- United States

- /

- Healthtech

- /

- OTCPK:MDRX

A Quick Analysis On Allscripts Healthcare Solutions' (NASDAQ:MDRX) CEO Salary

Paul Black became the CEO of Allscripts Healthcare Solutions, Inc. (NASDAQ:MDRX) in 2012, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Allscripts Healthcare Solutions.

See our latest analysis for Allscripts Healthcare Solutions

How Does Total Compensation For Paul Black Compare With Other Companies In The Industry?

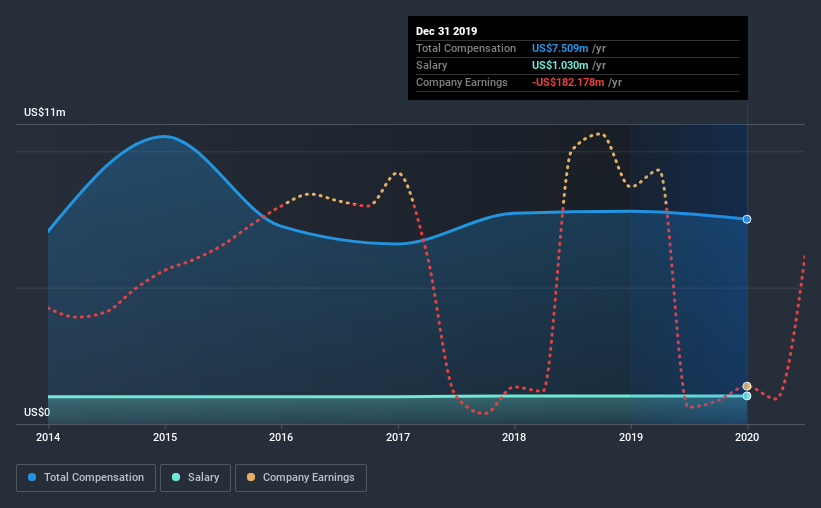

According to our data, Allscripts Healthcare Solutions, Inc. has a market capitalization of US$1.5b, and paid its CEO total annual compensation worth US$7.5m over the year to December 2019. We note that's a small decrease of 3.8% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$1.0m.

On examining similar-sized companies in the industry with market capitalizations between US$1.0b and US$3.2b, we discovered that the median CEO total compensation of that group was US$4.6m. This suggests that Paul Black is paid more than the median for the industry. What's more, Paul Black holds US$12m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$1.0m | US$1.0m | 14% |

| Other | US$6.5m | US$6.8m | 86% |

| Total Compensation | US$7.5m | US$7.8m | 100% |

Talking in terms of the industry, salary represented approximately 15% of total compensation out of all the companies we analyzed, while other remuneration made up 85% of the pie. Allscripts Healthcare Solutions is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Allscripts Healthcare Solutions, Inc.'s Growth

Allscripts Healthcare Solutions, Inc. saw earnings per share stay pretty flat over the last three years. In the last year, its revenue is down 1.9%.

We would prefer it if there was revenue growth, but the modest EPS growth gives us some relief. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Allscripts Healthcare Solutions, Inc. Been A Good Investment?

With a three year total loss of 27% for the shareholders, Allscripts Healthcare Solutions, Inc. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we touched on above, Allscripts Healthcare Solutions, Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. While we have not been overly impressed by the business performance, the shareholder returns have been utterly depressing, over the last three years. And the situation doesn't look all that good when you see Paul is remunerated higher than the industry average. Taking all this into account, it could be hard to get shareholder support for giving Paul a raise.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Allscripts Healthcare Solutions that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Allscripts Healthcare Solutions or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OTCPK:MDRX

Veradigm

A healthcare technology company, provides information technology solutions to healthcare providers, payers, and biopharma markets in the United States and internationally.

Limited growth with weak fundamentals.

Similar Companies

Market Insights

Community Narratives