- United States

- /

- Medical Equipment

- /

- NasdaqCM:PDEX

Pro-Dex, Inc.'s (NASDAQ:PDEX) 39% Dip In Price Shows Sentiment Is Matching Earnings

The Pro-Dex, Inc. (NASDAQ:PDEX) share price has softened a substantial 39% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 103%.

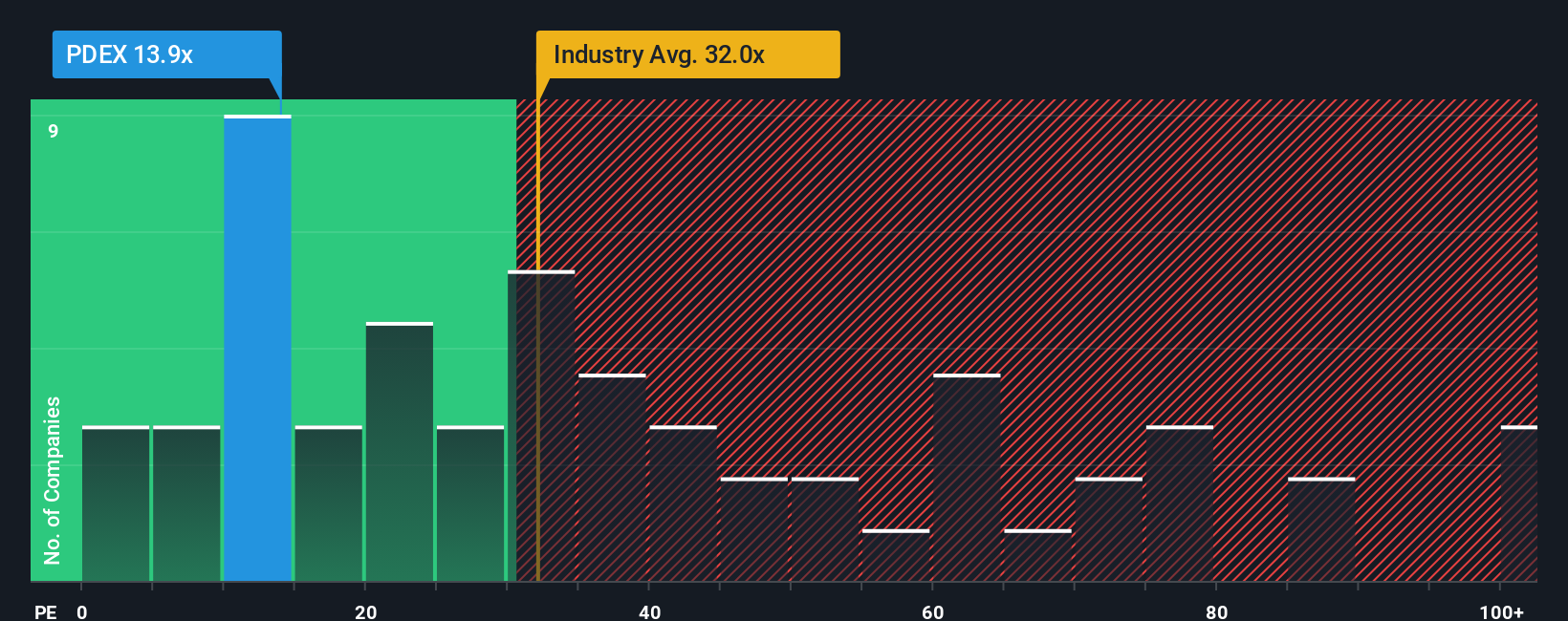

After such a large drop in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider Pro-Dex as an attractive investment with its 13.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Pro-Dex has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Pro-Dex

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Pro-Dex's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 388%. The strong recent performance means it was also able to grow EPS by 224% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings growth is heading into negative territory, declining 12% over the next year. With the market predicted to deliver 13% growth , that's a disappointing outcome.

In light of this, it's understandable that Pro-Dex's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

The softening of Pro-Dex's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Pro-Dex's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Pro-Dex (2 are a bit unpleasant!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PDEX

Pro-Dex

Designs, develops, manufactures, and sells powered surgical instruments for medical device original equipment manufacturers worldwide.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026