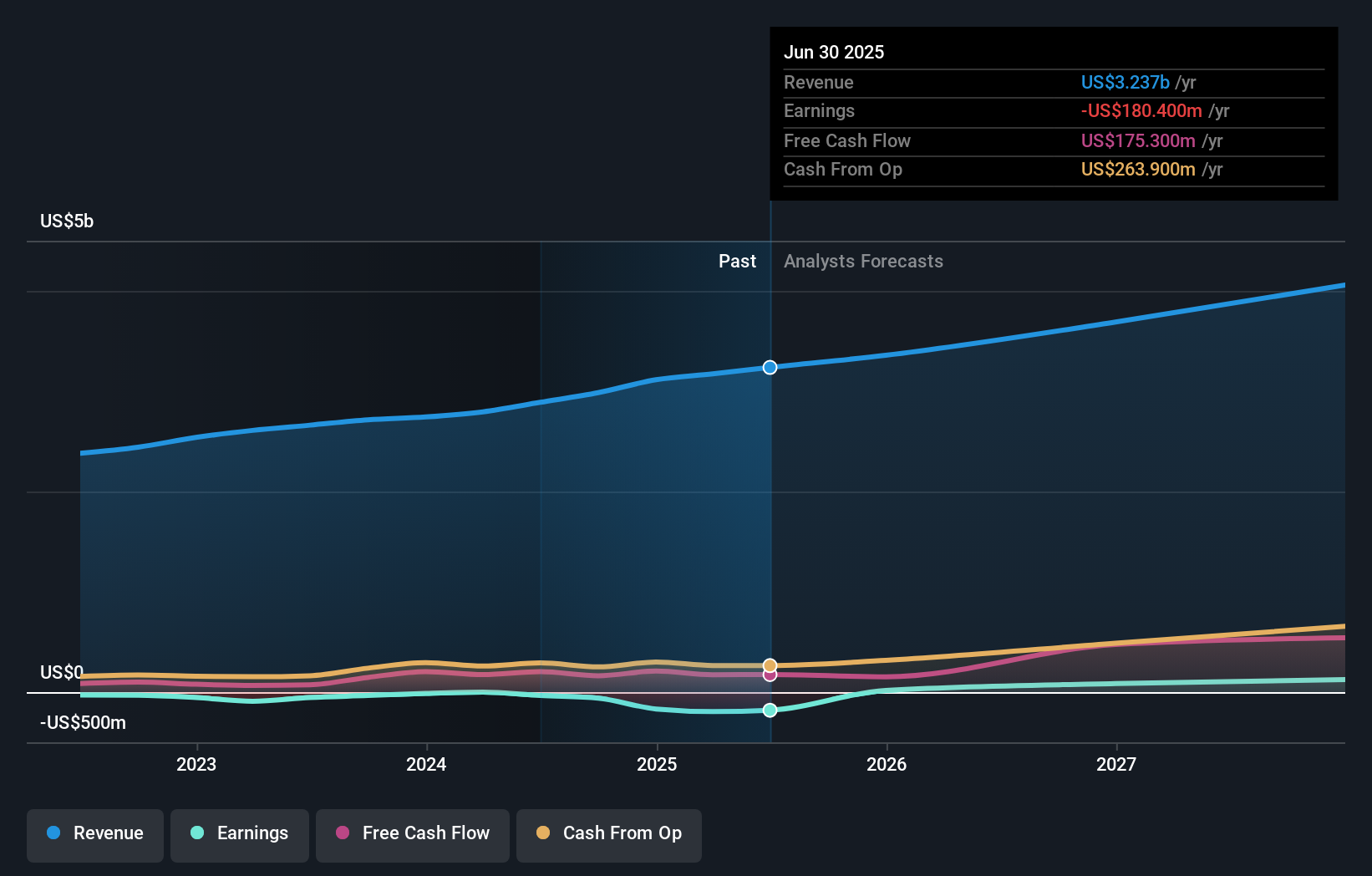

Surgery Partners' outlook forecasts $4.3 billion in revenue and $164.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 9.9% and an earnings increase of $344.7 million from current earnings of -$180.4 million.

Uncover how Surgery Partners' forecasts yield a $27.91 fair value, a 84% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$27.91 to US$72.78, reflecting two distinct perspectives. While the community expresses a wide range of opinions, updated revenue guidance from management could shift expectations quickly, consider reviewing several viewpoints before making any conclusions.

Explore 2 other fair value estimates on Surgery Partners - why the stock might be worth over 4x more than the current price!

Build Your Own Surgery Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Surgery Partners research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Surgery Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Surgery Partners' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026