- United States

- /

- Healthcare Services

- /

- NasdaqCM:NEO

Risks To Shareholder Returns Are Elevated At These Prices For NeoGenomics, Inc. (NASDAQ:NEO)

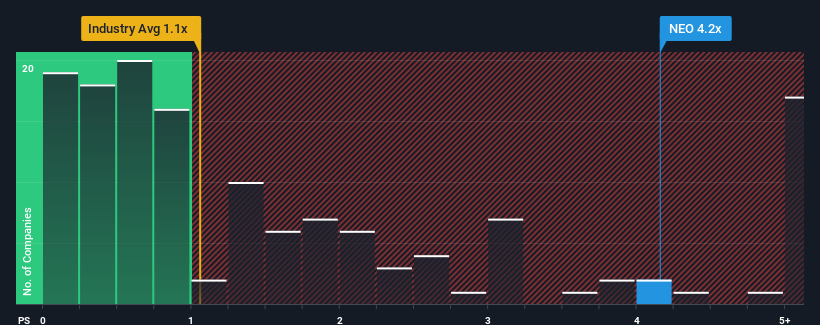

When you see that almost half of the companies in the Healthcare industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, NeoGenomics, Inc. (NASDAQ:NEO) looks to be giving off strong sell signals with its 4.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for NeoGenomics

What Does NeoGenomics' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, NeoGenomics has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think NeoGenomics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For NeoGenomics?

The only time you'd be truly comfortable seeing a P/S as steep as NeoGenomics' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 9.0%. The latest three year period has also seen a 26% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 8.3% during the coming year according to the analysts following the company. With the industry predicted to deliver 7.5% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that NeoGenomics' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From NeoGenomics' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given NeoGenomics' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for NeoGenomics you should know about.

If these risks are making you reconsider your opinion on NeoGenomics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if NeoGenomics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NEO

NeoGenomics

Operates a network of cancer-focused testing laboratories in the United States and the United Kingdom.

Adequate balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.