- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

How WRAPSODY CIE North America Registry Launch Could Influence Merit Medical Systems (MMSI) Investors

Reviewed by Simply Wall St

- Merit Medical Systems recently announced the successful enrollment of the first patient in its WRAP North America registry, which will study up to 250 US and Canadian hemodialysis patients with vascular access obstructions treated using the WRAPSODY CIE device.

- This registry follows a series of regulatory approvals and robust clinical trial results for WRAPSODY CIE, potentially providing important real-world data to support broader adoption across North America.

- Now, let's explore how launching this major North American registry for WRAPSODY CIE may strengthen Merit Medical Systems' investment thesis.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Merit Medical Systems Investment Narrative Recap

To be a shareholder in Merit Medical Systems, you need conviction in the company's ability to turn clinical innovation, such as WRAPSODY CIE, into consistent, profitable adoption across large healthcare markets. The successful launch of the WRAP North America registry adds meaningful real-world momentum to WRAPSODY CIE, but the near-term revenue and earnings impact still hinges on timely resolution of reimbursement delays, which remains the primary short-term catalyst and risk for investors at this stage.

Among recent company news, the December 2024 FDA premarket approval for WRAPSODY CIE stands out as directly relevant to the new North America registry launch. Regulatory approval was an essential milestone for kick-starting large-scale studies like WRAP, which are necessary to answer lingering questions about product efficacy, support broader clinical adoption, and, ultimately, create pathways for both commercial and reimbursement progress.

However, despite these positive developments, investors should be mindful that continued reimbursement uncertainty could still...

Read the full narrative on Merit Medical Systems (it's free!)

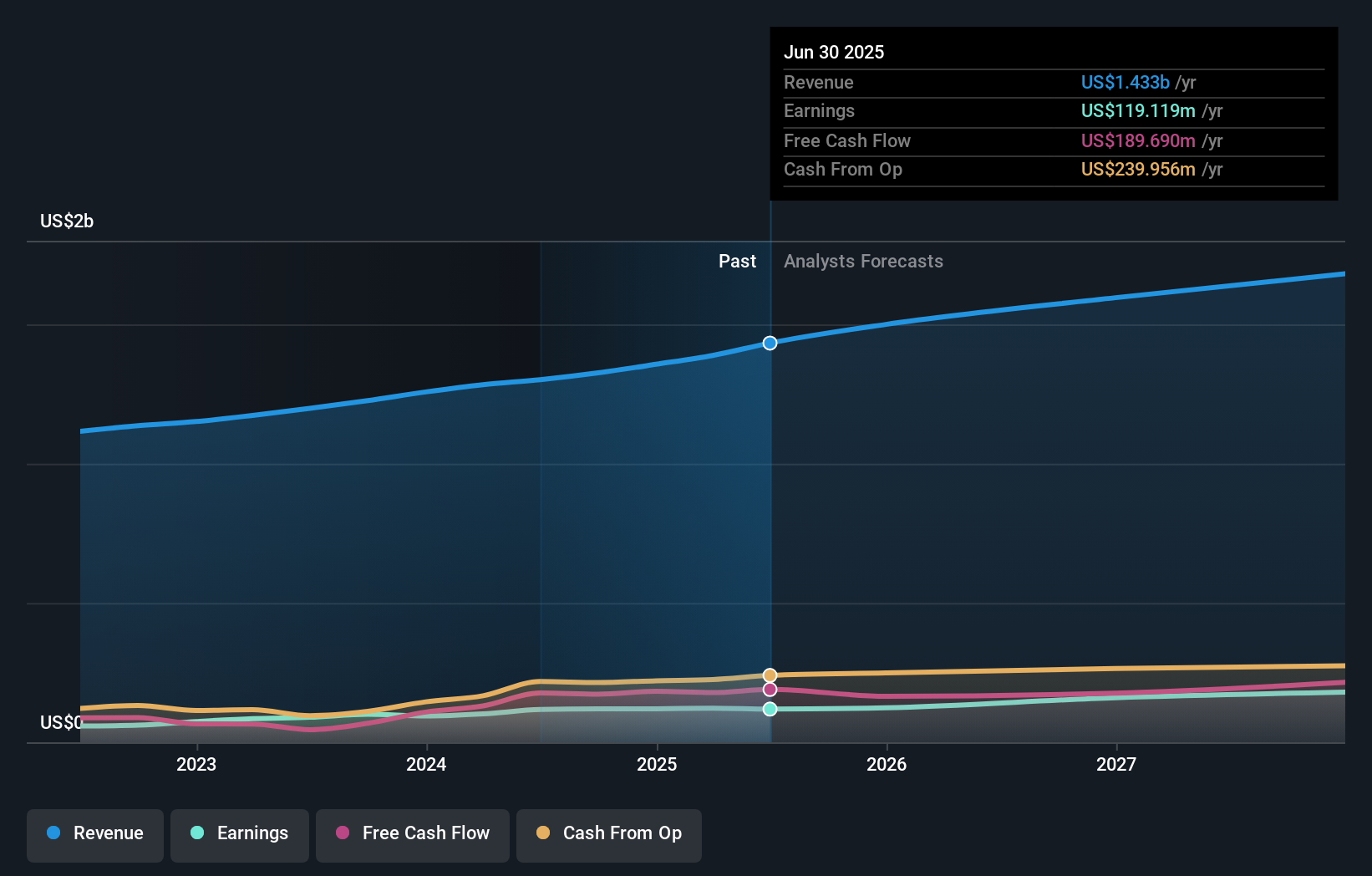

Merit Medical Systems is projected to reach $1.7 billion in revenue and $197.2 million in earnings by 2028. This outlook assumes annual revenue growth of 6.8% and an increase in earnings of $78.1 million from the current $119.1 million.

Uncover how Merit Medical Systems' forecasts yield a $103.55 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published two fair value estimates ranging from US$79.18 to US$103.55 per share. With WRAPSODY CIE’s registry progress shaping the company’s future, the resolution of reimbursement challenges could materially shift how these community valuations stack up, explore other perspectives before making your own decision.

Explore 2 other fair value estimates on Merit Medical Systems - why the stock might be worth as much as 14% more than the current price!

Build Your Own Merit Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Merit Medical Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Merit Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Merit Medical Systems' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives