- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Omnicell (OMCL): Rethinking Valuation After a Recent Rebound in Share Price

Reviewed by Simply Wall St

See our latest analysis for Omnicell.

While Omnicell's 15.8% one-month share price return points to renewed momentum, the stock has struggled in the bigger picture. Over the past year, the total shareholder return is -21.7%, and losses have deepened over a longer horizon as well. Investors seem to be reassessing risk and growth prospects as recent price action breaks from its downtrend.

If Omnicell's shift has you curious about other opportunities, now’s a perfect time to broaden your search and discover See the full list for free.

This recent move leaves investors asking a critical question: does the current price reflect Omnicell’s true value, or could the recent turnaround be the start of an even bigger opportunity for buyers?

Most Popular Narrative: 23.9% Undervalued

Omnicell’s narrative-implied fair value stands at $47.33 per share, a meaningful premium over the recent closing price of $36. While that difference hints at a bullish outlook, understanding the core reasoning requires a closer look at the business transformation underway.

The continued rollout and adoption of the cloud-native OmniSphere platform across Omnicell's customer base will simplify enterprise-wide medication management. This will make adding new features and integrating advanced analytics much easier and accelerate the company's transition to higher-margin, recurring SaaS-based revenues. These changes are expected to support improved revenue predictability and net margins.

Want to know the secret formula behind this value gap? It’s not just about momentum. The story pivots on a shift to recurring revenue, faster margin expansion, and ambitious profitability goals. High expectations are built in, but what are the numbers driving that confidence? Click to unravel Omnicell’s valuation playbook.

Result: Fair Value of $47.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff expenses and macroeconomic uncertainty could undermine Omnicell’s profitability and disrupt the expected pace of its recovery.

Find out about the key risks to this Omnicell narrative.

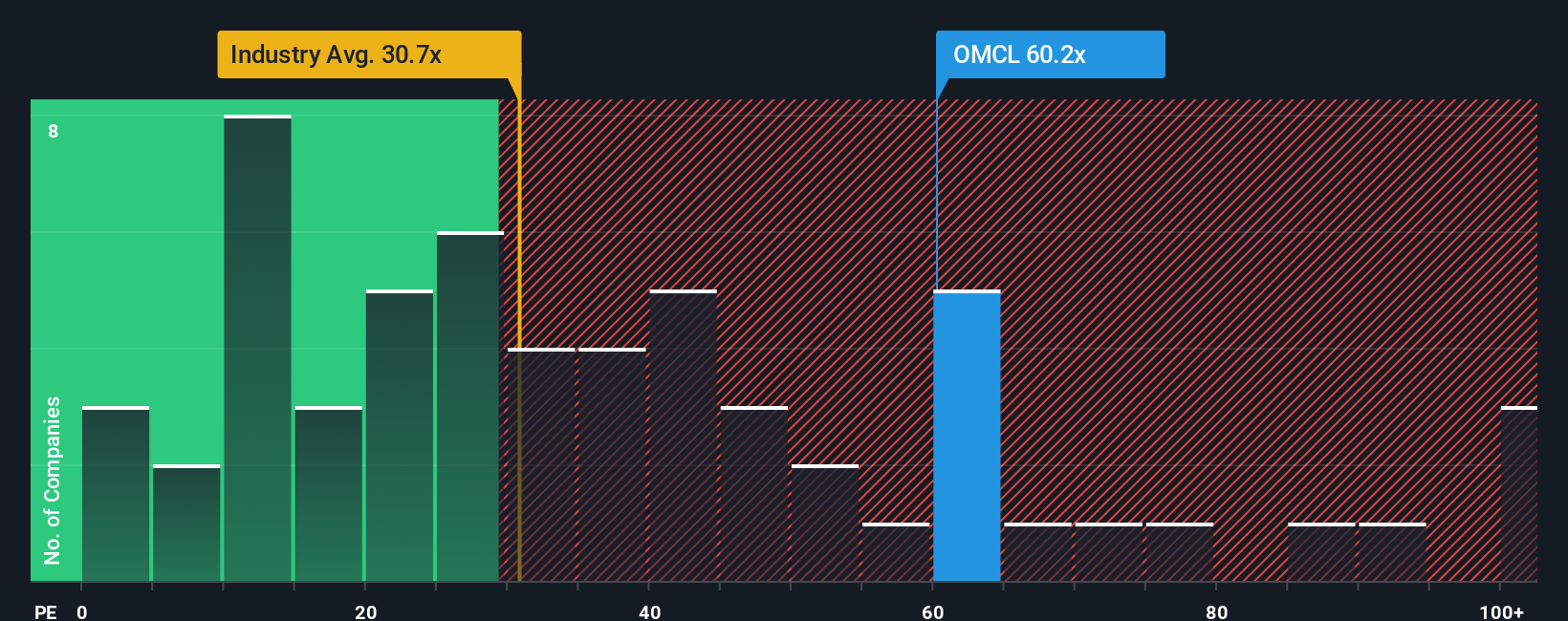

Another View: Multiples Signal Overvaluation

Looking from another angle, Omnicell trades at a price-to-earnings ratio of 81.1x, which is far above both the US Medical Equipment industry average of 27.7x and the peer group’s 29.4x. Even compared to a fair ratio of 32.2x, the current multiple stands out as aggressive. Is the high valuation justified, or is the market setting itself up for a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omnicell Narrative

Prefer hands-on insights or have your own interpretation of Omnicell’s story? The platform makes it quick and easy to shape your own narrative, and you can do so in just a couple of minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Omnicell.

Looking for More Investment Ideas?

Don’t wait for the next stock surge to pass you by. Tap into opportunities now and strengthen your watchlist with winning ideas across different markets.

- Unlock unique upside with these 3588 penny stocks with strong financials with strong balance sheets and potential for exponential returns.

- Capture income and growth by targeting these 15 dividend stocks with yields > 3% yielding over 3% to build a portfolio that pays you back.

- Seize the AI advantage and ride the momentum of innovation with these 26 AI penny stocks making waves in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives