- United States

- /

- Medical Equipment

- /

- NasdaqGM:LMAT

Earnings Not Telling The Story For LeMaitre Vascular, Inc. (NASDAQ:LMAT)

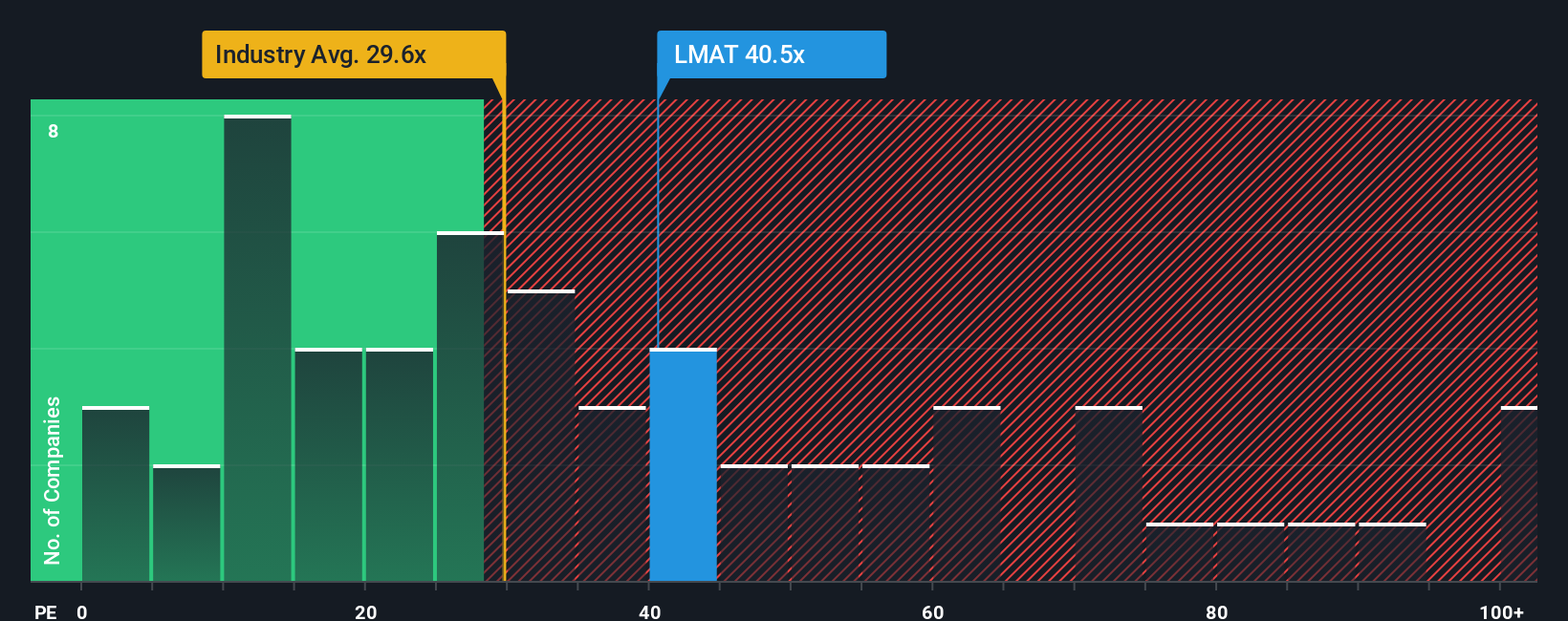

LeMaitre Vascular, Inc.'s (NASDAQ:LMAT) price-to-earnings (or "P/E") ratio of 40.5x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

LeMaitre Vascular certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for LeMaitre Vascular

Does Growth Match The High P/E?

LeMaitre Vascular's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 32% gain to the company's bottom line. The latest three year period has also seen an excellent 59% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 10% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 10% per year, which is not materially different.

In light of this, it's curious that LeMaitre Vascular's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of LeMaitre Vascular's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for LeMaitre Vascular that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LMAT

LeMaitre Vascular

Develops, manufactures, and markets medical devices and implants used in the field of vascular surgery in the Americas, Europe, the Middle Esat, Africa, and the Asia Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives