- United States

- /

- Medical Equipment

- /

- NasdaqGS:PODD

Insulet (PODD): Evaluating Valuation After Strong Share Price Gains and Consistent Financial Growth

Reviewed by Simply Wall St

See our latest analysis for Insulet.

Insulet’s strong run has seen momentum build, with the share price up 21.9% year-to-date and a 32.9% total shareholder return over twelve months. A steady cadence of product enhancements, along with robust top-line growth, continue to reinforce the company’s growth potential in the eyes of investors.

If you’re keeping an eye on innovation in the healthcare space, it’s worth exploring promising medical device stocks such as See the full list for free.

With the share price’s steady climb and strong financials, investors are now faced with a crucial question: Is Insulet undervalued with room to run, or is the market already pricing in all future growth?

Most Popular Narrative: 13.1% Undervalued

At $313.01, Insulet’s shares trade well below the narrative’s fair value estimate of $360.17, setting the stage for ongoing debate about upside potential from here. The current price reflects recent momentum, while the narrative projects even greater gains based on expected international expansion and product adoption.

Rapidly rising adoption of Omnipod 5 in both the U.S. and international markets, driven by strong clinical evidence, ease of use, and superior integration with the latest glucose sensors, is positioning Insulet to capture a disproportionately large share of the expanding global diabetes device market, supporting outsized top-line revenue growth for several years.

Want to know the numbers powering this bullish narrative? The secret lies in aggressive sales growth and game-changing future profit targets. The valuation blueprint is anything but typical. Find out which financial lever makes all the difference by reading the complete story.

Result: Fair Value of $360.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Insulet’s reliance on a single product and potential regulatory challenges could threaten growth if competitor dynamics change or if healthcare policies shift unexpectedly.

Find out about the key risks to this Insulet narrative.

Another View: High Price Relative to Peers

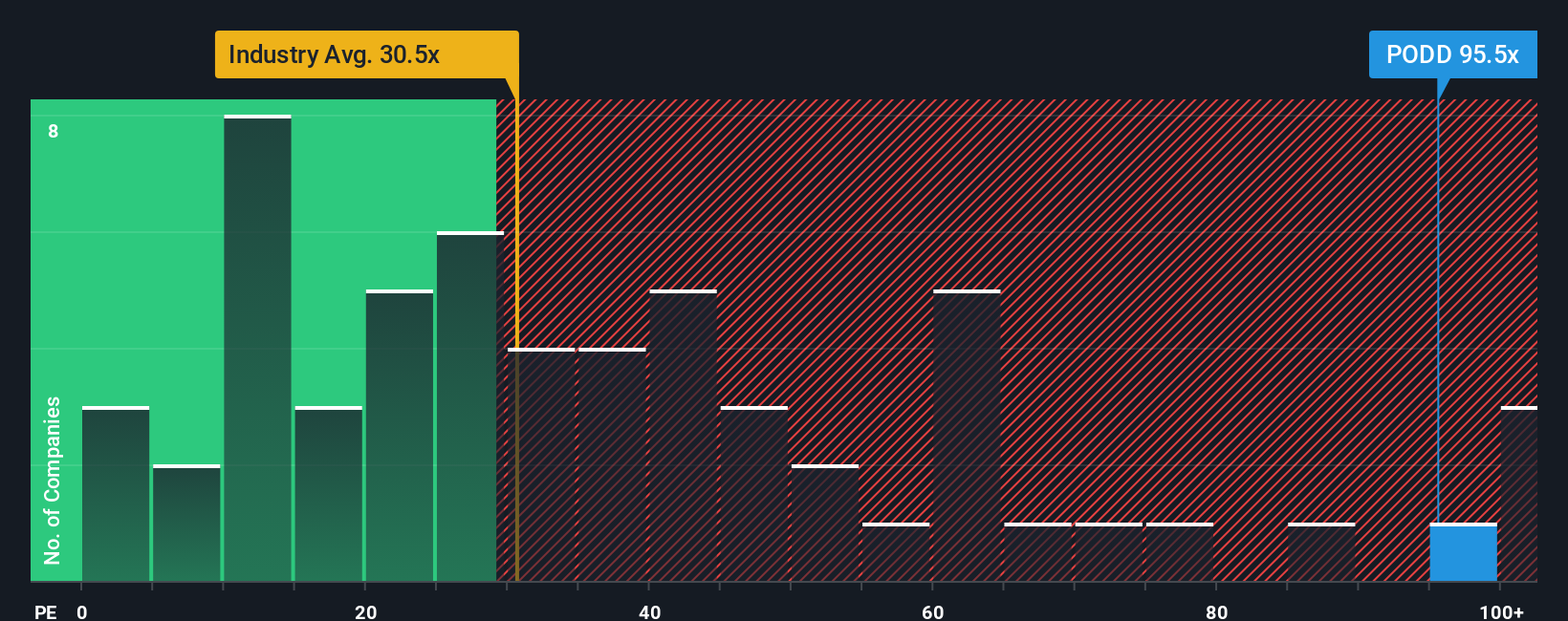

While the narrative places Insulet’s fair value well above today’s price, the actual price-to-earnings ratio tells a different story. Insulet trades at about 93 times earnings, far above the industry’s 27.7 and a fair ratio of 35.3. This suggests investors are paying a steep premium for future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insulet Narrative

If you have a different perspective or want to dive into the data yourself, you can build your own Insulet story in just a few minutes. Do it your way.

A great starting point for your Insulet research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. If you want to get ahead of the curve, take your strategy to the next level with these curated investing angles:

- Uncover income potential with these 22 dividend stocks with yields > 3%, featuring companies that reward shareholders with robust yields above 3%.

- Target innovation by checking out these 26 AI penny stocks to find businesses transforming industries with cutting-edge artificial intelligence advancements.

- Capitalize on growth by reviewing these 3589 penny stocks with strong financials, which pair solid fundamentals with upside others may be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PODD

Insulet

Develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives