- United States

- /

- Medical Equipment

- /

- NasdaqCM:PDEX

Even With A 26% Surge, Cautious Investors Are Not Rewarding Pro-Dex, Inc.'s (NASDAQ:PDEX) Performance Completely

Those holding Pro-Dex, Inc. (NASDAQ:PDEX) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

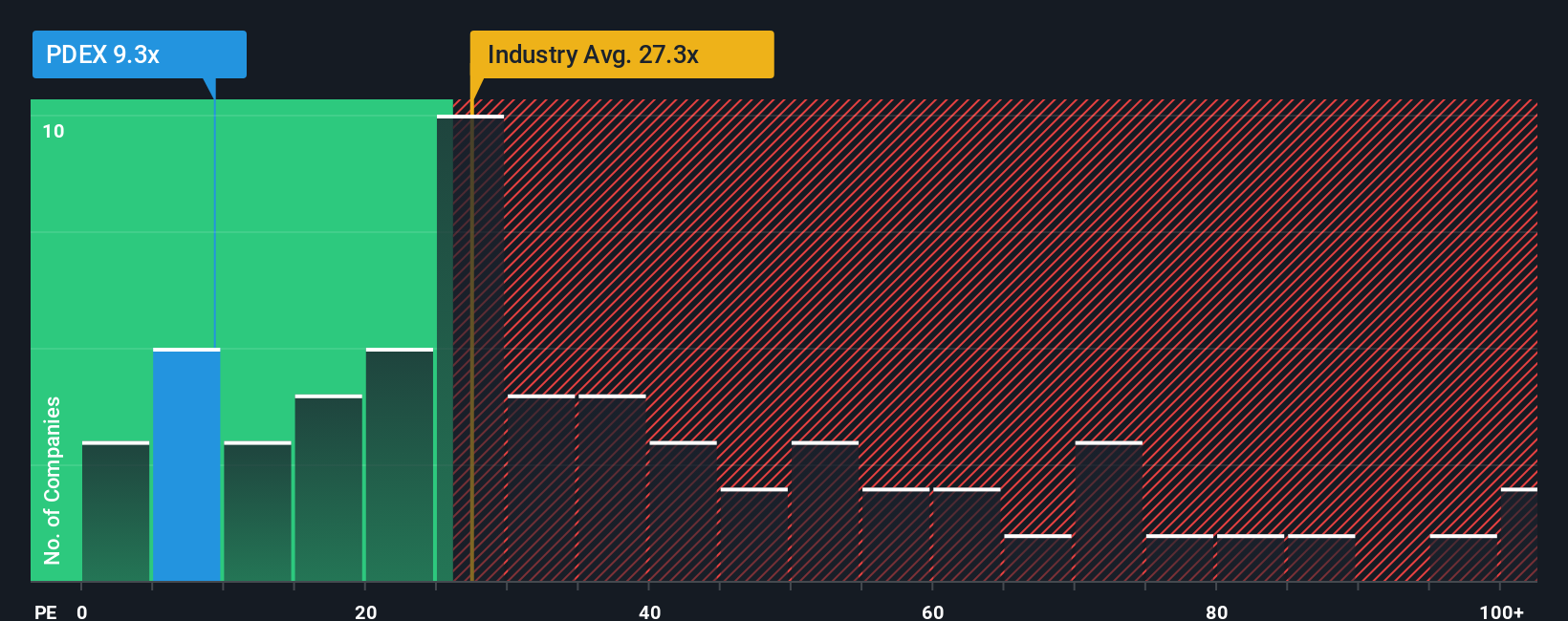

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Pro-Dex as an attractive investment with its 9.3x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Pro-Dex has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Pro-Dex

How Is Pro-Dex's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Pro-Dex's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 124% last year. Pleasingly, EPS has also lifted 164% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 16% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Pro-Dex's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Pro-Dex's P/E

Despite Pro-Dex's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Pro-Dex currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Pro-Dex (1 can't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Pro-Dex, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PDEX

Pro-Dex

Designs, develops, manufactures, and sells powered surgical instruments for medical device original equipment manufacturers worldwide.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives