- United States

- /

- Healthcare Services

- /

- NasdaqGM:SBC

Exploring Three Undiscovered Gems in the United States Market

Reviewed by Simply Wall St

The United States market has shown remarkable resilience, remaining flat over the last week while achieving a 33% increase over the past year, with earnings projected to grow by 15% annually. In such a dynamic environment, identifying stocks that are undervalued yet poised for growth can offer unique opportunities for investors seeking to capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Karooooo (NasdaqCM:KARO)

Simply Wall St Value Rating: ★★★★★★

Overview: Karooooo Ltd. offers a mobility software-as-a-service platform for connected vehicles across various regions including South Africa, Europe, and the United States, with a market cap of approximately $1.23 billion.

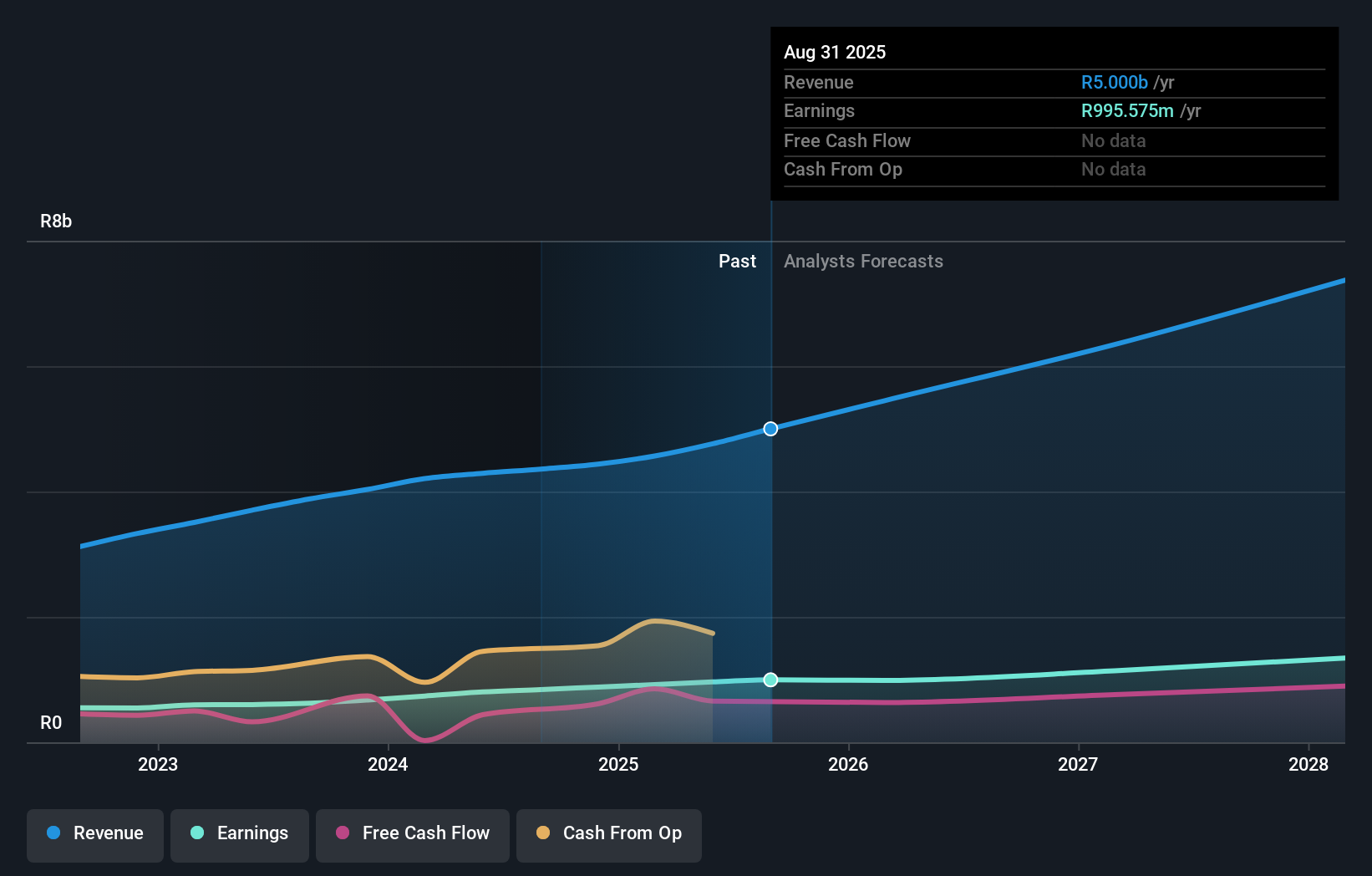

Operations: Karooooo Ltd.'s primary revenue stream is derived from its Cartrack segment, contributing ZAR 3.86 billion, while Karooooo Logistics adds ZAR 384.96 million.

Karooooo, a nimble player in the software sector, is making waves with its robust financial health and growth trajectory. The company boasts a price-to-earnings ratio of 28.5x, comfortably below the industry average of 41.2x, suggesting it might be undervalued. Its earnings surged by 35% over the past year, outpacing the industry's growth rate of 26.4%. With more cash than total debt and a reduced debt-to-equity ratio from 14.1% to 11.9% over five years, Karooooo seems financially sound. Recent earnings showed net income rising to ZAR 211 million from ZAR 174 million year-on-year, reflecting strong performance and potential for continued success in its niche market space.

- Unlock comprehensive insights into our analysis of Karooooo stock in this health report.

Review our historical performance report to gain insights into Karooooo's's past performance.

SBC Medical Group Holdings (NasdaqGM:SBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SBC Medical Group Holdings Incorporated offers management services to cosmetic treatment centers across Japan, Vietnam, the United States, and other international locations with a market cap of $717.02 million.

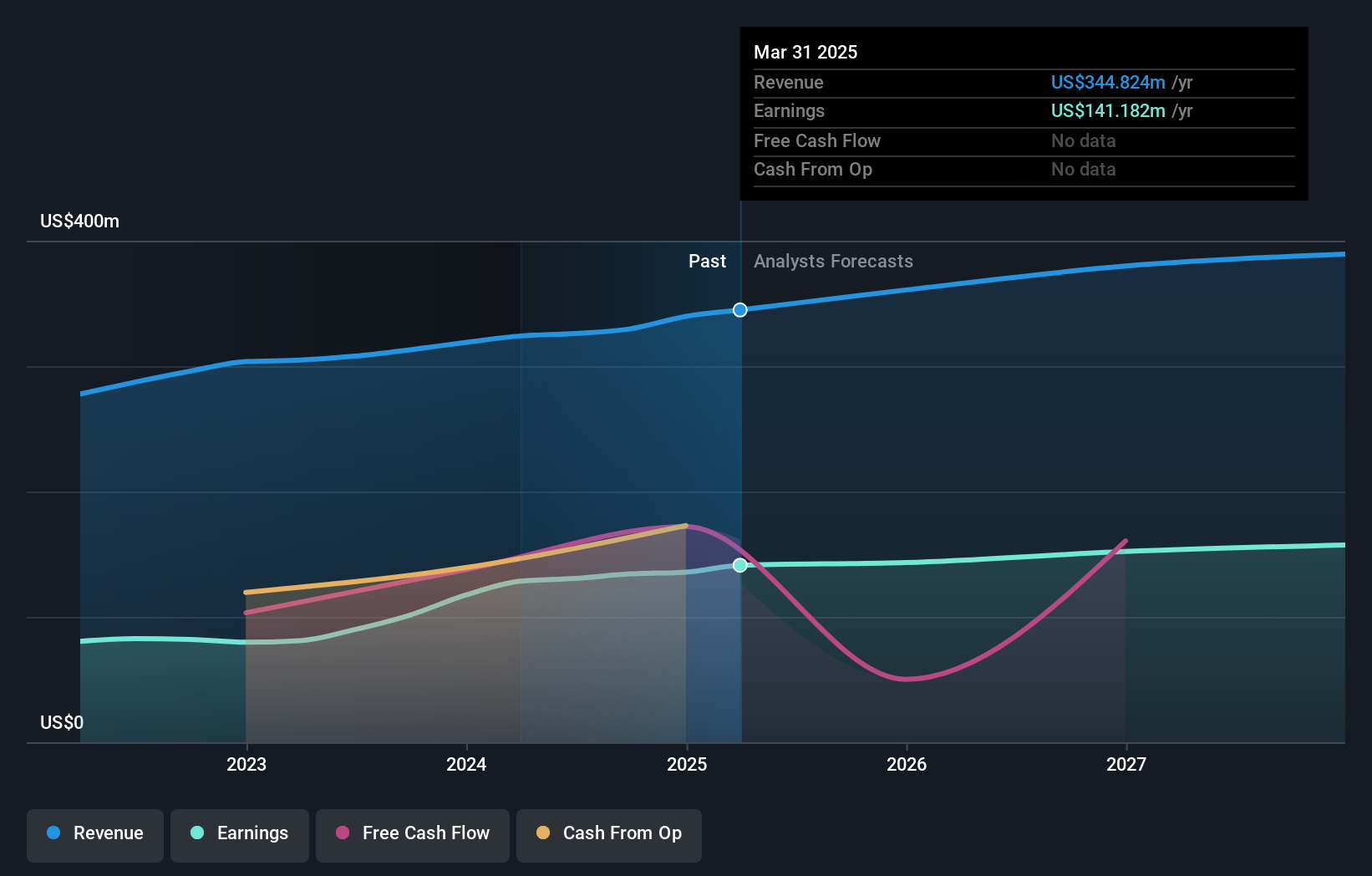

Operations: SBC Medical Group Holdings generates revenue primarily from healthcare facilities and services, amounting to $217.54 million. The company's market cap stands at approximately $717.02 million.

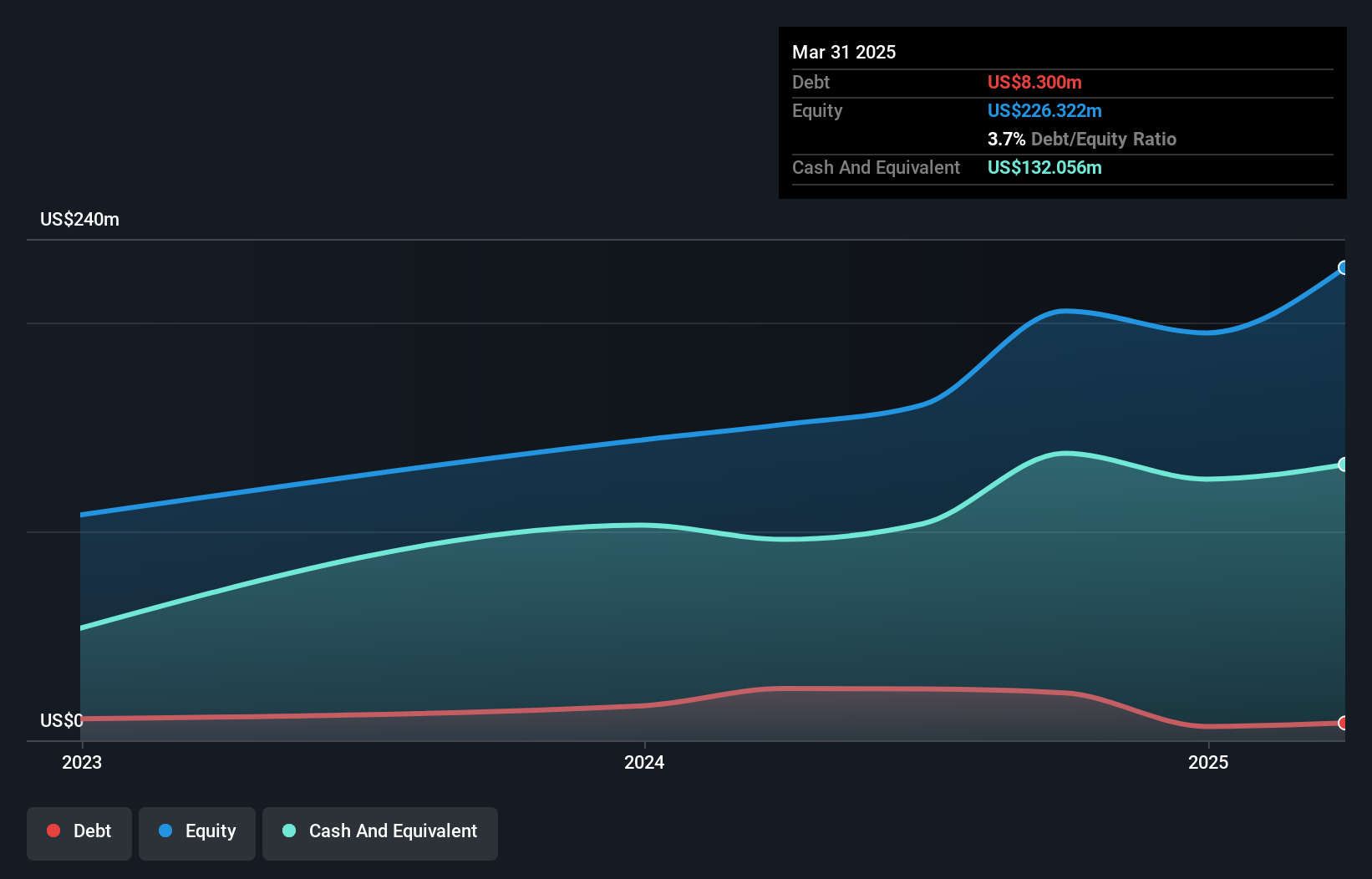

SBC Medical Group Holdings, a smaller player in the healthcare sector, has shown impressive earnings growth of 164% over the past year, outpacing the industry average of 10.4%. Despite its volatile share price recently, SBC remains an attractive value proposition trading at nearly 94% below its estimated fair value. However, shareholders have faced significant dilution over the past year. The company’s strategic alliance with MEDIROM Healthcare Technologies aims to broaden market reach and enhance customer offerings. With more cash than debt and positive free cash flow (US$64 million as of June), SBC demonstrates financial resilience amidst these dynamics.

Yalla Group (NYSE:YALA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yalla Group Limited operates a social networking and gaming platform primarily in the Middle East and North Africa region, with a market cap of $675.19 million.

Operations: Yalla Group generates revenue primarily from user subscriptions and in-app purchases on its social networking and gaming platform. The company reported a net profit margin of 25%, reflecting its ability to efficiently manage costs relative to its revenue streams.

Yalla Group, a nimble player in the Interactive Media and Services sector, has shown robust growth with earnings surging 32% over the past year, surpassing industry averages. Trading at a significant discount to its estimated fair value and maintaining a debt-free status for five years, it presents an intriguing investment profile. Recent financials reveal third-quarter sales of US$88.92 million and net income of US$39.85 million, reflecting year-over-year improvements. However, potential challenges loom with new UAE tax laws possibly affecting profit margins while operational costs could rise due to regulatory changes and reliance on external payment platforms.

Where To Now?

- Dive into all 221 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SBC

SBC Medical Group Holdings

Provides management services to cosmetic treatment centers in Japan, Vietnam, the United States, and internationally.

Excellent balance sheet and good value.