- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Does the Recent Lantheus Surge Signal a Fresh Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Curious if Lantheus Holdings could be a hidden gem or if its current price tells the true story? Let’s break down what has been driving interest in the stock lately.

- After a sluggish year, with shares down 34.0% over the past 12 months, Lantheus Holdings has caught a fresh wave. The stock has jumped 10.4% in the past week and 5.4% over the last month.

- Recently, the stock made headlines as investors reacted to major healthcare sector news and new clinical trial milestones for novel imaging agents. Both developments have shaped sentiment and likely contributed to this recent surge. Strategic partnerships announced during the last month have also fueled optimism about the company's growth trajectory.

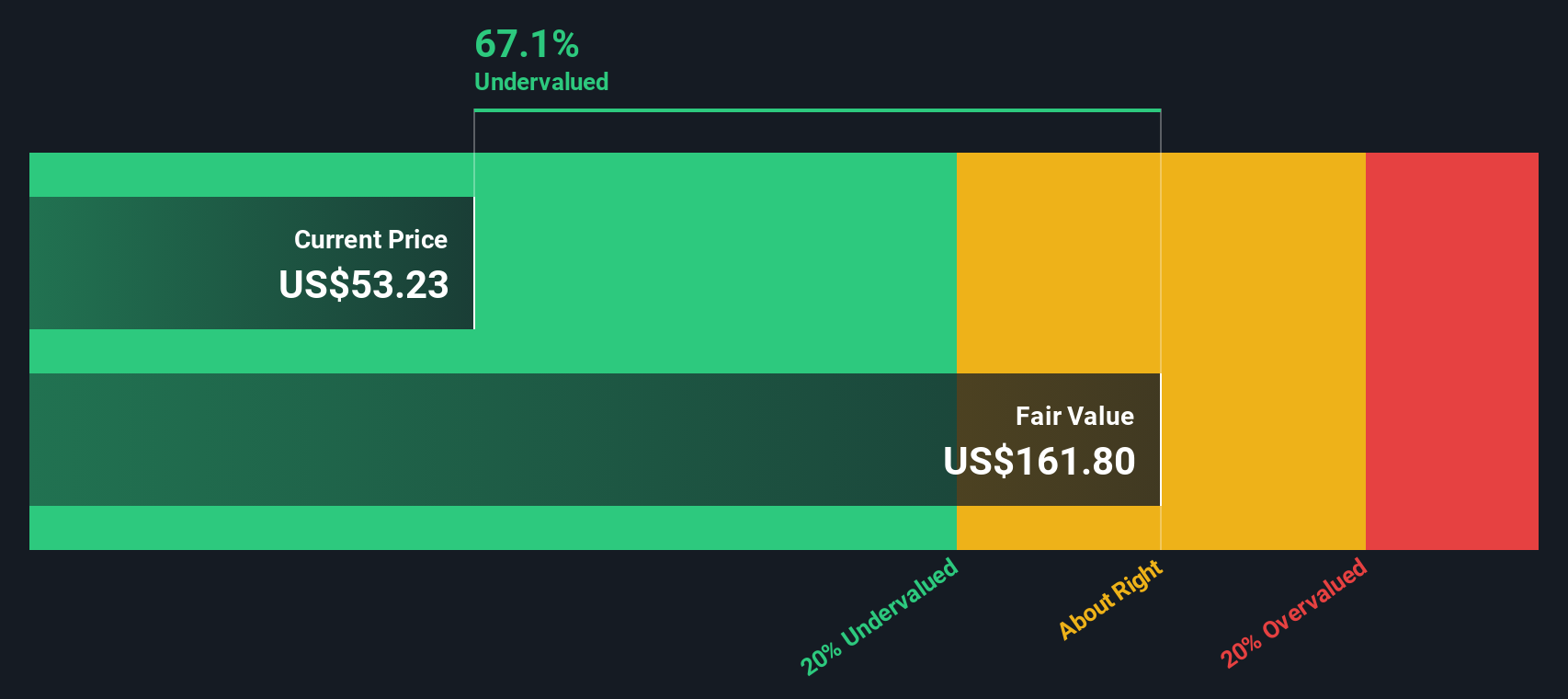

- Lantheus Holdings notched a strong 5 out of 6 valuation score on our checks, suggesting plenty is going right. The story, however, is more nuanced than any single metric. Let’s dig into how different valuation methods see things and why the best approach might still be on the horizon.

Find out why Lantheus Holdings's -34.0% return over the last year is lagging behind its peers.

Approach 1: Lantheus Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company's expected future cash flows and then discounting those cash flows back to their present value. This approach gives an estimate of what the business is intrinsically worth, based on how much cash it is likely to generate for shareholders going forward.

For Lantheus Holdings, the most recent reported Free Cash Flow stands at $271.3 million. Analysts expect growth over the years, with projections reaching $457 million by 2029. While estimates from analysts typically extend five years out, further projections, such as the ten-year outlook to 2035, are extrapolated by Simply Wall St and show a steady climb in annual cash flows.

Based on these projections, the DCF model estimates an intrinsic fair value of $141.23 per share. This valuation is 58.2% higher than the current share price, indicating the stock trades well below its calculated intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lantheus Holdings is undervalued by 58.2%. Track this in your watchlist or portfolio, or discover 924 more undervalued stocks based on cash flows.

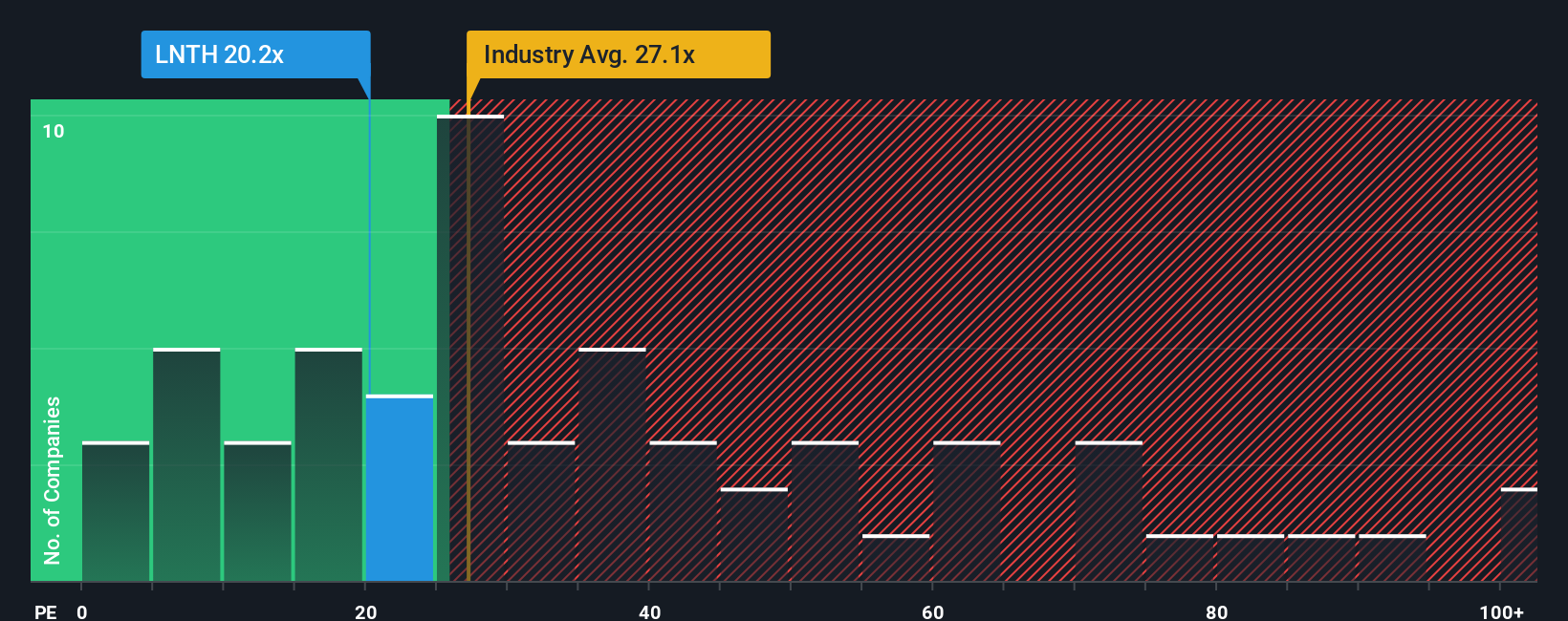

Approach 2: Lantheus Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely recognized way to value profitable companies like Lantheus Holdings, as it directly links a company's market value to its actual earnings. For investors, the PE ratio offers a quick way to gauge whether a stock seems cheap or expensive relative to how much profit it generates.

It is important to remember that what counts as a "normal" or "fair" PE ratio will depend on growth expectations and perceived risks. Companies with strong earnings growth or lower risk typically justify higher PE ratios. Those with slower growth or higher risk tend to trade at lower multiples.

Lantheus Holdings currently trades at a PE ratio of 23.36x. This is below both the average for its Medical Equipment industry peers at 30.17x and the industry average of 28.75x. However, these generalized benchmarks might not fully capture Lantheus’s specific outlook or risk profile.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in. Unlike traditional peer or industry comparisons, the Fair Ratio incorporates the company’s unique mix of growth prospects, profit margins, market cap, industry dynamics, and risk. Based on these factors, the Fair Ratio for Lantheus Holdings is calculated at 29.41x.

Comparing the Fair Ratio (29.41x) to the current PE (23.36x), the stock appears to be undervalued on a multiple basis. This suggests the market may be discounting its future earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lantheus Holdings Narrative

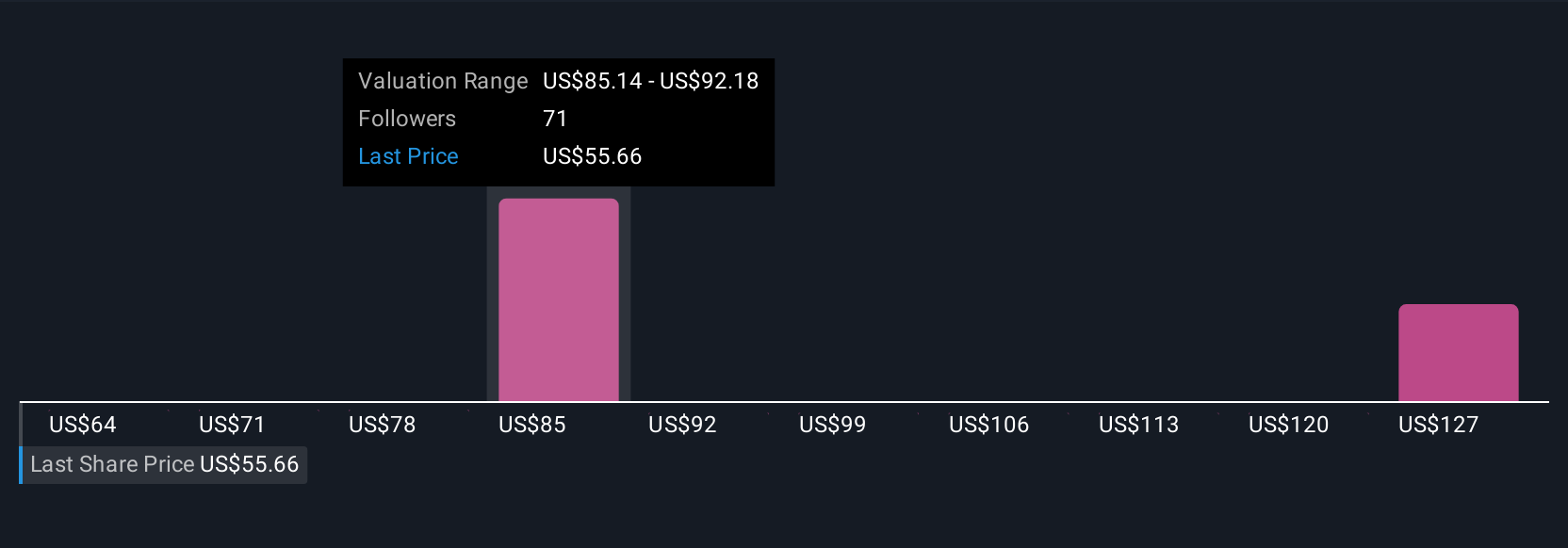

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, approachable way to link your perspective on a company’s future, such as your own expectations for revenue, earnings, and margins, to a financial forecast and estimate of fair value. Instead of only using standard metrics, Narratives let you tell the story behind the numbers and see how these assumptions would affect whether the stock looks attractive or not.

This dynamic, story-driven approach is available to all investors on Simply Wall St’s Community page, making sophisticated analysis accessible to everyone. Narratives help you decide when to buy or sell by comparing your Fair Value (based on your story) against the current Price, instantly showing how your views stack up. Importantly, Narratives are continually updated in real time as new news, earnings results, or company events emerge.

For Lantheus Holdings, for example, some investors believe expansions in Alzheimer’s and prostate cancer imaging will boost future revenues and set a fair value as high as $130 per share. Others worry about competition and see fair value closer to $63, so your narrative truly shapes your investment decisions.

Do you think there's more to the story for Lantheus Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success