- United States

- /

- Healthcare Services

- /

- NasdaqGS:PINC

Premier (PINC): Assessing Valuation Following Strong 2024 Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Premier.

Premier’s share price has surged this year, recording a robust 32% year-to-date gain and attracting attention for its strong momentum over the last quarter. While its long-term total shareholder return has lagged, recent price action suggests renewed optimism about growth and resilience in the healthcare sector.

If Premier’s momentum has you scanning for other healthcare standouts, it could be the right moment to discover See the full list for free.

With shares now trading just shy of analyst targets and strong recent gains, investors are left to wonder whether there is more value still to unlock in Premier or if the market has already priced in its future growth.

Most Popular Narrative: Fairly Valued

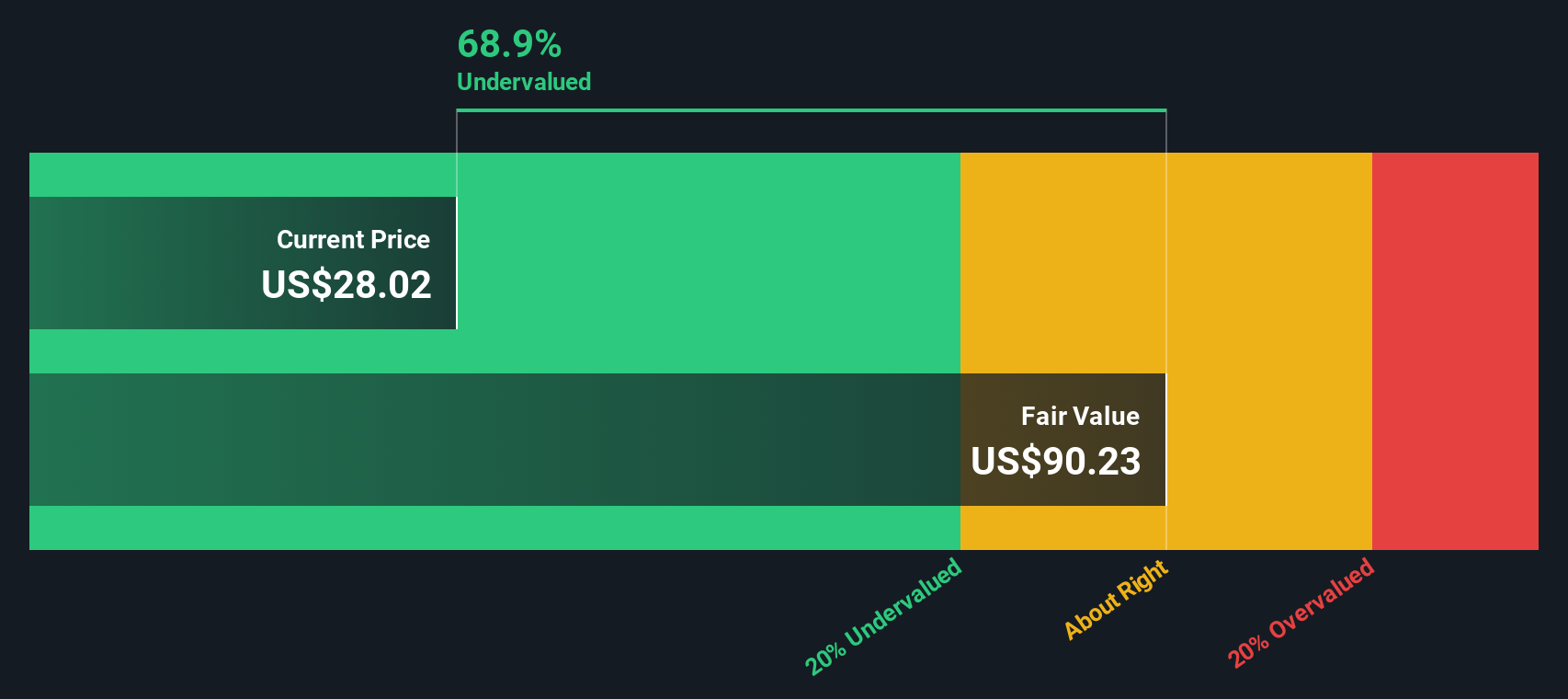

Premier’s most popular narrative sets a fair value at $27.50, nearly in line with the recent closing price of $28.20. This suggests little implied upside at current levels. This context frames the following quote outlining the expectations that drive the narrative’s fair value outlook.

Assumptions that reimbursement cuts and persistent cost pressures at Premier's core hospital customer base will limit hospitals' budgets for investing in Premier's data, analytics, and consulting solutions, constraining future revenue growth despite currently healthy pipelines. Concerns that a rising shift toward direct sourcing and self-distribution strategies among large health systems will erode the traditional group purchasing business model, potentially cannibalizing a significant portion of Premier's supply chain revenues and contributing to lower long-term earnings growth.

There’s a bold logic behind this near-fair value call. The valuation hangs on a handful of aggressive growth and margin assumptions. Wondering how future profit targets and sector shifts could tip the scales? The full story spells out exactly what moves the needle for Premier’s market worth.

Result: Fair Value of $27.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong demand for Premier’s AI-driven analytics and broad demographic shifts could support recurring revenue growth and help reduce some downside risk to earnings.

Find out about the key risks to this Premier narrative.

Another View: Discounted Cash Flow Perspective

Looking beyond analyst targets, our DCF model presents a surprising contrast. By focusing solely on Premier’s future cash flows, the SWS DCF model estimates fair value at $64.12, which is more than double the current price. Does this suggest the market is dramatically underestimating Premier’s long-term potential, or are there risks the model overlooks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Premier Narrative

If you think there is more to Premier’s story or want to see where your own numbers lead, you can build your own take in just a few minutes, starting with Do it your way

A great starting point for your Premier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass you by. The best investors seize trends early, so check out these handpicked ways to upgrade your strategy right now.

- Capitalize on the latest breakthroughs in healthcare innovation by reviewing these 31 healthcare AI stocks, making waves with artificial intelligence advancements in medicine.

- Secure your income potential with these 18 dividend stocks with yields > 3%, offering attractive yields and reliable payouts for patient investors.

- Tap into the future of finance and technology with these 81 cryptocurrency and blockchain stocks, as they shape next-generation payment platforms and digital asset solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PINC

Premier

Operates as a healthcare improvement company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives