- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPCH

Option Care Health (OPCH) Rises on Upbeat Guidance and Buybacks Is Its Capital Allocation Shifting?

Reviewed by Sasha Jovanovic

- Option Care Health, Inc. recently reported its third-quarter 2025 results, with sales of US$1.44 billion and adjusted earnings of US$0.45 per share, and raised full-year revenue and earnings guidance to between US$5.60 billion and US$5.65 billion and US$1.68 to US$1.72 per share, respectively.

- The company also completed a buyback of 6.76 million shares for US$212.51 million, retiring over 4% of outstanding shares under its ongoing repurchase program.

- We'll now explore how Option Care Health's raised full-year guidance and continued buybacks influence its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Option Care Health Investment Narrative Recap

To be a shareholder in Option Care Health, you need to believe in the long-term expansion of home and alternate site infusion services, supported by demographic and healthcare delivery trends. The company’s raised full-year guidance following stronger-than-expected third-quarter results reinforces its growth catalyst, while risks connected to reimbursement rate changes and payer negotiations still remain. At this time, the latest financial updates do not materially shift these short-term catalysts or the key risks facing the business.

Among recent announcements, the update that Option Care Health completed a major tranche of its share buyback program stands out. By retiring over 4% of outstanding shares in just three quarters, the company is actively managing capital allocation, which may enhance per-share metrics and aligns with ongoing efforts to drive shareholder value. However, the underlying long-term growth is still linked to factors such as payer relationships and gross margin pressures.

By contrast, one issue investors should be aware of is how further shifts in therapy mix could stress gross margins and, ultimately ...

Read the full narrative on Option Care Health (it's free!)

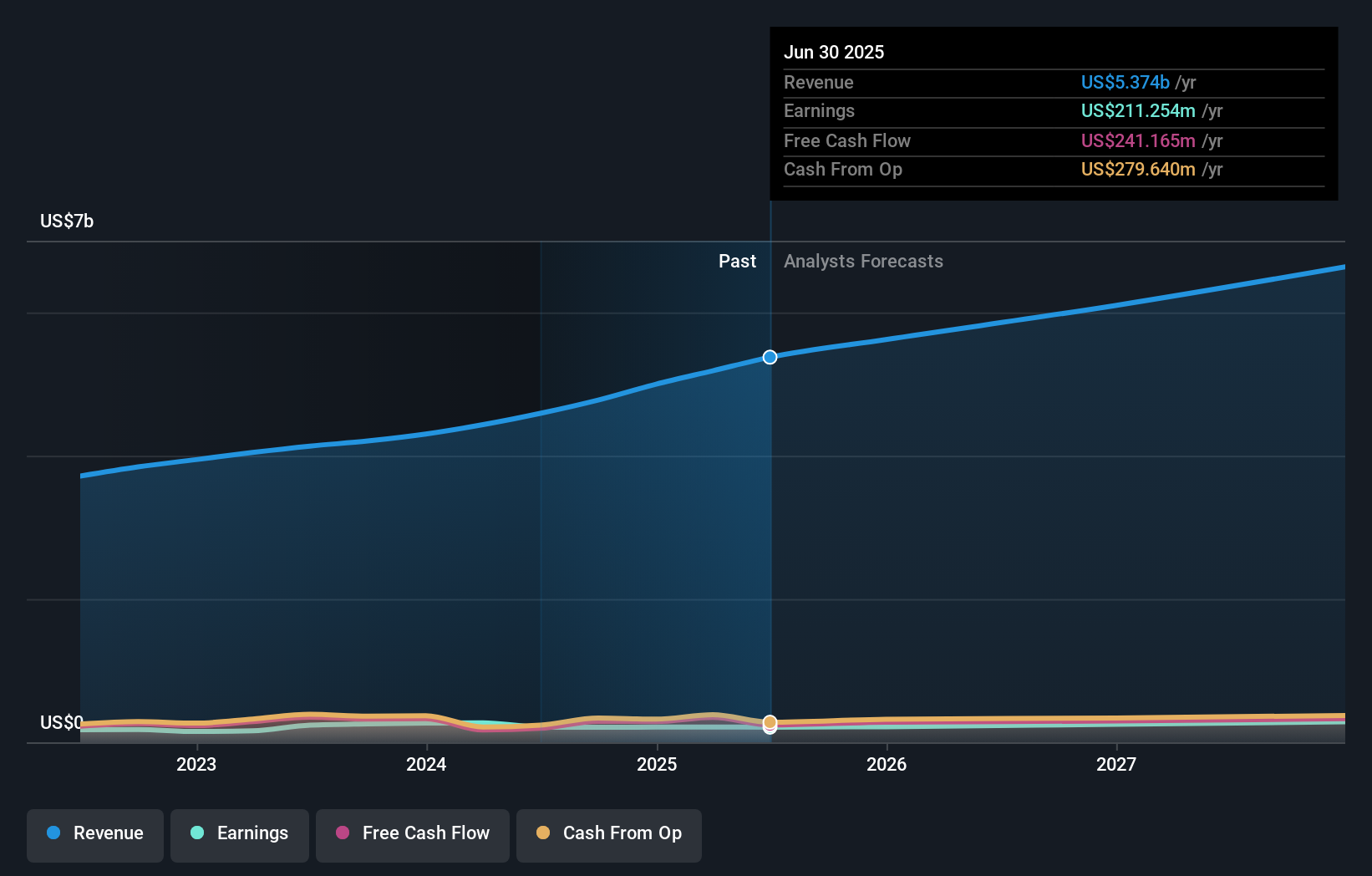

Option Care Health's outlook forecasts $6.9 billion in revenue and $306.2 million in earnings by 2028. Achieving this requires 8.8% annual revenue growth and a $94.9 million increase in earnings from the current $211.3 million.

Uncover how Option Care Health's forecasts yield a $37.90 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community estimates put Option Care Health’s fair value between US$37.90 and US$61.99 per share. While perspectives vary, recent upward guidance and steady buybacks continue to frame the importance of margin trends on future performance.

Explore 2 other fair value estimates on Option Care Health - why the stock might be worth over 2x more than the current price!

Build Your Own Option Care Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Option Care Health research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Option Care Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Option Care Health's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPCH

Option Care Health

Offers home and alternate site infusion services in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives