- United States

- /

- Medical Equipment

- /

- NasdaqGS:NEOG

Neogen Corporation (NASDAQ:NEOG) Investors Are Less Pessimistic Than Expected

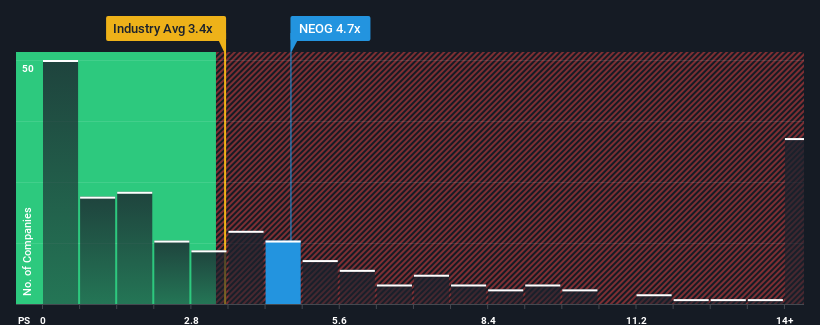

You may think that with a price-to-sales (or "P/S") ratio of 4.7x Neogen Corporation (NASDAQ:NEOG) is a stock to potentially avoid, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios under 3.4x and even P/S lower than 1.3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Neogen

What Does Neogen's Recent Performance Look Like?

Recent times have been advantageous for Neogen as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Neogen will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Neogen?

Neogen's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 73% last year. The latest three year period has also seen an excellent 116% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 6.0% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 8.7%, which is noticeably more attractive.

In light of this, it's alarming that Neogen's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Neogen's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Neogen currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Neogen with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Neogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NEOG

Neogen

Develops, manufactures, and markets various products and services for food and animal safety in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives