- United States

- /

- Medical Equipment

- /

- NasdaqCM:PLSE

What Pulse Biosciences (PLSE)'s Positive Human Trial Data Could Mean for Its Cardiac Device Ambitions

Reviewed by Sasha Jovanovic

- Pulse Biosciences, Inc. announced late-breaking results from its first-in-human feasibility study of the nPulse Cardiac Surgical System, presented at the 39th European Association for Cardio-Thoracic Surgery Annual Meeting in Copenhagen, which showed high acute success rates and no major ablation-related adverse events in atrial fibrillation treatment.

- The study highlighted not only strong early efficacy and safety, but also showcased the system's swift, efficient procedure workflow through a live case presentation.

- We’ll explore how initial safety and procedure efficiency reported for the nPulse system could shape Pulse Biosciences’ investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Pulse Biosciences' Investment Narrative?

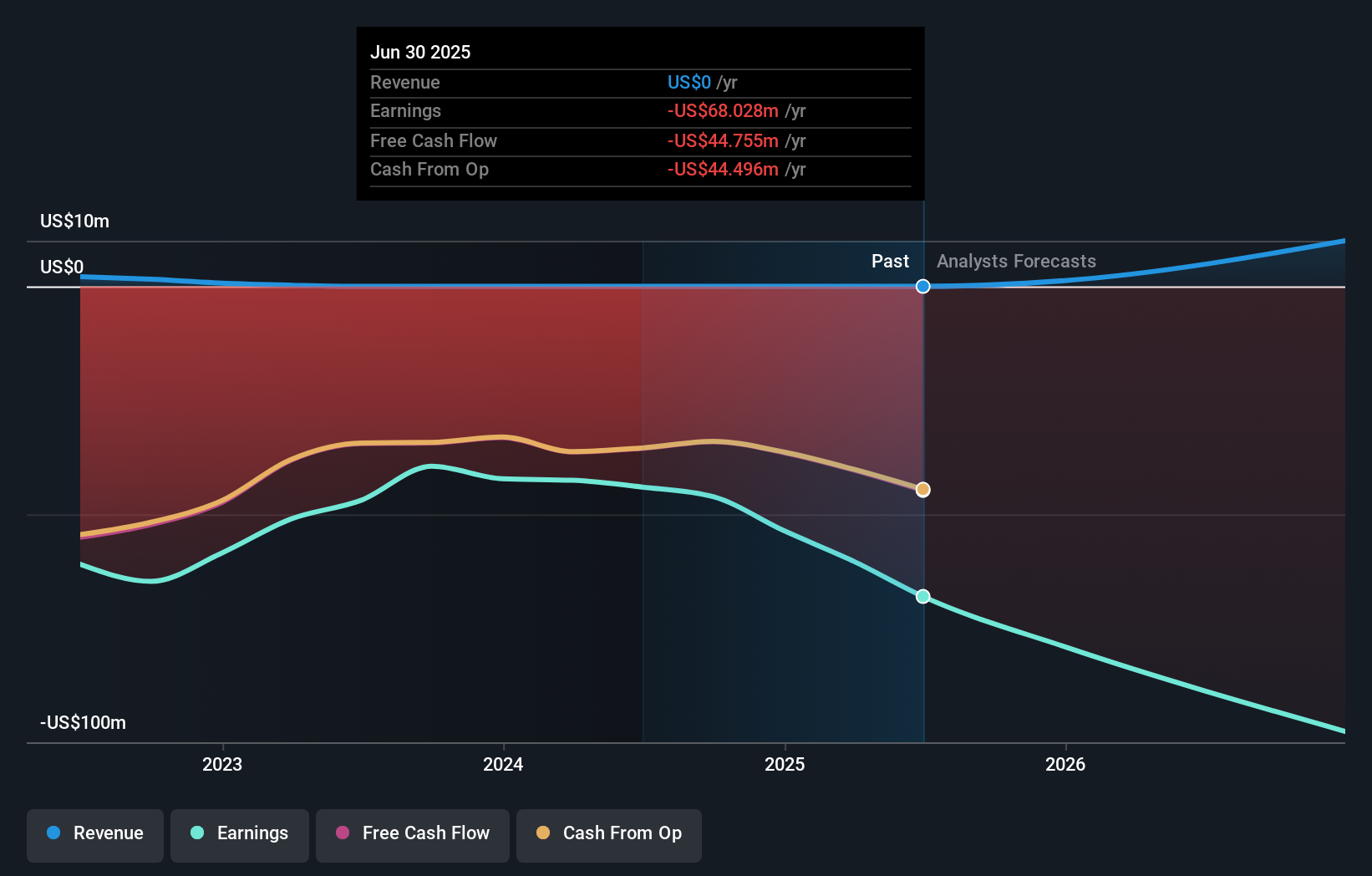

To be a Pulse Biosciences shareholder, you need to believe in the company's ability to translate early clinical promise, such as the recent high acute success rates and clean safety profile of its nPulse Cardiac Surgical System, into material commercial and regulatory momentum. The late-breaking results add weight to the short-term story by boosting credibility for both the technology and management's execution. This could accelerate progress toward pivotal trials or partnerships, serving as a potential catalyst that distinguishes Pulse Biosciences in its niche. At the same time, the company continues to report heavy losses and no meaningful revenue yet, so the long-term investment case still rests on overcoming execution risk, future reimbursement decisions, and adoption hurdles. While the new clinical data helps support initial optimism, it doesn’t change the core risks tied to profitability timelines or future market uptake. Yet, funding needs and persistent losses remain key issues investors should keep an eye on.

Our valuation report unveils the possibility Pulse Biosciences' shares may be trading at a premium.Exploring Other Perspectives

Build Your Own Pulse Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pulse Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Pulse Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pulse Biosciences' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLSE

Flawless balance sheet with low risk.

Market Insights

Community Narratives