- United States

- /

- Healthcare Services

- /

- NasdaqCM:NUTX

Nutex Health Inc. (NASDAQ:NUTX) Might Not Be As Mispriced As It Looks

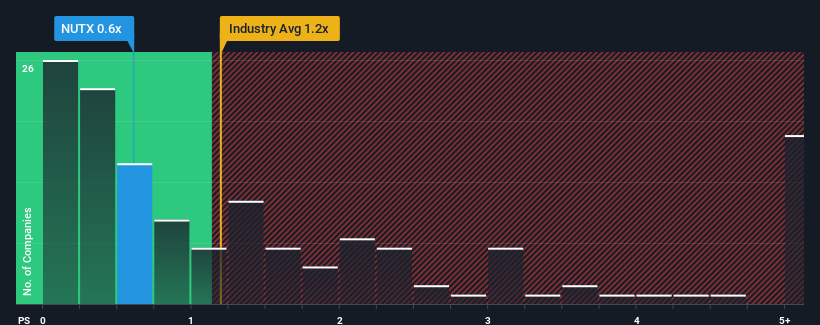

When close to half the companies operating in the Healthcare industry in the United States have price-to-sales ratios (or "P/S") above 1.2x, you may consider Nutex Health Inc. (NASDAQ:NUTX) as an attractive investment with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Nutex Health

How Has Nutex Health Performed Recently?

Nutex Health could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Nutex Health's future stacks up against the industry? In that case, our free report is a great place to start.How Is Nutex Health's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nutex Health's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 15% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 21% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 7.7%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Nutex Health is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Nutex Health's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Nutex Health currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for Nutex Health that we have uncovered.

If these risks are making you reconsider your opinion on Nutex Health, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nutex Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NUTX

Nutex Health

Operates as a healthcare services and operations company in the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives