- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Is Omnicell Attractively Priced After Recent Double Digit Share Price Rally?

Reviewed by Bailey Pemberton

- Curious if Omnicell might be a hidden gem or just fairly priced? You're not alone; valuation is often top of mind for investors searching for opportunity.

- The stock has made some noise recently, jumping 7.5% over the past week and 19.0% in the last month, but it is still down 16.5% for the year and nearly 65% over five years.

- Recent headlines have focused on Omnicell’s strategic moves and ongoing efforts to boost operational efficiency, which has put the company back in the spotlight. Investor attention seems to be shifting as management explores new ways to adapt in the evolving healthcare technology landscape.

- On our valuation scorecard, Omnicell earns a 1 out of 6, meaning it is considered undervalued in just one of the six checks we use. Let's dig into how this score is determined, and stick around; there is a more nuanced way to understand Omnicell’s value coming up at the end.

Omnicell scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Omnicell Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate the intrinsic value of a business by projecting its future cash flows and discounting them back to today’s dollars. This approach condenses expected future earnings into a single figure that helps investors gauge whether a stock is priced attractively.

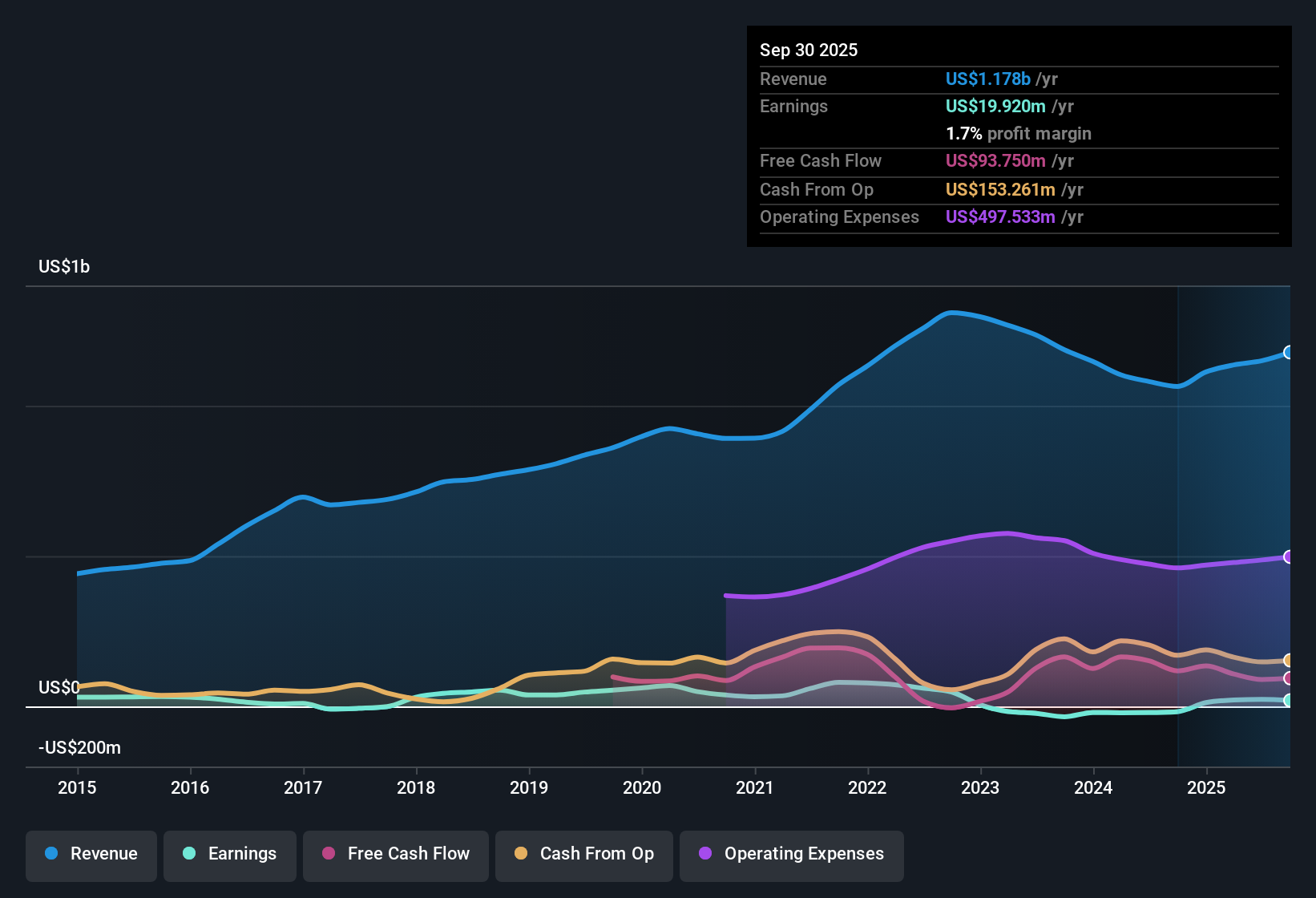

For Omnicell, the current Free Cash Flow stands at $94.5 million. Based on analyst projections, Free Cash Flow is expected to steadily grow, reaching $88.7 million by 2029. Beyond that, future values are estimated by Simply Wall St’s team using extrapolation methods. The DCF model in this analysis relies on a two-stage forecast, where analysts provide estimates for the first five years and subsequent years are projected using historical and expected trends.

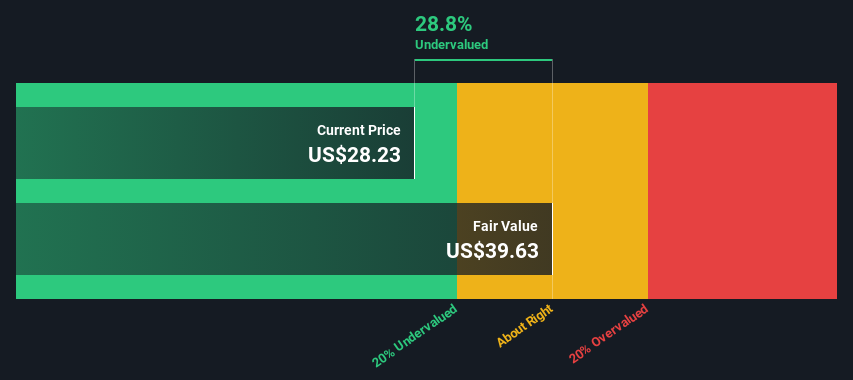

After analyzing these forecast numbers, the resulting intrinsic value for Omnicell is $44.36 per share. This represents a 16.6% discount to the current share price, which may suggest that the stock is undervalued by the market according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Omnicell is undervalued by 16.6%. Track this in your watchlist or portfolio, or discover 935 more undervalued stocks based on cash flows.

Approach 2: Omnicell Price vs Earnings

For companies that are profitable, the Price-to-Earnings (PE) ratio is one of the most widely used valuation tools. It acts as a quick shorthand for how much investors are willing to pay for each dollar of earnings. A higher PE can indicate high growth expectations or lower risk, while a lower PE may reflect slower growth prospects or higher perceived risks.

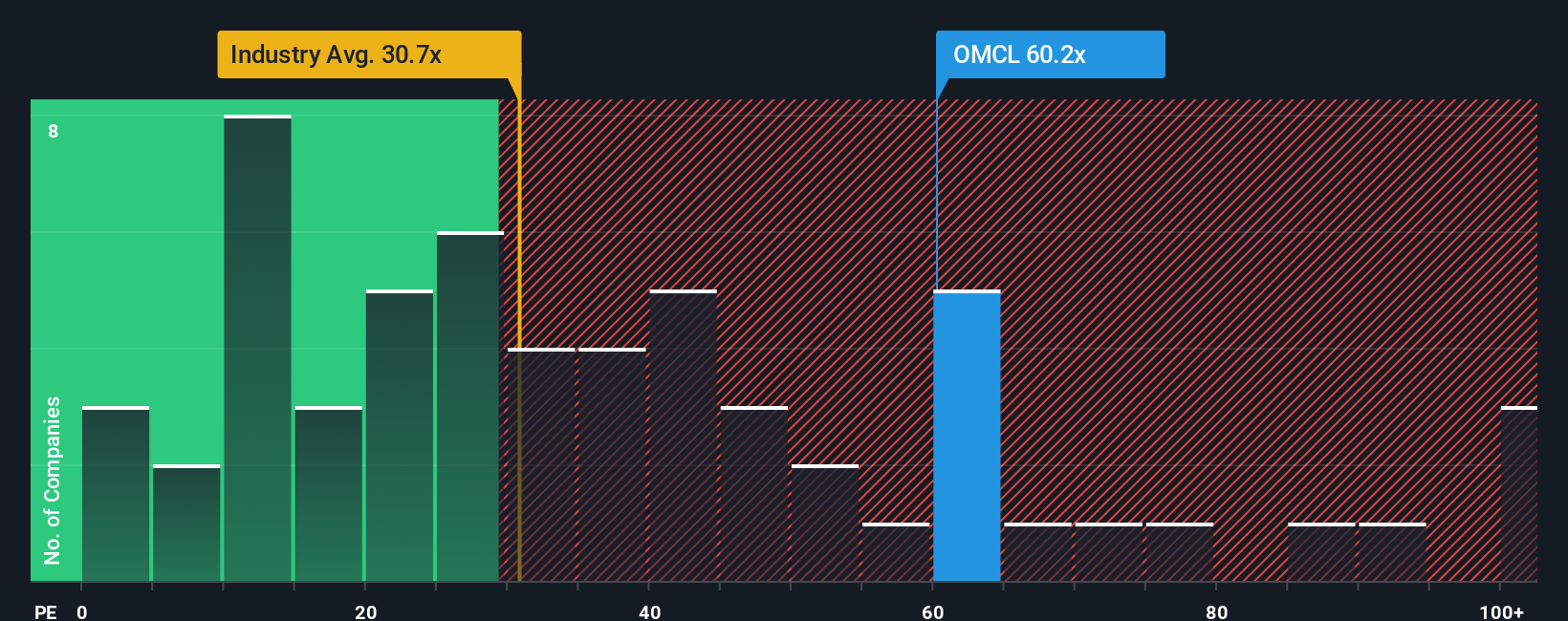

Omnicell currently trades at a PE ratio of 83.4x. That is well above both the Medical Equipment industry average of 28.8x and the peer average of 29.4x. However, rather than relying solely on these broad benchmarks, it is important to determine if this elevated multiple is justified for Omnicell specifically.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. For Omnicell, the Fair PE Ratio is calculated at 32.3x. The Fair Ratio goes beyond simple peer comparison by factoring in Omnicell’s earnings growth outlook, underlying business risks, profit margins, and its position within the industry and broader market. This gives a more nuanced and tailored answer to what Omnicell’s “normal” valuation should be in today’s market environment.

With Omnicell’s actual PE multiple of 83.4x sitting significantly higher than the Fair Ratio of 32.3x, the stock appears to be trading well above what fundamentals suggest is justified at present.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Omnicell Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative combines your view of Omnicell’s story with your assumptions about its future revenue, earnings, and margins. This lets you create a personalized financial forecast that ties directly to an estimated fair value. This approach moves beyond simple ratios, making it easier to see how your perspective on growth, risks, or industry trends translates into what the company is truly worth.

Simply Wall St’s Narratives tool, available on the Community page and used by millions of investors, makes this powerful process accessible. It lets you build, update, and share your Narrative quickly and intuitively. When news breaks or earnings are announced, Narratives are updated automatically, so your investment thesis always reflects the latest information.

Narratives also help you compare your fair value calculation with the current share price. For example, one user's Narrative projects strong cloud revenue and margin expansion, producing a fair value of $55.00 per share. Another, more cautious Narrative factors in margin pressure and competitive risks, leading to a fair value of just $34.00. By creating your own Narrative, you can invest with clarity and confidence, grounded in both your research and your beliefs about the future.

Do you think there's more to the story for Omnicell? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success