Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, PAVmed Inc. (NASDAQ:PAVM) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for PAVmed

What Is PAVmed's Debt?

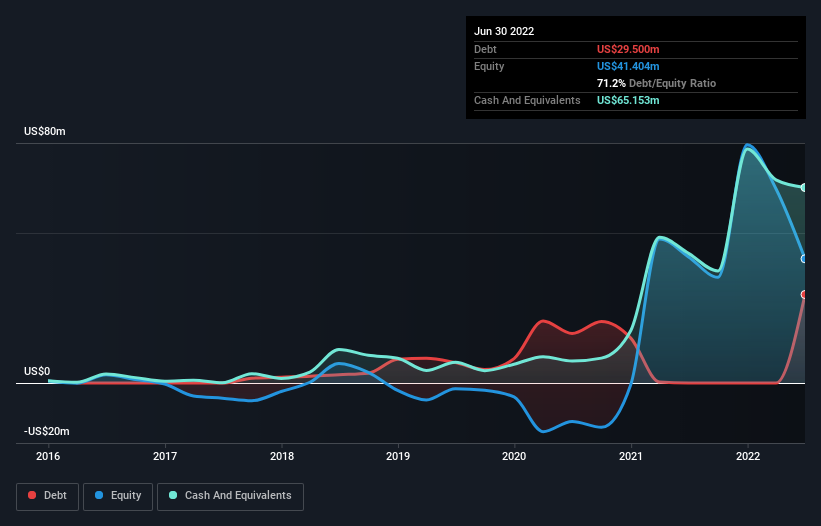

You can click the graphic below for the historical numbers, but it shows that as of June 2022 PAVmed had US$29.5m of debt, an increase on none, over one year. But it also has US$65.2m in cash to offset that, meaning it has US$35.7m net cash.

How Healthy Is PAVmed's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that PAVmed had liabilities of US$38.9m due within 12 months and liabilities of US$2.18m due beyond that. On the other hand, it had cash of US$65.2m and US$89.0k worth of receivables due within a year. So it can boast US$24.2m more liquid assets than total liabilities.

This surplus suggests that PAVmed has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that PAVmed has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if PAVmed can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year PAVmed managed to produce its first revenue as a listed company, but given the lack of profit, shareholders will no doubt be hoping to see some strong increases.

So How Risky Is PAVmed?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that PAVmed had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$62m of cash and made a loss of US$72m. Given it only has net cash of US$35.7m, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example PAVmed has 5 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PAVM

PAVmed

Engages in acquiring, developing, and commercializing novel products that target unmet needs in the United States.

Medium-low risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026