- United States

- /

- Healthcare Services

- /

- NasdaqGS:PGNY

A Fresh Look at Progyny (PGNY) Valuation as It Expands Global Women’s Health Offerings

Reviewed by Simply Wall St

Progyny (PGNY) has announced a broad expansion of its women’s and family health offerings. The company now includes pregnancy, postpartum, and menopause support for employers in over 127 countries, signaling a greater commitment to comprehensive workplace health benefits.

See our latest analysis for Progyny.

Progyny’s latest move to expand support beyond fertility, alongside upcoming earnings, has put the spotlight back on its long-term growth narrative. While its share price is up nearly 10% so far this year, the one-year total shareholder return of 26% shows that momentum has picked up considerably. At the same time, three- and five-year returns reflect the volatility typical of growth stocks in healthcare.

If this broader push into global benefits piques your interest, it could be the perfect moment to explore opportunities through our healthcare stocks screener See the full list for free.

With the stock up for the year and trading well below analyst price targets, investors must ask themselves if Progyny is attractively valued for further upside, or if the market is already factoring in its global growth ambitions.

Most Popular Narrative: 31% Undervalued

The current fair value estimate for Progyny sits far above its recent closing price, suggesting that the market may be overlooking key fundamental drivers. This sets the backdrop for a valuation thesis anchored on both the company’s financial momentum and a set of ambitious growth assumptions.

Investment in an integrated women's health platform (including new services such as pelvic floor therapy, leave navigation, and enhanced digital engagement) positions Progyny to cross-sell adjacent products. This results in a higher share of wallet with current clients and additional revenue streams, supporting both topline and margin expansion.

Want to know what powers this bold upside target? The narrative hinges on transformative revenue growth, expanding profit margins, and a future earnings multiple rarely seen outside of market disruptors. Curious to see the projections the market is missing? Go inside the fair value formula and see what’s fueling such optimism.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, broad employer cost constraints or intensifying competition could limit Progyny's market share and slow the revenue growth that underlies the bullish outlook.

Find out about the key risks to this Progyny narrative.

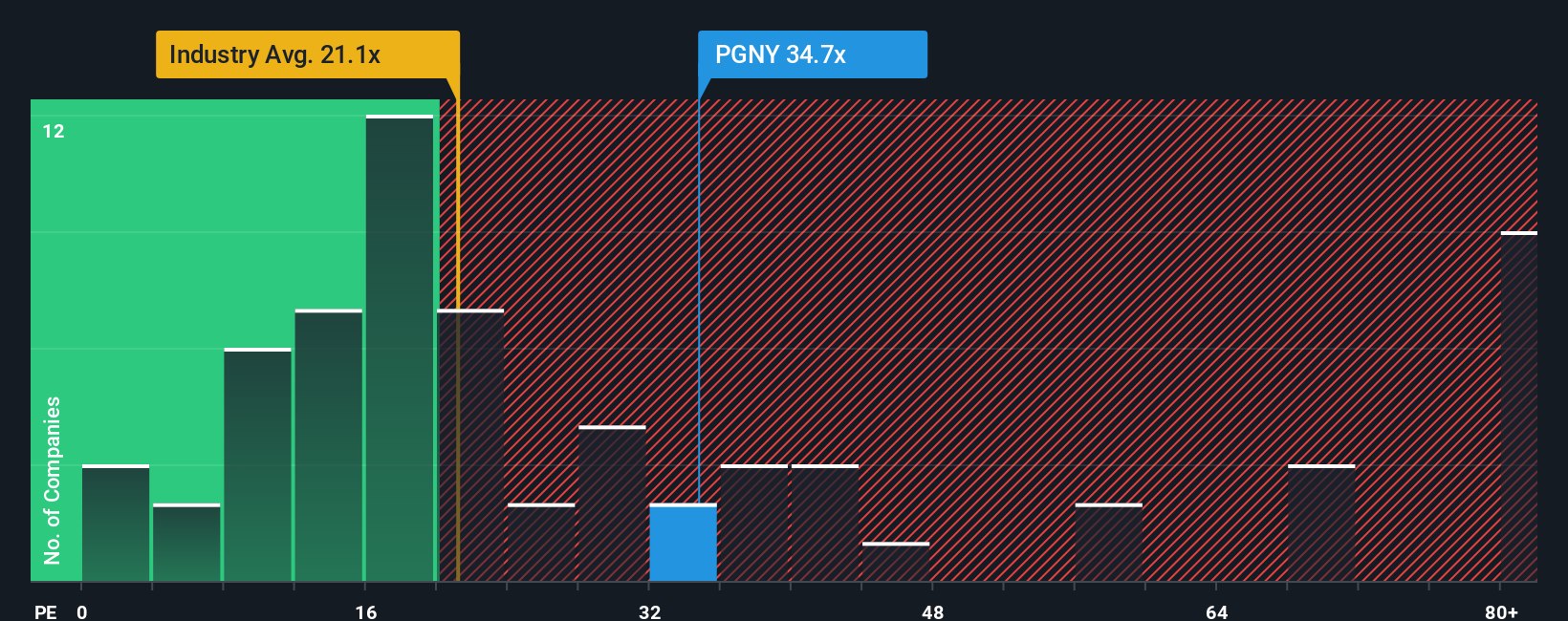

Another View: Not So Cheap Based on Earnings

While the earlier analysis revealed a potential bargain, looking at Progyny’s earnings ratio tells a different story. Shares trade at 31.5 times earnings, making them more expensive than both peers at 24.2x and the broader US Healthcare industry at 21.7x. That is a notable premium, especially compared to the fair ratio of 25.5x, raising questions about whether the market is pricing in too much future success.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progyny Narrative

If you have a different perspective or want to dive deeper into Progyny's numbers, it takes just minutes to build your own thesis. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Progyny.

Looking for More Smart Investment Ideas?

Level up your portfolio by tapping into high-potential opportunities most investors overlook. These expert screens spotlight stocks with unique qualities and exciting growth potential today.

- Boost your returns by targeting companies with strong financials and huge upside. Start with these 877 undervalued stocks based on cash flows for possible hidden gems most are missing.

- Follow the money into the future of artificial intelligence, where innovation and rapid growth converge. these 27 AI penny stocks is leading the charge.

- Build consistent passive income by searching for attractive yields using these 17 dividend stocks with yields > 3%, where stable dividends meet healthy fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGNY

Progyny

A benefits management company, provides fertility, family building, and women’s health benefits solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives