- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

How Investors Are Reacting To Intuitive Surgical (ISRG) Strong Earnings Beat and Raised Annual Guidance

Reviewed by Sasha Jovanovic

- Intuitive Surgical recently reported another quarter of double-digit revenue and earnings growth, exceeding consensus expectations and announcing raised earnings estimates for the current fiscal year.

- Despite near-term caution tied to uneven hospital capital-equipment spending, strong underlying procedure volumes and continuous leadership in robotic-assisted surgery highlight sustained long-term growth potential for the company.

- We’ll explore how Intuitive Surgical’s strong earnings beat and improved guidance reinforce the company’s investment narrative and future growth outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Intuitive Surgical Investment Narrative Recap

To be a shareholder in Intuitive Surgical, you need to believe in the long-term expansion of robotic-assisted surgery, underpinned by strong global procedure growth, ongoing innovation, and the company’s clear leadership in the field. The recent earnings beat and raised guidance reinforce confidence in underlying procedure demand, though the key short-term catalyst, procedure volume growth, remains exposed to near-term caution over hospital capital expenditures. For now, these near-term macro headwinds do not appear to materially impact the core growth story.

The most relevant announcement to this report is Intuitive Surgical’s Q3 2025 earnings results, where both revenue (US$2,505.1 million) and net income (US$704.4 million) surpassed consensus forecasts. This performance, despite premium valuation concerns and margin risks from cost pressures or competition, highlights the underlying resilience of the company’s business drivers and supports continued optimism around long-term recurring revenue.

Yet, in contrast to this strong growth narrative, hospital spending constraints worldwide remain a risk investors should actively monitor…

Read the full narrative on Intuitive Surgical (it's free!)

Intuitive Surgical's narrative projects $13.4 billion revenue and $3.7 billion earnings by 2028. This requires 13.5% yearly revenue growth and a $1.1 billion earnings increase from $2.6 billion currently.

Uncover how Intuitive Surgical's forecasts yield a $592.96 fair value, a 5% upside to its current price.

Exploring Other Perspectives

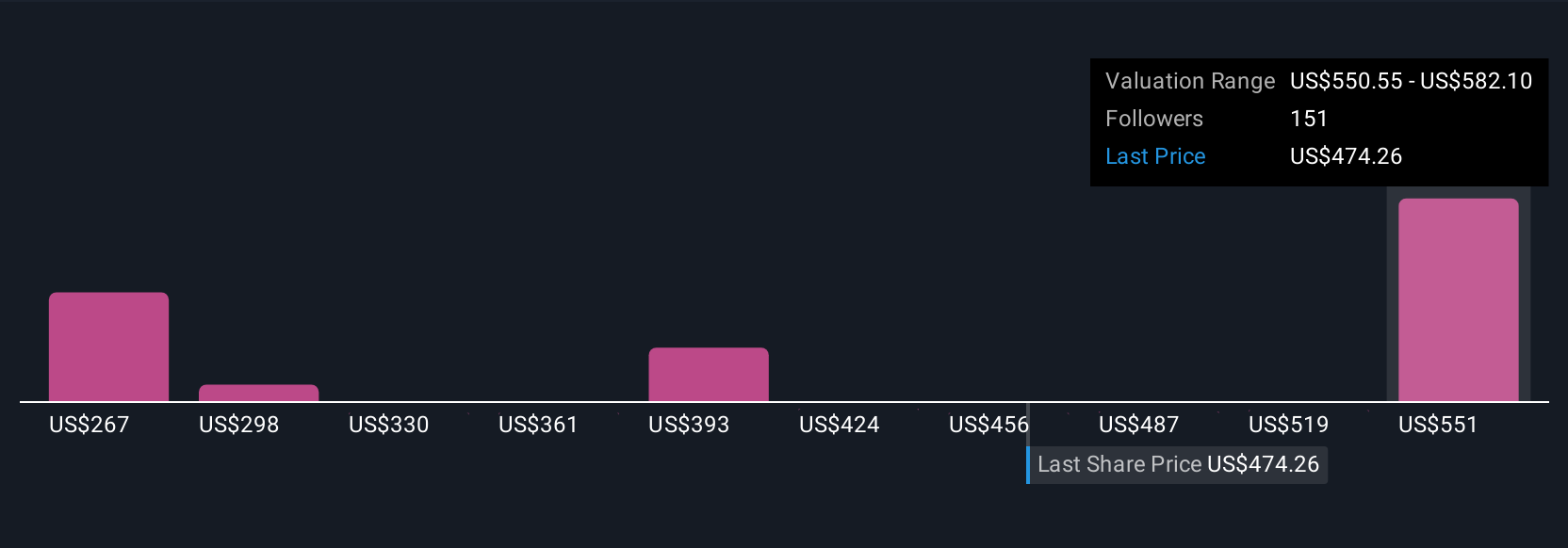

Simply Wall St Community members submitted 15 fair value estimates for Intuitive Surgical, ranging widely from US$322.59 to US$592.96 per share. While outlooks differ, many see recurring revenue strength as key in shaping the company’s future, so consider several viewpoints before making decisions.

Explore 15 other fair value estimates on Intuitive Surgical - why the stock might be worth as much as 5% more than the current price!

Build Your Own Intuitive Surgical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Surgical research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Intuitive Surgical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Surgical's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives