- United States

- /

- Medical Equipment

- /

- NasdaqGM:PRCT

PROCEPT BioRobotics (PRCT): Assessing Valuation as Analyst Support Holds Steady on Innovation and Growth Prospects

Reviewed by Simply Wall St

Recent analyst reports continue to back PROCEPT BioRobotics (PRCT), highlighting its innovation in surgical robotics and solid growth outlook. Even with financial challenges, analysts point to the company’s strategic focus and sector trends as positives.

See our latest analysis for PROCEPT BioRobotics.

PROCEPT BioRobotics' share price has seen some turbulence, with a sharp 90-day decline and a year-to-date share price return of -57.9% underscoring investor caution. Still, the company’s story is far from over, as analysts remain optimistic about its long-term prospects and product innovation, even amid shifting sentiment. Over the past year, total shareholder return stands at -49.1%, but the recent uptick in the 7-day share price suggests market momentum could be starting to shift. This is something worth monitoring alongside sector trends and valuation factors.

If you’re interested in discovering more companies evolving in the healthcare technology space, check out the latest opportunities in our MedTech and healthcare screener: See the full list for free.

With shares trading at a significant discount to analyst price targets despite ongoing innovation, the question becomes whether PROCEPT BioRobotics is now undervalued or if the market has already factored in all potential growth.

Most Popular Narrative: 44.2% Undervalued

At $34.99, PROCEPT BioRobotics shares sit well below the narrative's fair value estimate, reflecting expectations of major changes on the horizon. The latest viewpoint suggests the gap could be closed by surging demand and market expansion, but there are demanding assumptions behind that optimism.

International revenue growth, particularly in key markets like the UK, Japan, and Korea, demonstrates early execution on geographic expansion. This provides substantial new, long-term revenue streams and improved operational leverage that should enhance earnings power.

Curious what powers this bold price target? The secret lies in projections of market adoption and a profit turnaround usually reserved for MedTech giants. High growth, margin transformation, and new revenue sources combine to create a formula you don't want to miss. Dive in to discover the key figures that drive this upside case.

Result: Fair Value of $62.7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operating losses or increased competition from alternative technologies could quickly challenge the optimistic outlook that supports PROCEPT BioRobotics’ current narrative.

Find out about the key risks to this PROCEPT BioRobotics narrative.

Another View: What Do Sales Ratios Say?

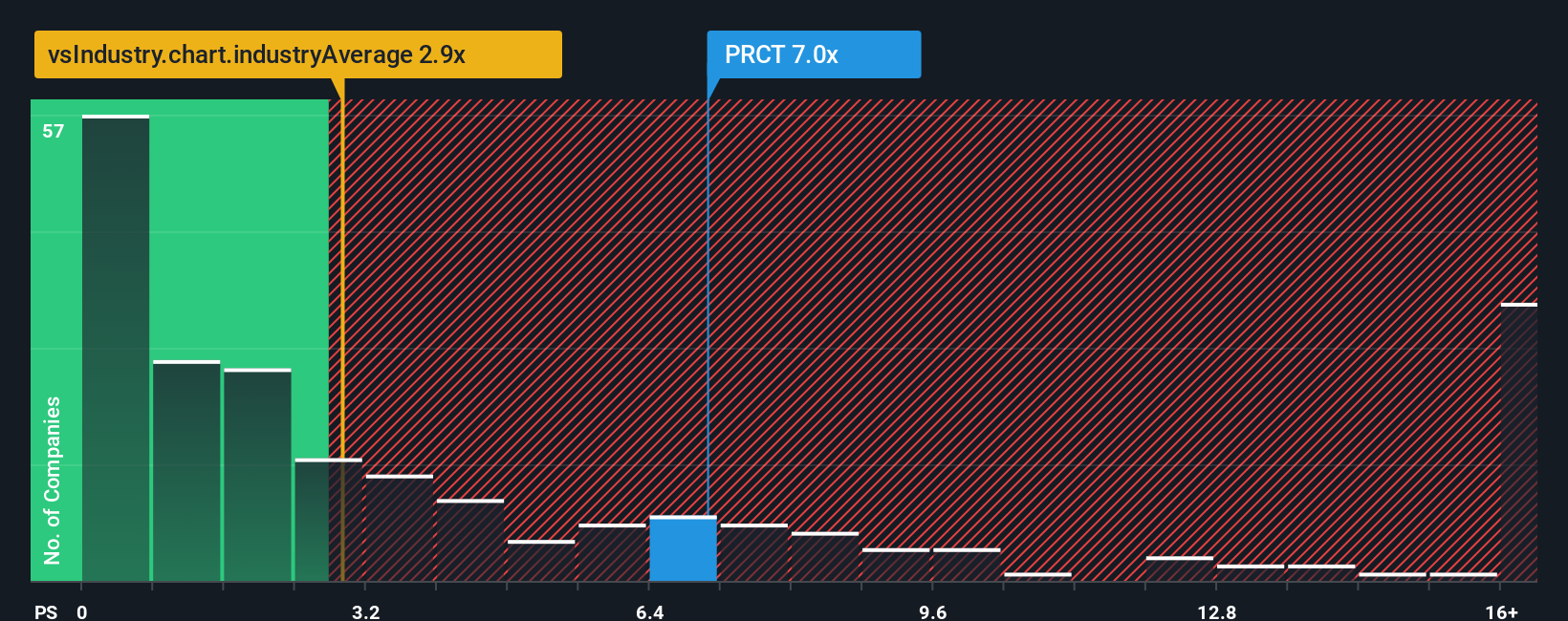

Looking beyond the narrative’s fair value, the current price-to-sales ratio for PROCEPT BioRobotics sits well above both industry peers and its own fair ratio. With the stock trading at 7.1 times sales compared to a peer average of 4.6 and a fair ratio of 4.4, investors are clearly paying a premium for the company’s future growth. Could this premium be justified, or is there valuation risk if growth does not meet expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PROCEPT BioRobotics Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft a personalized outlook on PROCEPT BioRobotics in just a few minutes. Do it your way.

A great starting point for your PROCEPT BioRobotics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Tap into other game-changing opportunities with the Simply Wall Street Screener and future-proof your strategy. There are standout stocks waiting that you don't want to miss.

- Unlock the potential of high-yield portfolios by starting with these 17 dividend stocks with yields > 3% for stocks offering impressive income streams and stable cash flows.

- Spot up-and-coming technologies when you check out these 27 AI penny stocks at the forefront of artificial intelligence innovation and real-world applications.

- Supercharge your search for bargains by zeroing in on these 877 undervalued stocks based on cash flows, revealing hidden gems trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PRCT

PROCEPT BioRobotics

A surgical robotics company, focuses on developing transformative solutions in urology in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives