- United States

- /

- Medical Equipment

- /

- NasdaqGM:NPCE

NeuroPace, Inc. (NASDAQ:NPCE) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

NeuroPace, Inc. (NASDAQ:NPCE) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 57%.

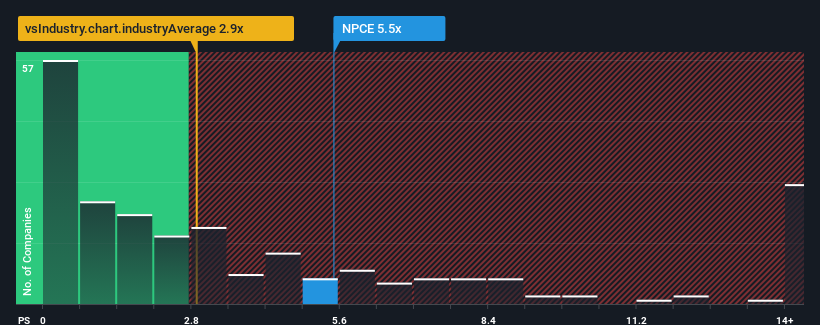

Following the firm bounce in price, given around half the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 2.9x, you may consider NeuroPace as a stock to avoid entirely with its 5.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

We've discovered 1 warning sign about NeuroPace. View them for free.View our latest analysis for NeuroPace

What Does NeuroPace's Recent Performance Look Like?

Recent times have been advantageous for NeuroPace as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on NeuroPace will help you uncover what's on the horizon.How Is NeuroPace's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like NeuroPace's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The latest three year period has also seen an excellent 77% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 18% each year over the next three years. That's shaping up to be materially higher than the 9.8% per year growth forecast for the broader industry.

With this in mind, it's not hard to understand why NeuroPace's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

NeuroPace's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that NeuroPace maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 1 warning sign for NeuroPace that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NeuroPace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NPCE

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026