- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Omnicell (OMCL): Exploring Valuation After Recent Share Weakness and Ongoing Business Transition

Reviewed by Kshitija Bhandaru

Omnicell (OMCL) shares have been under pressure lately, retreating 4% in the last day and down 7% over the past month. The healthcare technology company’s recent stock movement may pique investor curiosity, as shares are lagging behind longer-term benchmarks.

See our latest analysis for Omnicell.

After a difficult year for Omnicell, with a year-to-date share price return of -32.94% and a 1-year total shareholder return of -30.45%, momentum remains weak despite a brief 90-day rebound. The volatile moves suggest shifting investor sentiment and possible reevaluation of the company's growth outlook and risk profile.

With healthcare stocks making headlines for innovation and resilience, it’s a smart time to see who else is standing out. Check out the latest opportunities in our See the full list for free..

With shares trading below analyst price targets and recent gains failing to reverse longer-term declines, the big question remains: is Omnicell now trading at a bargain, or is the market already pricing in modest growth ahead?

Most Popular Narrative: 32.5% Undervalued

Omnicell’s latest close of $29.72 sits notably below the most widely followed fair value estimate of $44, suggesting significant upside if the narrative projections hold. As the market weighs Omnicell’s recurring revenue transition, automation leadership, and cloud focus, the most popular narrative offers a bullish perspective that is drawing attention.

“The continued rollout and adoption of the cloud-native OmniSphere platform across Omnicell's customer base will simplify enterprise-wide medication management, make adding new features and integrating advanced analytics much easier, and accelerate the company's transition to higher-margin, recurring SaaS-based revenues, supporting improved revenue predictability and net margins.”

Curious what powers this bullish target? The secret sauce behind the high fair value is a bold revenue and profit turnaround, paired with a future earnings multiple rarely seen outside tech. Want the full blueprint and the one assumption that makes or breaks this upside? Dive in to see the drivers no one is talking about.

Result: Fair Value of $44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as ongoing tariff impacts and slow progress in recurring revenues could challenge Omnicell’s positive outlook and growth trajectory in the years ahead.

Find out about the key risks to this Omnicell narrative.

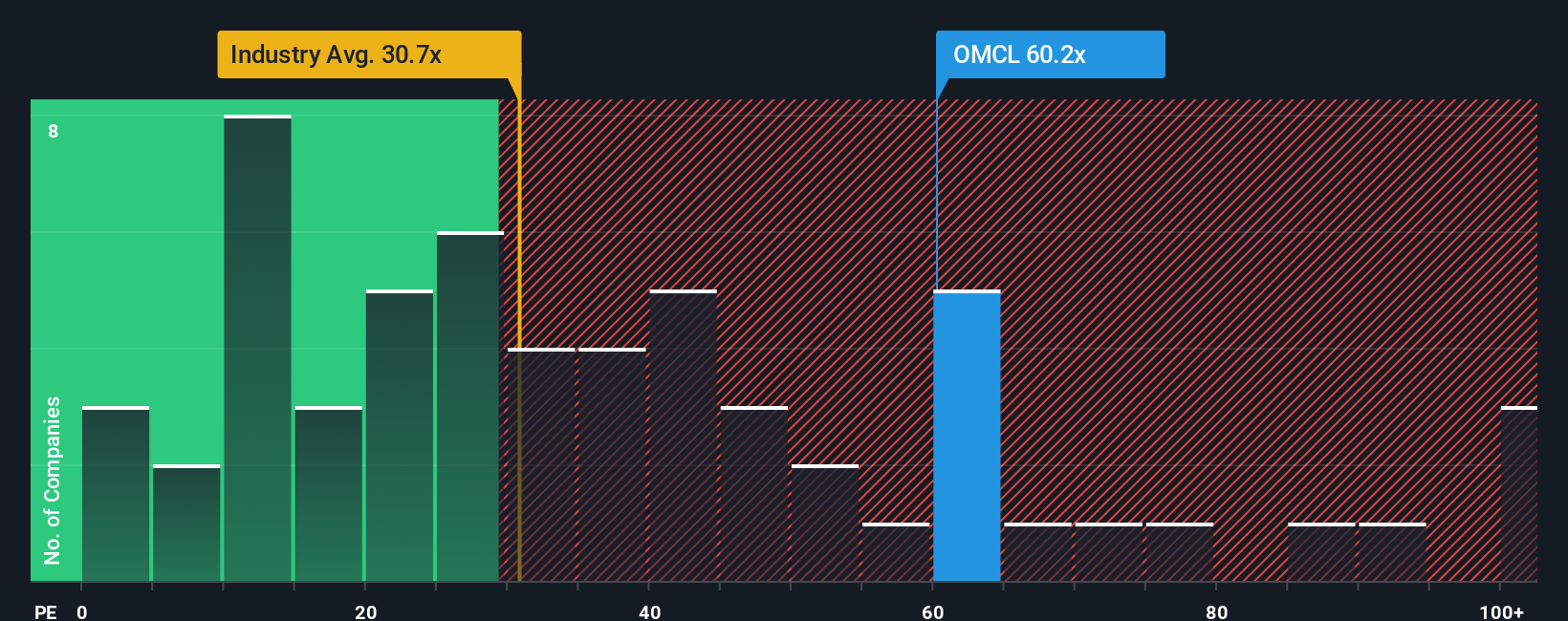

Another View: Market Ratios Raise Questions

Taking a look through the lens of market ratios, Omnicell appears pricey. Its current valuation is nearly double the average for both the industry and its peers, and it also stands far above the fair ratio the market could move toward. This sizable gap means the shares could be exposed to additional downside risk if sentiment turns, or it might simply signal high future growth expectations. Is the market overconfident, or is there something more beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omnicell Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own view in just a few minutes, so why not Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Omnicell.

Looking for more investment ideas?

Seize the chance to uncover what others might miss by checking out unique stock picks tailored to different strategies. Don't let winning opportunities pass you by. Expand your investing universe using these tools:

- Target steady income streams by starting with these 19 dividend stocks with yields > 3% featuring reliable payers with yields exceeding 3%.

- Capitalize on powerful market trends by tapping into innovation with these 24 AI penny stocks and spot the companies driving the AI revolution forward.

- Catch mispriced gems by seeing these 891 undervalued stocks based on cash flows offering value boosts based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives