- United States

- /

- Healthcare Services

- /

- NasdaqGS:PGNY

Progyny (PGNY): Assessing Valuation as White House IVF Coverage Push Sparks Investor Interest

Reviewed by Kshitija Bhandaru

The White House has unveiled plans to encourage employers to make in vitro fertilization coverage available as a standalone benefit. Progyny (PGNY), a leader in fertility benefits, saw its stock jump nearly 7% following the news.

See our latest analysis for Progyny.

Progyny’s strong jump this week follows a year marked by big swings and renewed optimism, with its 1-year total shareholder return reaching nearly 28%. Momentum is gathering, as heightened interest in fertility policy changes has clearly boosted sentiment. Despite recent volatility, investors are keeping their eyes on long-term growth potential.

If you’re interested in more innovative healthcare stocks riding industry shifts, there are plenty of discovery opportunities in our curated list: See the full list for free.

With shares rallying and attention on coming policy changes, are investors seizing a real bargain in Progyny, or is all this optimism already accounted for in the current stock price, leaving little room for future upside?

Most Popular Narrative: 24.5% Undervalued

Progyny’s fair value according to the prevailing narrative sits notably above its last close, suggesting room for price appreciation if bullish assumptions take hold. The difference between market skepticism and narrative confidence sets the scene for further debate.

Sustained high levels of employer interest in women's health and family-building benefits, supported by a recent national study and 81% of HR leaders prioritizing these services, point toward robust long-term demand, especially as employers seek to attract and retain talent. This broadening acceptance and adoption are likely to expand revenue and topline growth over time.

Curious what drives this bold valuation call? Unpack the projections behind the fair value. It hinges on aggressive future earnings, expanding margins, and premium pricing compared to the industry. Which of these key levers shapes the bullish outlook? Dive into the narrative for the critical details.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, broad-based employer cost-cutting or intensifying competition could curb Progyny’s growth and challenge the bullish outlook outlined above.

Find out about the key risks to this Progyny narrative.

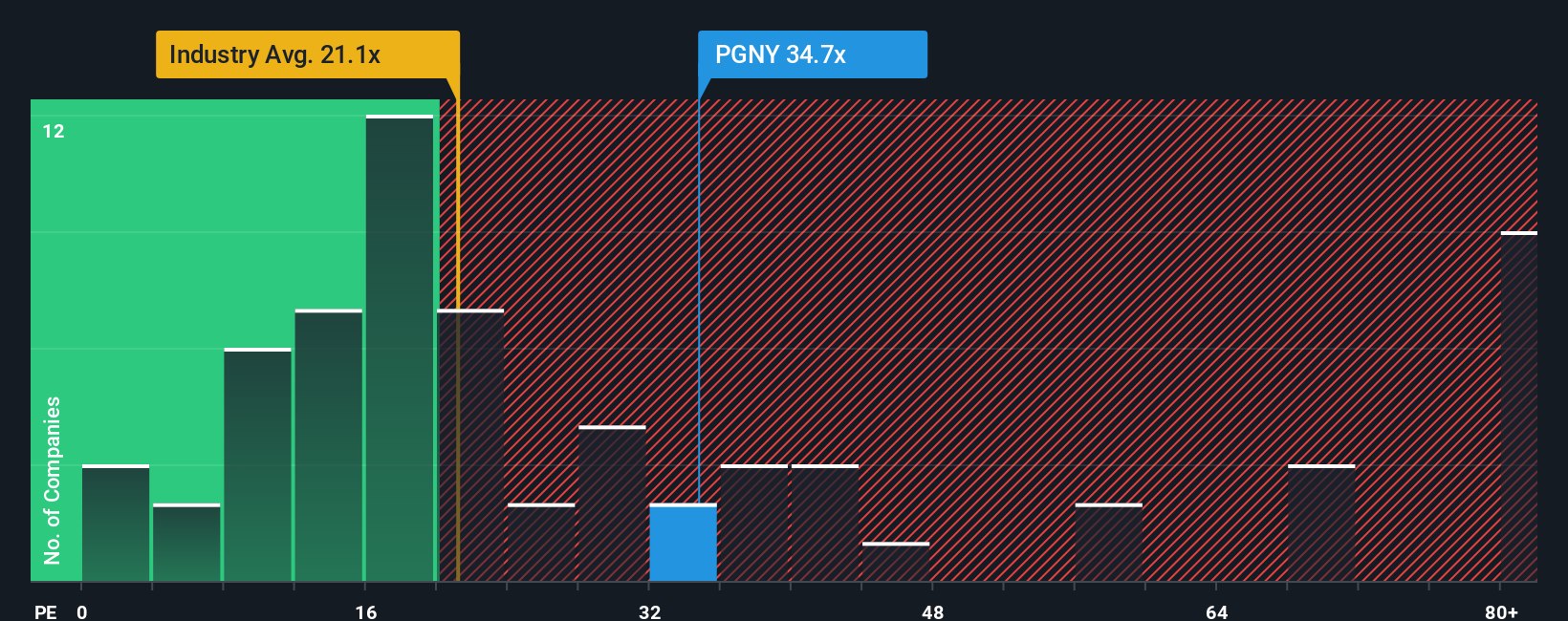

Another View: Using Earnings Multiples

While the prevailing narrative suggests Progyny is undervalued, a look at its price-to-earnings ratio raises questions. Shares trade at 34.5 times earnings, well above both the US Healthcare industry average of 20.8x, peers at 22.9x, and even above the fair ratio of 25.4x. This premium hints at higher expectations, but also means the stock could be at risk if results disappoint. Is the market pricing in too much optimism, or does Progyny's growth potential justify paying up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progyny Narrative

If you want to take a different angle or dive deeper into the numbers yourself, you’re free to build a fresh perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Progyny.

Looking for more investment ideas?

Don’t let big opportunities pass you by. Broaden your portfolio using hand-picked stock ideas you might overlook, all rooted in robust fundamental research.

- Capitalize on market rebounds and sift through potential bargains using these 868 undervalued stocks based on cash flows, which focuses on companies trading below their intrinsic value.

- Ride the AI surge and pinpoint your next breakout opportunity among these 24 AI penny stocks, identified for disruptive growth and tech innovation.

- Secure your financial future by targeting consistent cash flow through these 20 dividend stocks with yields > 3%, which prioritizes steady, above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGNY

Progyny

A benefits management company, provides fertility, family building, and women’s health benefits solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives