- United States

- /

- Healthcare Services

- /

- NasdaqGS:PGNY

Progyny (PGNY): Assessing Valuation After Recent 18% Share Price Climb

Reviewed by Simply Wall St

See our latest analysis for Progyny.

Progyny’s recent momentum has certainly caught investors’ attention, with a 27% 7-day share price return building on steady gains. The stock’s 73% total shareholder return over the past year shows how sentiment has shifted. However, the three- and five-year total returns remain in the red, indicating that a longer-term rebound is still in progress.

If you’re following the healthcare space, it’s a great time to see which other innovative companies are on the move with our See the full list for free.

With shares trading about 20% below consensus analyst targets and solid earnings growth, investors might wonder whether Progyny is currently undervalued or if the market is already pricing in all the company’s future potential.

Most Popular Narrative: 14.8% Undervalued

Progyny's widely-followed narrative suggests the fair value is $28.25, a meaningful premium to the last close at $24.07. This sets up a discussion of what could propel the share price higher.

Investment in an integrated women's health platform (including new services such as pelvic floor therapy, leave navigation, and enhanced digital engagement) positions Progyny to cross-sell adjacent products. This could result in a higher share of wallet with current clients and additional revenue streams, supporting both topline and margin expansion.

Curious why analysts are assigning such a high valuation? The narrative hints at hidden upside driven by ambitious growth targets and expanding profit margins over the next few years. Want to know what crucial assumptions set this price target apart? Only a deep dive will reveal the bold bets and intricate calculations behind it.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, broad-based cost cutting by employers or a sudden wave of new competitors could quickly dampen Progyny’s expected growth trajectory and investor optimism.

Find out about the key risks to this Progyny narrative.

Another View: Multiples Point to a Higher Price Tag

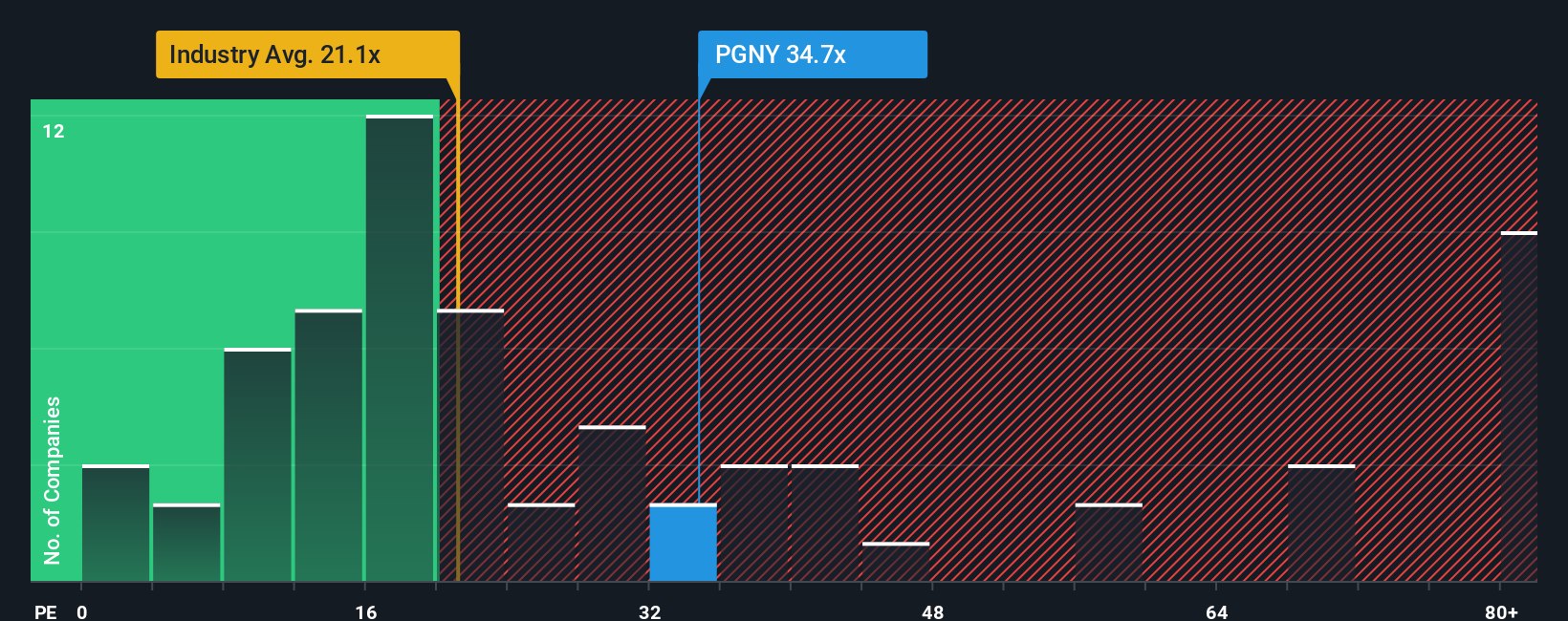

Looking at valuation multiples, Progyny trades at a price-to-earnings ratio of 36.7x, well above both the industry average of 21.9x and the peer group’s 27.4x. That is also higher than the fair ratio of 24.8x, suggesting the market is pricing in substantial future growth. Is this optimism warranted or a valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progyny Narrative

If you have a different perspective or want to dig into the details yourself, creating your own view of Progyny only takes a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Progyny.

Looking for More Investment Ideas?

Snap up your next opportunity and give yourself an investing edge with genuinely unique stock screens tailored to today's trends. Don't let the best picks pass you by.

- Accelerate your portfolio by scoping out these 25 AI penny stocks, which are taking artificial intelligence mainstream and powering rapid innovation.

- Lock in potential long-term income as you assess these 14 dividend stocks with yields > 3%, offering attractive yields above 3% for steady returns.

- Catch promising trends early by scouting these 3574 penny stocks with strong financials, built on solid financials and primed for outsized growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGNY

Progyny

A benefits management company, provides fertility, family building, and women’s health benefits solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives