- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPCH

How Option Care Health's Strategic Moves at Jefferies Conference (OPCH) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Option Care Health recently outlined its strategic plans at the Jefferies London Healthcare Conference, responding to a US$60 million to US$70 million anticipated revenue headwind in 2025 from Stelara biosimilar discount adjustments, while raising its full-year outlook and forecasting growth in key financial metrics for 2026.

- Despite addressing near-term revenue challenges, the company's continued expansion of its advanced practitioner model and commitment to share buybacks signal a focus on long-term market reach and shareholder returns.

- We'll explore how Option Care Health's proactive approach to upcoming biosimilar-related revenue pressures could impact its investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Option Care Health Investment Narrative Recap

To be a shareholder of Option Care Health, you need to believe that growth in both acute and chronic infusion services will continue to outpace the healthcare market and that the company can convert demographic trends and payer partnerships into lasting revenue expansion. The recent update regarding the anticipated US$60 million to US$70 million biosimilar-related revenue headwind in 2025 is unlikely to materially change the central catalyst of expanding market access through advanced practitioner and technology investments, nor does it alter the main risk of ongoing gross margin compression from therapy mix shifts. One announcement aligning closely with the latest news is Option Care Health’s ongoing commitment to its share buyback program, with over 6.7 million shares repurchased in 2025 alone. This reinforces the organization’s confidence in its fundamentals and provides an additional lever to support shareholder value, underscoring its resolve even in the face of reimbursement disruptions and market shifts. Yet, despite these positives, investors should remain aware of the potential for future contract renegotiations and reimbursement rate squeezes, which...

Read the full narrative on Option Care Health (it's free!)

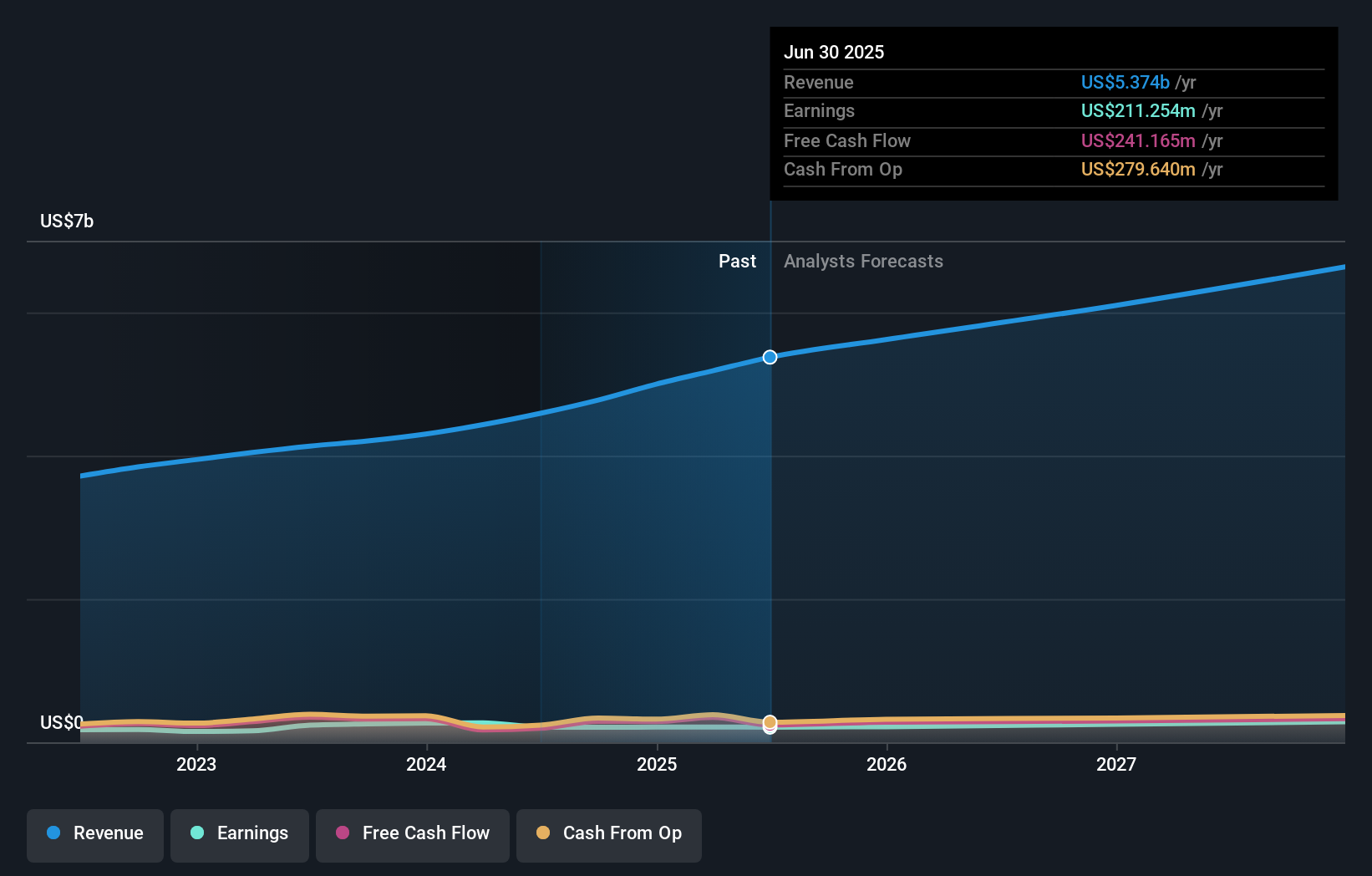

Option Care Health’s narrative projects $6.9 billion in revenue and $306.2 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $94.9 million earnings increase from current earnings of $211.3 million.

Uncover how Option Care Health's forecasts yield a $35.30 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates for Option Care Health that span from US$35.30 to US$61.53 per share. With this diversity of outlooks, consider how the ongoing risk of changes in therapy mix and gross margin compression could impact future growth or profitability targets.

Explore 2 other fair value estimates on Option Care Health - why the stock might be worth just $35.30!

Build Your Own Option Care Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Option Care Health research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Option Care Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Option Care Health's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPCH

Option Care Health

Offers home and alternate site infusion services in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives