- United States

- /

- Medical Equipment

- /

- NasdaqGS:LIVN

LivaNova (LIVN): Loss Reduction and Profitability Forecast Bolster Bull Case Despite Slower Revenue Growth

Reviewed by Simply Wall St

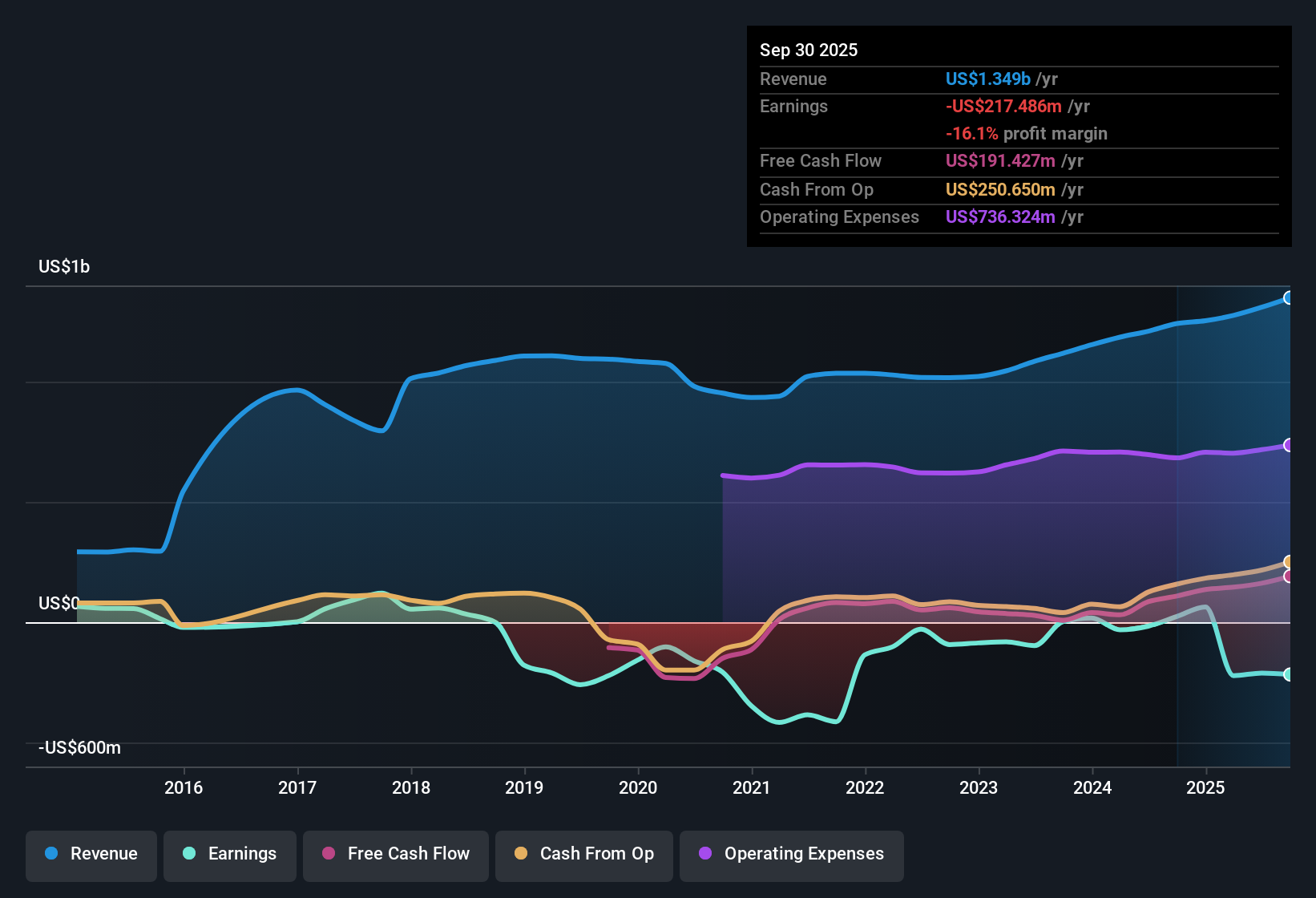

LivaNova (LIVN) remains in the red, but the company has made significant progress by narrowing its losses at an annual rate of 42.1% over the past five years. While margins failed to show improvement, investors are paying attention to an expected 32.89% earnings growth per year and the prospect of reaching profitability within three years, which would be well ahead of the broader market's pace.

See our full analysis for LivaNova.Now, let’s see how these headline results compare to the stories and expectations circulating among analysts and the investment community.

See what the community is saying about LivaNova

Margins Projected to Swing from -16.1% to 10.7%

- Analysts expect profit margins to rise sharply, moving from -16.1% today to a positive 10.7% in three years. This would mark a major improvement in profitability for LivaNova.

- From the analysts' consensus view, this projected margin turnaround heavily supports hopes for higher earnings quality and operational leverage:

- Consensus narrative highlights LivaNova's strategic focus on recurring revenue and service monetization as key levers for this margin shift.

- However, persistent cost pressures and regulatory risks are flagged as threats that could slow or stall the transition to higher margins, especially if innovation investments run above plan or major reimbursements do not materialize as forecast.

- With current margins still in negative territory, consensus sees the coming years as pivotal for the company's shift from unprofitable operations to sustainable profitability.

Double-digit margin improvement could be a turning point. Analysts are watching to see if LivaNova's bets on innovation and services pay off. 📊 Read the full LivaNova Consensus Narrative.

Price-to-Sales: Discounted Versus Peers

- LivaNova trades at 2.9x Price-To-Sales compared to industry peers at 3.0x and an industry average of 2.1x. Its share price of $50.81 is also below both the DCF fair value of $68.02 and the consensus analyst price target of $65.50.

- According to the analysts' consensus view, this relative discount is seen as an upside driver for patient investors:

- Consensus narrative points to LivaNova’s attractive valuation as a reward for those willing to look beyond current unprofitability and await profitability inflection, given the margin and earnings growth forecasts.

- Yet the narrative also reminds us that trading at a peer-based discount may not close the valuation gap unless forecasted revenue and margins actually materialize. Execution risk is still critical for value realization.

Revenue Growth Lags US Market

- LivaNova’s annual revenue growth is forecast at 5.2%, lagging behind the broader US market’s expected 10.5%, even as analysts expect revenue to reach $1.6 billion in three years.

- The analysts' consensus narrative sees global medical device trends and aging populations as positive secular drivers, but acknowledges that LivaNova’s core revenue growth projections remain a step behind the wider market:

- Consensus highlights expansion into emerging markets, increased procedure volumes, and regulatory wins (such as faster China approvals and reimbursement boosts) as catalysts for top-line gains.

- However, the narrative warns that industry competition and reimbursement risks could prevent LivaNova from fully closing the growth gap with peers. This may keep revenue momentum below sector averages for the next few cycles.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for LivaNova on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Take just a few minutes to share your outlook and shape your own viewpoint. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding LivaNova.

See What Else Is Out There

LivaNova’s slower projected revenue growth and below-market momentum could leave investors waiting longer for consistent gains compared to sector leaders.

If you want to target companies consistently growing sales and earnings, see how your portfolio could benefit with stable growth stocks screener (2079 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIVN

LivaNova

A medical technology company, designs, develops, manufactures, markets, and sells products and therapies for neurological and cardiac conditions worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives