- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPCH

Option Care Health (OPCH): Evaluating Valuation After Guidance Upgrade and 2025 Revenue Headwind Update

Reviewed by Simply Wall St

Option Care Health (OPCH) drew investor attention at the Jefferies London Healthcare Conference after addressing a projected $60 to $70 million revenue headwind in 2025 from Stelara biosimilar discount changes, while also raising its full-year guidance for the year ahead.

See our latest analysis for Option Care Health.

Option Care Health’s positive update seems to have reignited investor confidence, with the stock up 24.6% year to date and delivering a 29.3% total shareholder return over the last year. Momentum has been building following raised guidance and management’s reassurance around long-term growth, which suggests that recent news is driving optimism despite upcoming revenue headwinds.

Curious which other healthcare names are showing similar resilience and upside? Discover new opportunities by exploring our See the full list for free.

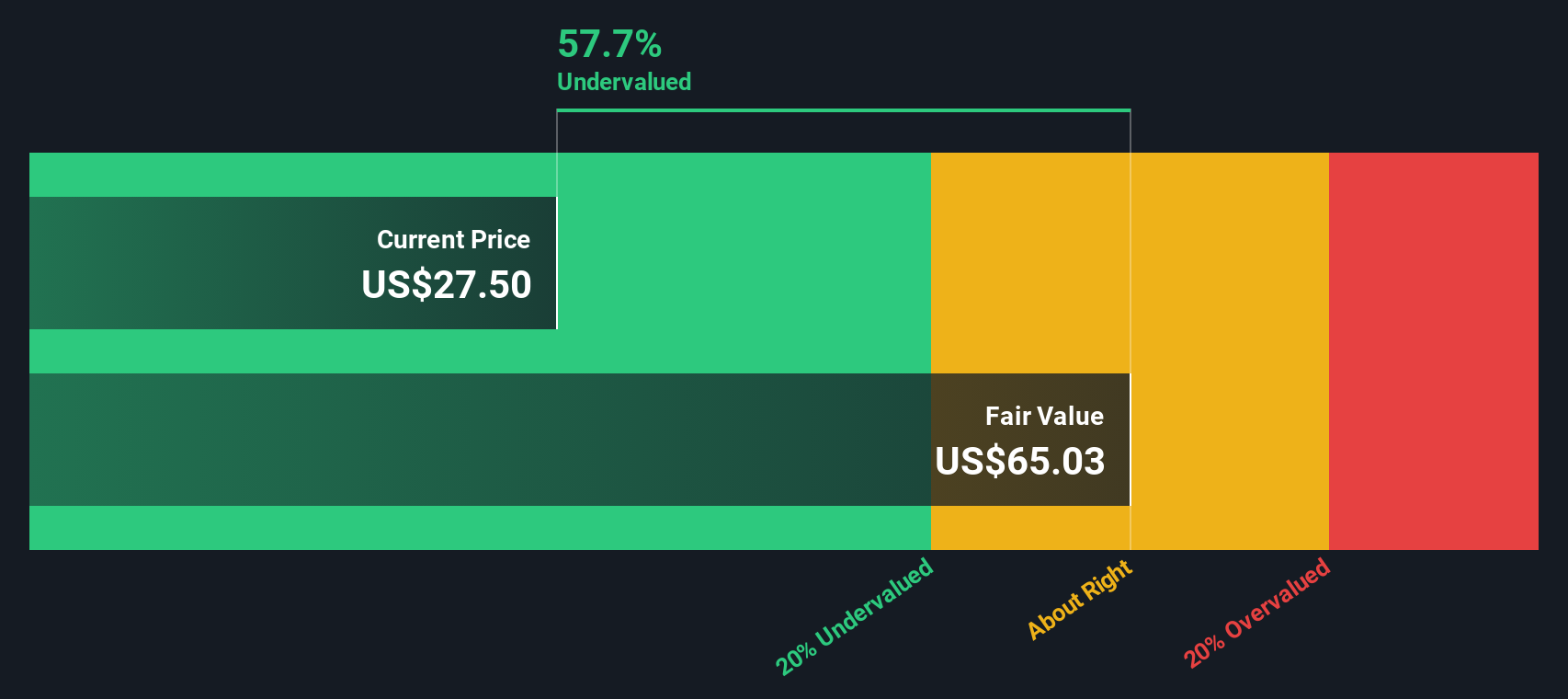

Given the upbeat guidance and recent rally, the question now is whether Option Care Health remains undervalued or if the market has already factored in the company’s future growth. Could there still be a buying opportunity?

Most Popular Narrative: 19.9% Undervalued

Option Care Health’s narrative assigns a fair value noticeably higher than the last close of $28.28, implying notable upside based on future company performance and market opportunity. The stage is set for some ambitious projections. Here’s a direct quote from the most widely followed narrative that captures its bullish underpinning:

Investments in technology, clinical efficiency, and strategic capital deployment are driving margin improvements, new revenue streams, and long-term earnings expansion. Continued expansion of the company's national suite footprint and advanced practitioner model is improving nurse productivity and enabling the treatment of higher acuity, complex, and new therapeutic cohorts (including oncology and Alzheimer's), driving both margin improvements and new revenue streams.

What’s the secret behind this bullish valuation target? It hinges on a roadmap of aggressive profit expansion and a future earnings multiple that could surprise even the most seasoned investors. Want to know the unexpected drivers powering the analysts’ confidence? Discover the quantitative story and see what makes this fair value so provocative. Read the entire narrative to reveal the projections at its core.

Result: Fair Value of $35.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is worth noting that ongoing reimbursement changes or shifts towards lower-margin therapies could challenge Option Care Health’s long-term profit and revenue outlook.

Find out about the key risks to this Option Care Health narrative.

Another View: What About Fair Value Using the SWS DCF Model?

While analysts see upside using earnings-based multiples, our DCF model tells a different story. According to this approach, Option Care Health is trading at a remarkable 54% discount to its estimated fair value of $61.53. This large gap could mean the market is underestimating the company's future cash flows. Could this be a hidden opportunity, or is the DCF model too optimistic given industry risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Option Care Health Narrative

If you want to take a closer look or see things from a different angle, you can build your own narrative using the latest data in just minutes. Do it your way

A great starting point for your Option Care Health research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let new opportunities pass you by. There are incredible companies flying under the radar right now. Equip yourself to spot tomorrow’s leaders and strengthen your portfolio using Simply Wall Street’s powerful tools.

- Unlock access to companies with high growth potential and robust financial health by checking out these 3579 penny stocks with strong financials.

- Capture big yield possibilities and future cash flow by reviewing these 18 dividend stocks with yields > 3% with yields over 3%.

- Tap into the transformative future of medicine and technology by investigating these 31 healthcare AI stocks driving real-world healthcare breakthroughs through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPCH

Option Care Health

Offers home and alternate site infusion services in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives