- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

A Look at Merit Medical Systems's Valuation as WRAPSODY Trial Results Impress but Reimbursement Decision Faces Delay

Reviewed by Simply Wall St

Merit Medical Systems (MMSI) is attracting investor attention after sharing strong trial results for its WRAPSODY device. However, the company is also facing a delay in U.S. reimbursement approval, which pushes possible incremental payments out to 2027.

See our latest analysis for Merit Medical Systems.

Following these key updates, Merit Medical Systems’ 1-day share price return edged up 0.8%, while the 1-year total shareholder return remains in negative territory at -17.5%. Positive momentum from the WRAPSODY trial results has given the stock a recent boost. However, lingering questions about reimbursement appear to be tempering the excitement for now. Over the past five years, long-term investors have still seen a robust 57% total return, reflecting resilience amid temporary setbacks.

If you’re interested in finding more healthcare stocks with innovation stories and growth potential, take the next step and see the full list here: See the full list for free.

With strong trial data but delayed reimbursement on the horizon, the question is whether Merit Medical Systems stock is currently undervalued in light of its growth prospects, or if the market is already factoring in the company’s future advances.

Most Popular Narrative: 17.1% Undervalued

Compared to the last closing price of $85.79, the narrative fair value of $103.55 signals meaningful upside if growth and margin forecasts play out. The valuation is based on future profitability potential rather than recent headwinds or delays in reimbursement.

The expanding global prevalence of chronic diseases and an aging population are increasing the need for interventional, diagnostic, and therapeutic medical procedures. Merit’s strong growth in cardiovascular and endoscopy segments, robust new product development, and recent acquisitions (such as Biolife and EndoGastric) position the company to capture a larger share of this growing market and drive sustained long-term revenue growth.

Curious what bold projections power this premium valuation? There is one underlying metric linked to margins and future earnings that could make or break the thesis. Wondering which number lights up the analysts’ models? Dive in to see what really drives this bullish case.

Result: Fair Value of $103.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in reimbursement approval or further weakness in international sales could undermine these optimistic forecasts and put pressure on Merit Medical’s future earnings growth.

Find out about the key risks to this Merit Medical Systems narrative.

Another View: Multiples Paint a Pricier Picture

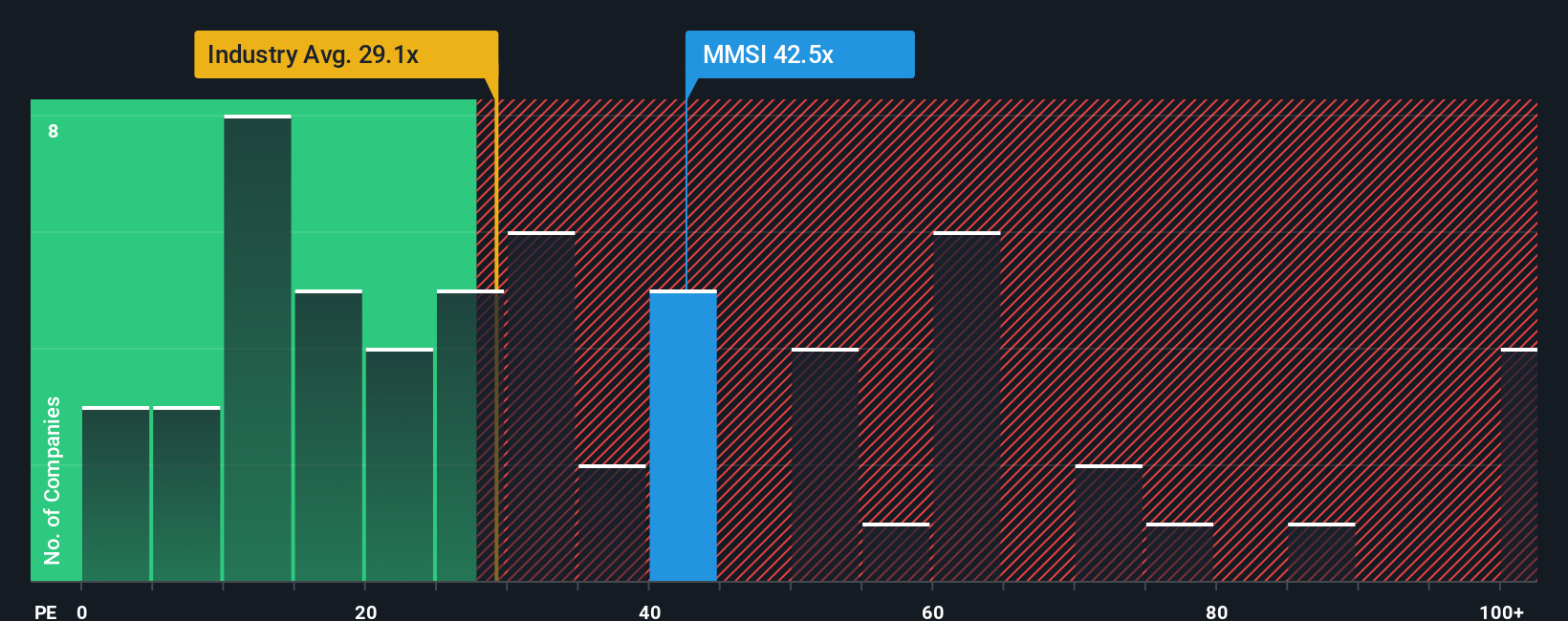

While narrative-driven fair value sees room for upside, a scan of valuation multiples tells a more cautious story. Merit Medical Systems trades at a price-to-earnings ratio of 42.9x, which is markedly higher than both peers at 25.4x and the industry average of 27.9x. Even compared to the fair ratio of 23.3x, shares appear expensive. This gap signals investors might be banking on ambitious future growth. Are the market’s hopes justified, or is some risk being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Merit Medical Systems Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Merit Medical Systems.

Looking for More Smart Investment Opportunities?

Why settle for just one idea when new market winners emerge every day? Don’t let these standout opportunities pass you by. Move quickly and stay ahead of the curve.

- Capture breakthrough potential with these 26 AI penny stocks changing the landscape in artificial intelligence and automation.

- Lock in resilient income by checking out these 18 dividend stocks with yields > 3% offering attractive yields and stable financials.

- Ride the next financial revolution and explore these 82 cryptocurrency and blockchain stocks making waves with blockchain innovations and digital currency growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives