- United States

- /

- Healthcare Services

- /

- NasdaqGM:RDNT

Is RadNet Still Worth Its Price After a 14% Yearly Surge and Recent Pullback?

Reviewed by Bailey Pemberton

- Curious whether RadNet is truly worth its current price? You're not alone, and we're here to unravel what those numbers really mean for investors.

- The stock has been on quite a ride, up 14.2% over the last year. However, recent weeks saw a dip of 8.9% this past week and a 3.0% slide over the last month.

- Much of this movement has been influenced by sector-wide shifts and ongoing discussions about healthcare expansion. This includes reports highlighting the rising demand for diagnostic imaging and technology-driven improvements in patient care.

- RadNet currently scores a 0 out of 6 on our valuation checks, which means it is not undervalued in any of the standard metrics we track. Let's dig into what goes into these traditional valuation methods. At the end, we will reveal an approach that can offer an even clearer view of RadNet’s true worth.

RadNet scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: RadNet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting those amounts back to today. This provides investors with a sense of the business’s intrinsic value based on fundamentals.

For RadNet, the most recent Free Cash Flow stands at $71.6 million. Analysts provide estimates for the next few years, forecasting Free Cash Flow to rise to $74.4 million in 2026 and $84.2 million by 2027. For the following years up to 2035, further growth is extrapolated, with projections reaching $114.7 million by 2035. These values remain well below the billion dollar mark, confirming that RadNet is a mid-size player in healthcare imaging and not a cash flow giant.

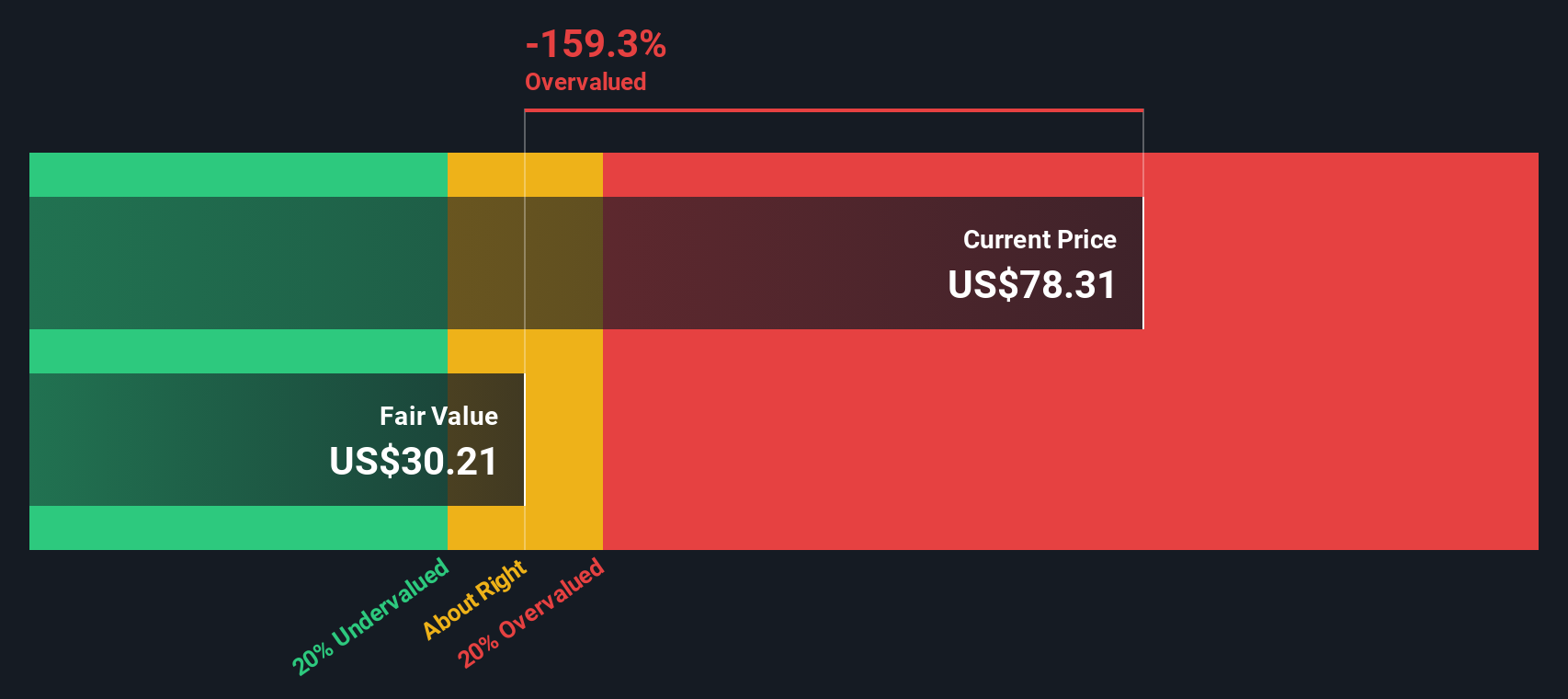

After discounting these future cash flows to present value using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out to $30.36 per share. Compared to the current stock price, this suggests RadNet is around 150% overvalued according to this method. While future growth is anticipated, the current share price builds in very optimistic expectations far beyond the DCF forecast.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests RadNet may be overvalued by 150.3%. Discover 832 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: RadNet Price vs Sales

For companies where profitability is not yet robust or consistent, the Price-to-Sales (P/S) ratio is the preferred yardstick. The P/S ratio gives investors insight into how much they are paying for each dollar of RadNet’s revenue, making it useful for understanding valuation when earnings are negative or volatile.

Higher growth companies in expanding industries typically command higher P/S ratios, as investors accept paying a premium for expected future gains. However, risk factors such as operating margins, market volatility, and size can justify a lower "normal" P/S ratio for more mature or riskier businesses.

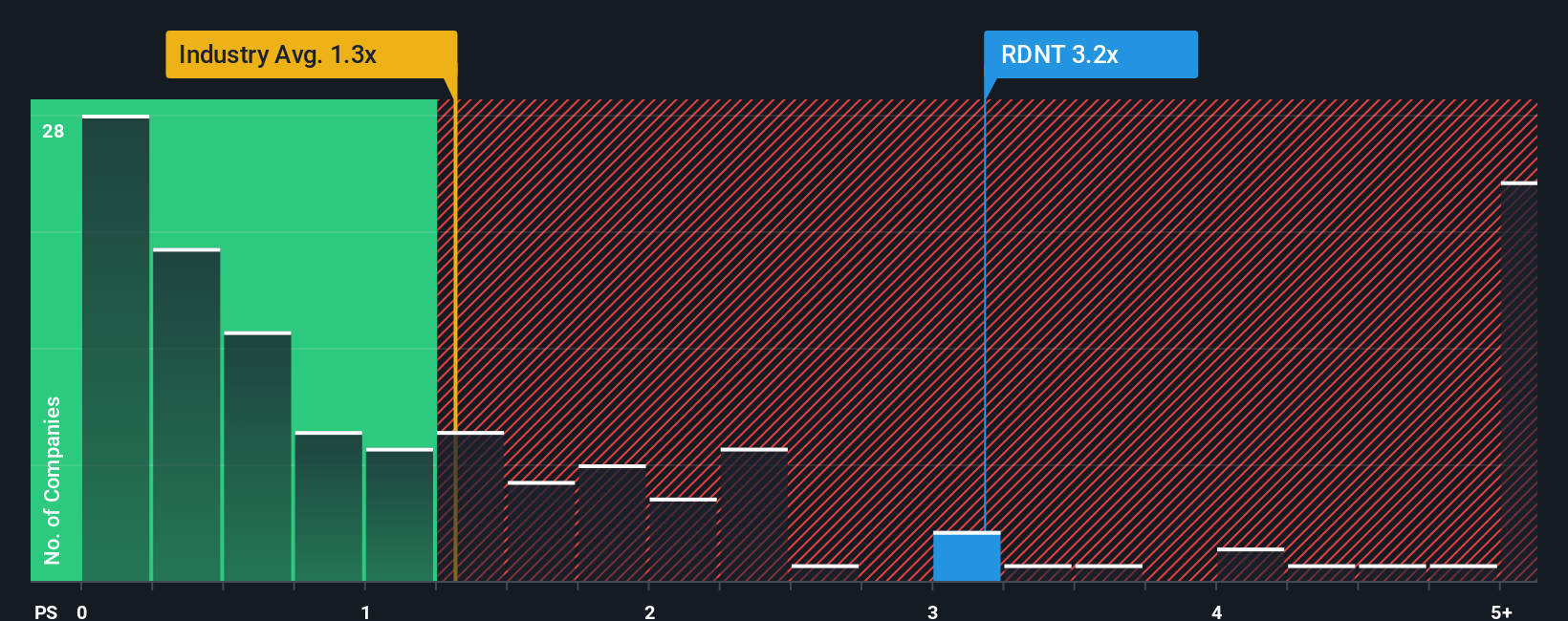

Currently, RadNet is trading at a P/S ratio of 3.06x. This is considerably higher than the Healthcare industry average of 1.27x and above the peer average of 1.97x. At first glance, this might suggest the stock is overvalued compared to the broader sector. However, Simply Wall St's proprietary "Fair Ratio" model calculates that a fair P/S for RadNet is 0.85x. This model is based on a holistic assessment including its growth prospects, risks, margins, and market position, not just peer averages.

The Fair Ratio goes a step further than simple comparisons. It distills a wide range of company-specific factors, giving a more complete and tailored assessment for RadNet’s unique profile.

Since RadNet’s actual P/S of 3.06x is significantly above its Fair Ratio of 0.85x, the stock looks overvalued according to this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your RadNet Narrative

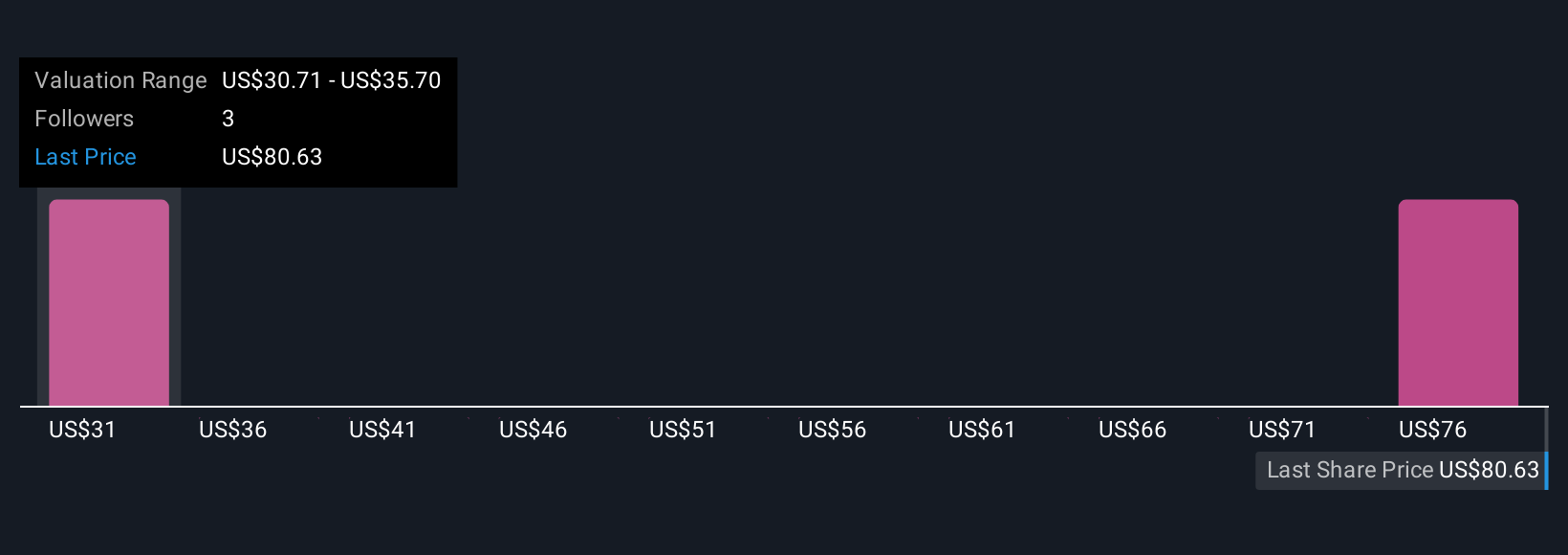

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, the story behind the stock’s numbers. A Narrative is your personalised investment thesis for a company, allowing you to connect your outlook (on future revenue, earnings, margins, and valuation) to a financial forecast and then to a fair value estimate. Narratives take the information you know, your perspective on RadNet's business prospects, and turn it into a transparent model. This makes sense of the numbers through the lens of your expectations.

This approach is accessible and easy to use right on Simply Wall St’s Community page, where millions of investors share and review Narratives every day. Narratives help you decide when to buy or sell by directly comparing your Fair Value to the current stock price. They automatically update whenever new information, such as fresh earnings results or breaking news, changes the outlook.

For example, if you believe RadNet will hit analysts’ optimistic targets, your Narrative might yield a fair value of $80.57 per share, which would imply some upside from today’s price. If you’re more cautious about growth and margin expansion, your Narrative might indicate a far lower valuation. In the end, Narratives let every investor test their own story and see how their view stacks up, giving you a dynamic, data-driven tool for smarter investment decisions.

Do you think there's more to the story for RadNet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RDNT

RadNet

Provides outpatient diagnostic imaging services in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives