- United States

- /

- Healthcare Services

- /

- NasdaqGM:SBC

Undiscovered Gems in United States for October 2024

Reviewed by Simply Wall St

The market has stayed flat over the past 7 days but has risen 34% in the past 12 months, with earnings forecast to grow by 15% annually. In this dynamic environment, identifying stocks with strong growth potential and solid fundamentals can uncover some of the most promising opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| San Juan Basin Royalty Trust | NA | 33.61% | 35.00% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

SBC Medical Group Holdings (NasdaqGM:SBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SBC Medical Group Holdings Incorporated provides management services to cosmetic treatment centers in Japan, Vietnam, and internationally and has a market cap of $802.92 million.

Operations: SBC Medical Group Holdings generates revenue primarily from healthcare facilities and services, amounting to $217.54 million. The company has a market cap of $802.92 million.

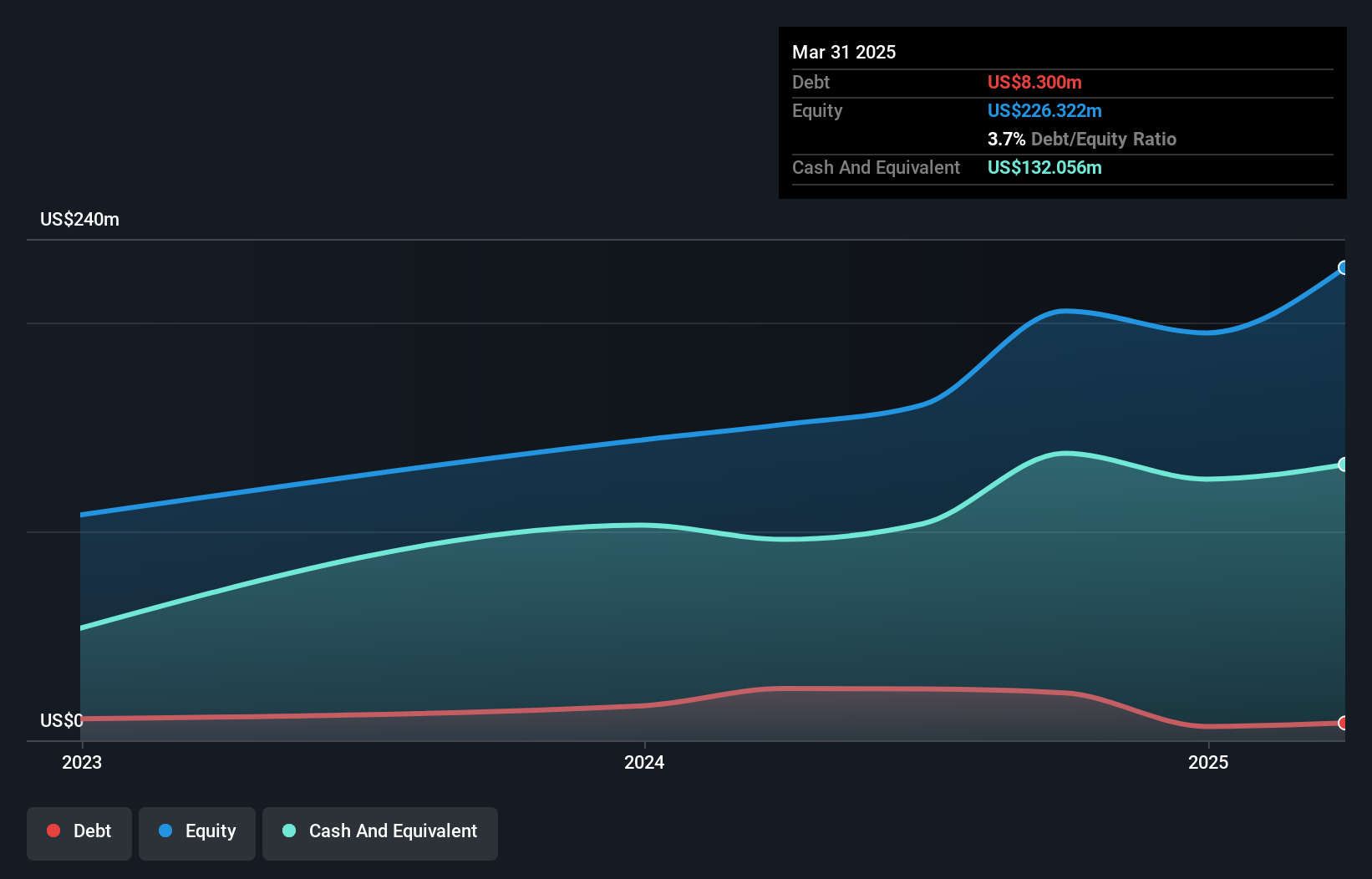

SBC Medical Group Holdings, a small-cap healthcare player, has seen impressive earnings growth of 164% over the past year, outpacing the industry average of 8%. Despite its high volatility in share price recently and substantial shareholder dilution, SBC remains profitable with levered free cash flow reaching US$64.23 million by mid-2024. Trading at 92.9% below its estimated fair value and added to the NASDAQ Composite Index in September 2024, it presents an intriguing investment case.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. supplies nuclear fuel components and services for the nuclear power industry in the United States, Belgium, Japan, and internationally with a market cap of $892.95 million.

Operations: Centrus Energy generates revenue primarily through its Low-Enriched Uranium (LEU) segment, which contributed $320.80 million, and its Technical Solutions segment, adding $71.80 million. The company has a market cap of $892.95 million and reported a Segment Adjustment of -$5 million.

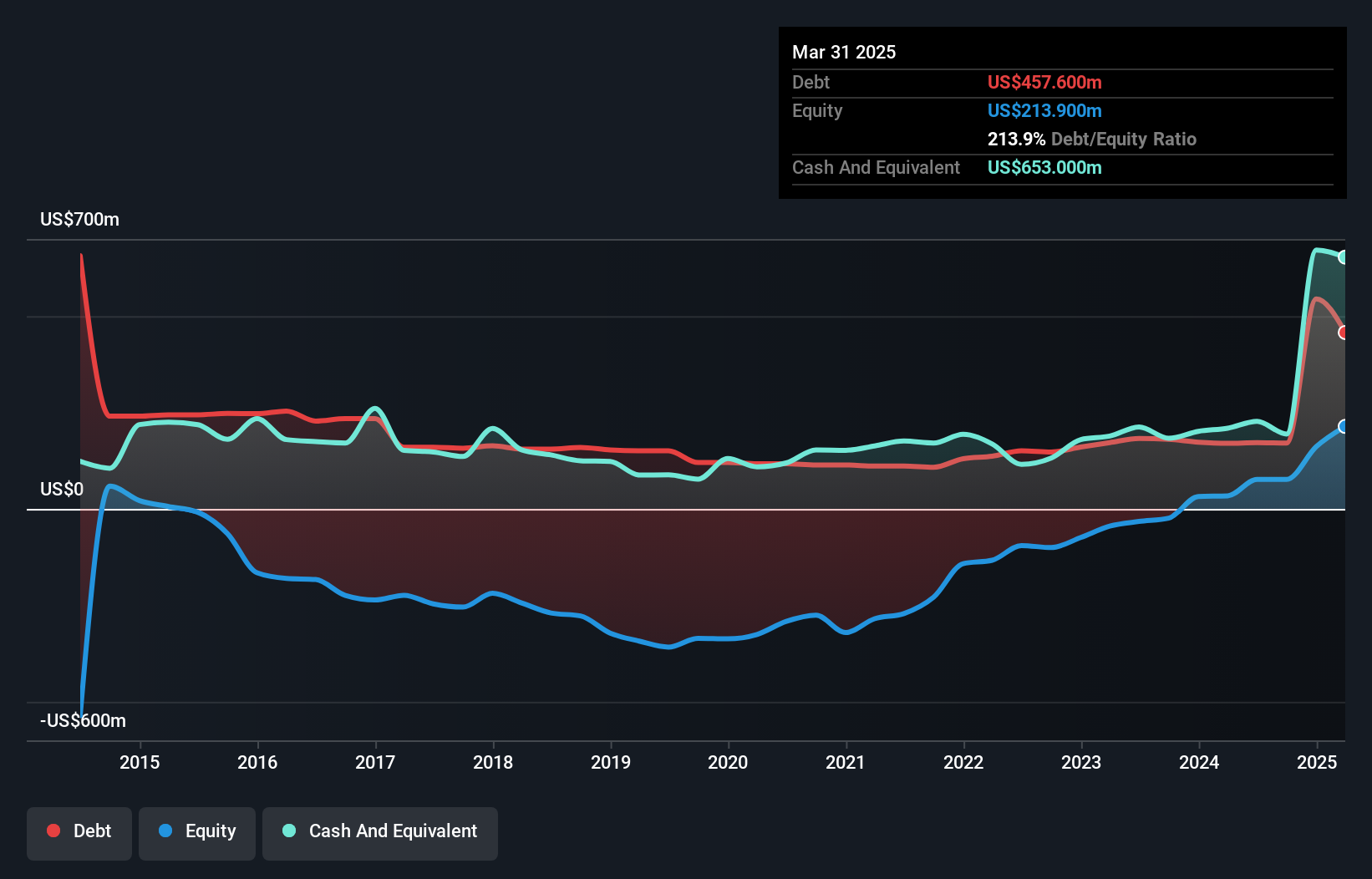

Centrus Energy, a niche player in the energy sector, has shown impressive earnings growth of 164.9% over the past year, outpacing the Oil and Gas industry. Trading at 63.4% below its estimated fair value, it offers potential upside for investors. Despite significant insider selling recently and shareholder dilution last year, Centrus maintains more cash than total debt and has improved from negative shareholder equity five years ago to positive now.

- Get an in-depth perspective on Centrus Energy's performance by reading our health report here.

Gain insights into Centrus Energy's historical performance by reviewing our past performance report.

Yiren Digital (NYSE:YRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiren Digital Ltd. provides financial services through an AI-powered platform in China and has a market cap of approximately $494.66 million.

Operations: Yiren Digital generates revenue primarily from its Financial Services Business (CN¥3.04 billion) and Insurance Brokerage Business (CN¥579.22 million), with additional contributions from its Consumption & Lifestyle segment (CN¥1.84 billion).

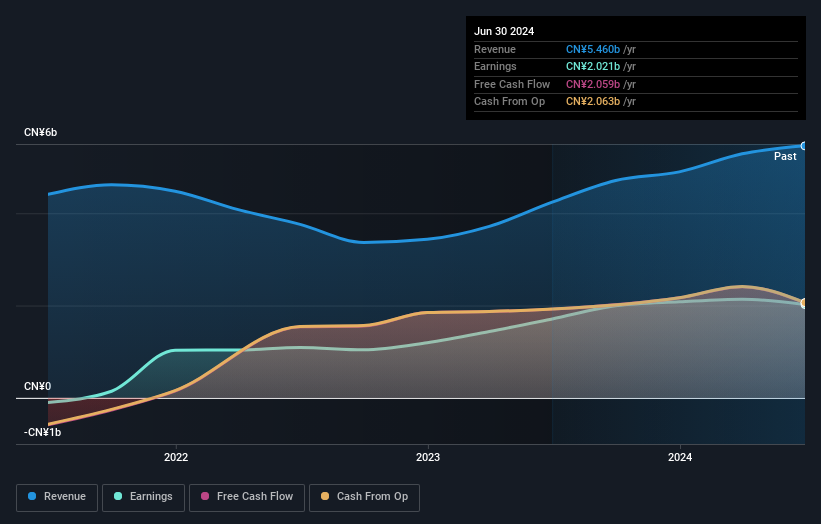

Yiren Digital, trading at 79.2% below its estimated fair value, has shown impressive growth with earnings up 18.2% over the past year, outperforming the Consumer Finance industry. The company is debt-free and enjoys high-quality earnings and positive free cash flow. Recent developments include a semi-annual dividend policy and a share buyback program that repurchased 4.87% of shares for $13.46 million as of June 2024. The new CFO appointment brings extensive investment banking experience to drive financial operations forward effectively.

- Navigate through the intricacies of Yiren Digital with our comprehensive health report here.

Review our historical performance report to gain insights into Yiren Digital's's past performance.

Summing It All Up

- Click here to access our complete index of 211 US Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SBC

SBC Medical Group Holdings

Provides management services to cosmetic treatment centers in Japan, Vietnam, the United States, and internationally.

Excellent balance sheet and good value.