- United States

- /

- Healthcare Services

- /

- NasdaqGS:PHLT

Performant Healthcare, Inc.'s (NASDAQ:PHLT) Shares Climb 26% But Its Business Is Yet to Catch Up

Performant Healthcare, Inc. (NASDAQ:PHLT) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 4.5% isn't as impressive.

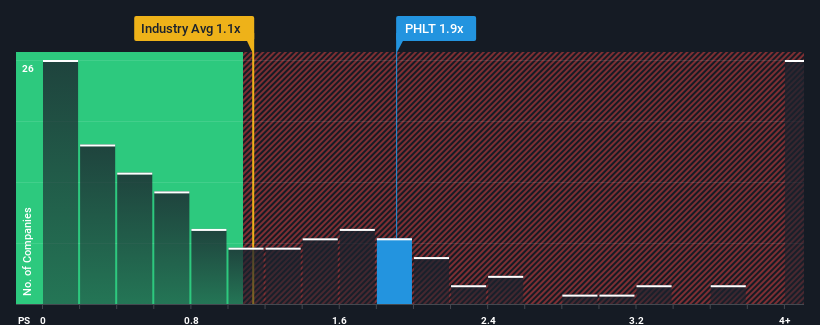

After such a large jump in price, given close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Performant Healthcare as a stock to potentially avoid with its 1.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Performant Healthcare

What Does Performant Healthcare's Recent Performance Look Like?

Performant Healthcare's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Performant Healthcare's future stacks up against the industry? In that case, our free report is a great place to start.How Is Performant Healthcare's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Performant Healthcare's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.1% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 1.1% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 7.9% over the next year. That's shaping up to be materially lower than the 10% growth forecast for the broader industry.

With this information, we find it concerning that Performant Healthcare is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Performant Healthcare's P/S Mean For Investors?

Performant Healthcare's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Performant Healthcare, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Performant Healthcare with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PHLT

Performant Healthcare

Provides audit, recovery, and analytics services in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success