- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

A Look at Merit Medical Systems's Valuation Following CEO Transition and Leadership Changes

Reviewed by Kshitija Bhandaru

Merit Medical Systems (MMSI) has announced Martha G. Aronson as its new CEO, while Fred P. Lampropoulos, the longtime leader, will transition to Executive Chairman until January 2026. Leadership transitions like this often prompt investors to reassess a company’s direction and future prospects.

See our latest analysis for Merit Medical Systems.

Shares of Merit Medical Systems have pulled back sharply in recent months, down 17.8% year-to-date. Despite upbeat Q2 earnings and annual revenue growth, the past year’s total shareholder return of -16.3% shows momentum is fading for now. Long-term holders have seen strong gains of 44% and 65% over three and five years, respectively. Recent volatility has been shaped not just by the CEO transition but also by broader industry pressures, including renewed trade tensions and changes in healthcare policy.

If leadership shakeups or shifting sector trends have you wondering what else is out there, consider exploring See the full list for free..

With the stock down sharply this year but trading nearly 31% below its average analyst price target, the key question for investors is whether Merit Medical Systems is undervalued at these levels or if the market has already factored in the company’s future growth potential.

Most Popular Narrative: 23.7% Undervalued

With shares of Merit Medical Systems closing at $78.99 and a widely followed narrative fair value of $103.55, the market appears to be discounting the company’s projected profit trajectory and growth outlook. The divergence highlights bold expectations for revenue and margin expansion that not everyone is currently pricing in.

Ongoing investments in operational efficiency, manufacturing automation, and product portfolio expansion through innovation and strategic M&A are driving improved gross and operating margins (evidenced by record 21% non-GAAP operating margin), supporting higher cash flow and net earnings.

Want to know which operational and financial drivers push the stock’s value far above its current price? The narrative’s fair value rests on an ambitious set of growth levers, profit margin strategies, and a future profit multiple that rivals industry leaders. Which number is the linchpin? See the projections that make up this bullish valuation story.

Result: Fair Value of $103.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as delays in key product reimbursement and rising trade tensions could quickly undermine the optimistic outlook for future growth.

Find out about the key risks to this Merit Medical Systems narrative.

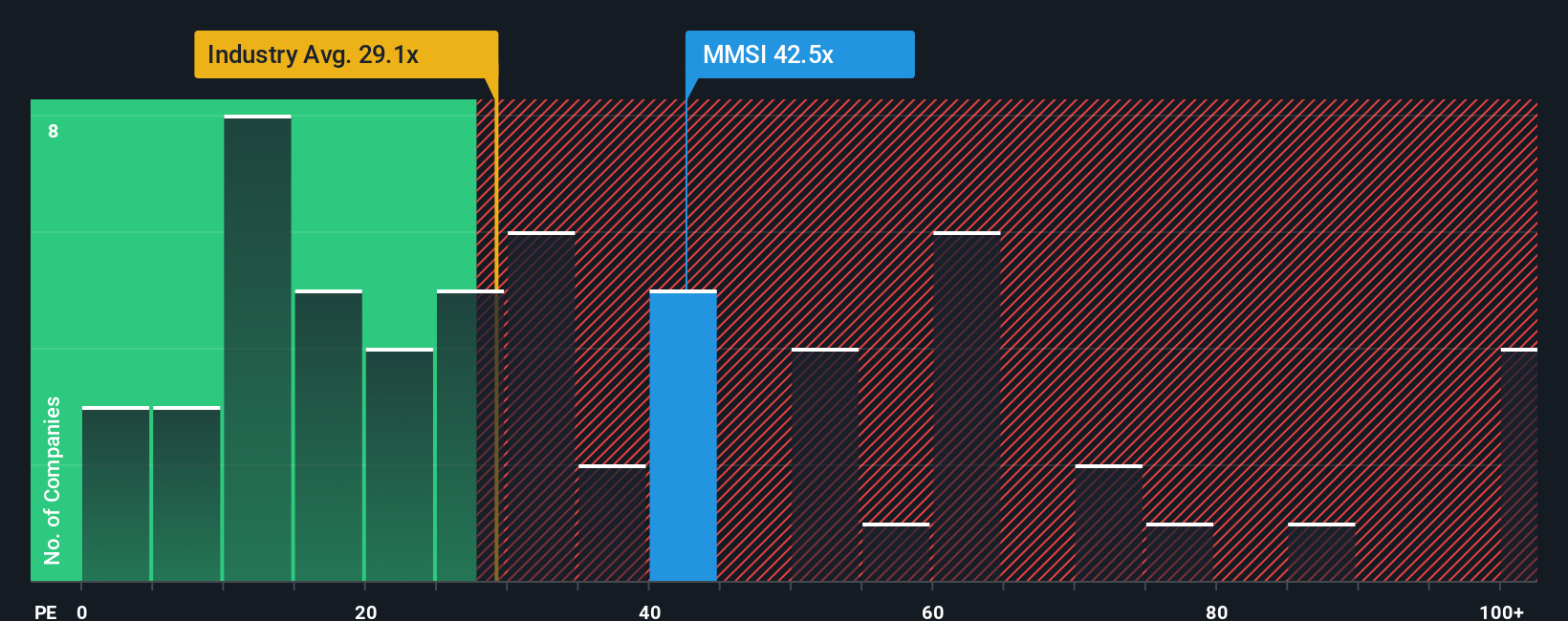

Another View: Market Ratios Suggest Overvaluation

Looking through the lens of the price-to-earnings ratio, Merit Medical Systems currently trades at 39.3x earnings. This figure is nearly double the peer group average of 20.5x and is well above the Medical Equipment industry’s 29.5x. The company’s fair ratio is estimated at just 21.8x, meaning today’s price signals elevated valuation risk if growth expectations are not met. Does this gap highlight hidden risks, or is the market simply paying up for future promise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Merit Medical Systems Narrative

Readers who want to draw their own conclusions or look deeper into the numbers can quickly build a custom analysis from the data in just a few minutes, all on their own. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Merit Medical Systems.

Looking for More Smart Investment Ideas?

Don’t let great potential slip through your fingers. Take charge of your next move by targeting stocks poised for growth, resilience, and technological leadership with these unique ideas:

- Seize the upside of tech innovation by checking out these 24 AI penny stocks companies pushing the boundaries in artificial intelligence, automation, and software breakthroughs.

- Tap into steady earning power with these 19 dividend stocks with yields > 3% offering reliable yields above 3% and robust financials for income-focused portfolios.

- Position yourself for outsized returns by investigating these 3587 penny stocks with strong financials featuring strong financials and untapped upside waiting to be realized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives