- United States

- /

- Healthcare Services

- /

- NasdaqCM:NEO

Market Cool On NeoGenomics, Inc.'s (NASDAQ:NEO) Revenues Pushing Shares 27% Lower

NeoGenomics, Inc. (NASDAQ:NEO) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 70% share price decline.

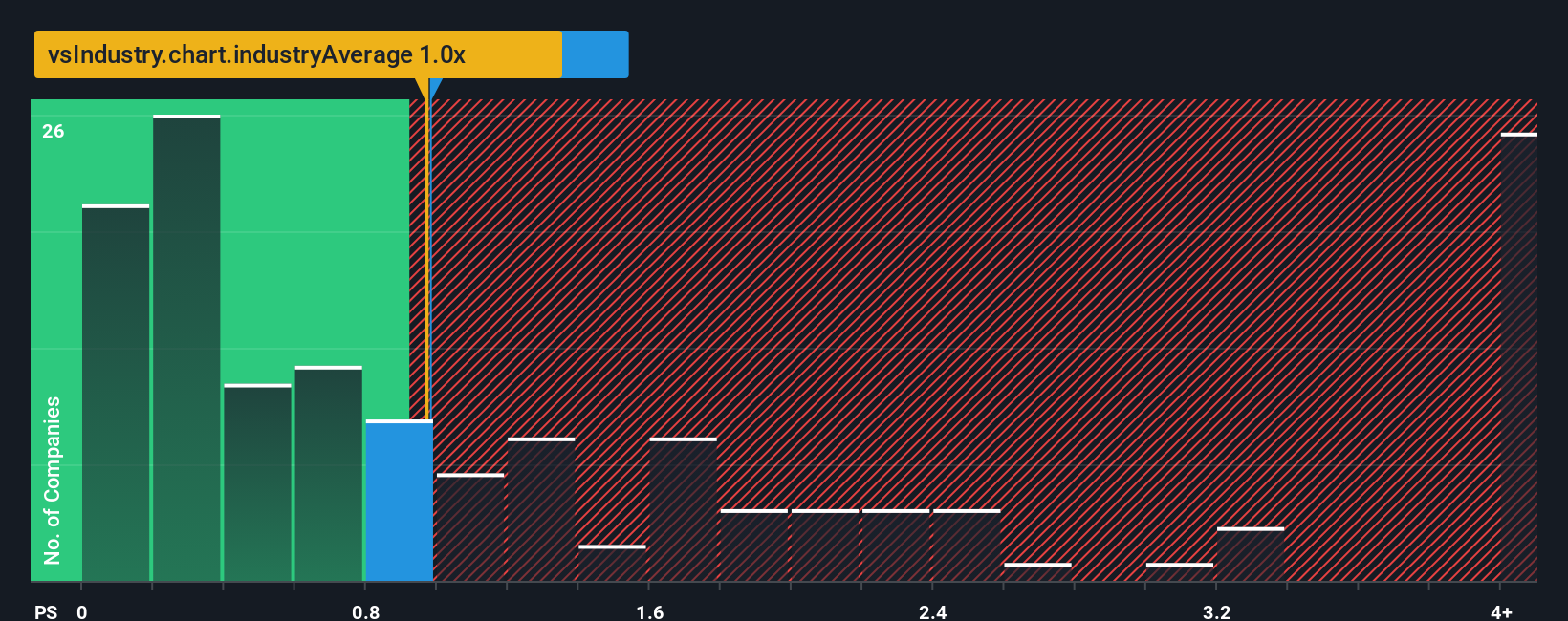

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about NeoGenomics' P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in the United States is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for NeoGenomics

What Does NeoGenomics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, NeoGenomics has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NeoGenomics.Is There Some Revenue Growth Forecasted For NeoGenomics?

In order to justify its P/S ratio, NeoGenomics would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.7% last year. The latest three year period has also seen an excellent 41% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the analysts watching the company. With the industry only predicted to deliver 6.8% each year, the company is positioned for a stronger revenue result.

In light of this, it's curious that NeoGenomics' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On NeoGenomics' P/S

Following NeoGenomics' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, NeoGenomics' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for NeoGenomics that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NeoGenomics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NEO

NeoGenomics

Operates a network of cancer-focused testing laboratories in the United States and the United Kingdom.

Adequate balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success