- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Are Shares of Intuitive Surgical Still Justified After 22% Rally and Growing Robot Adoption?

Reviewed by Bailey Pemberton

- Ever wondered if Intuitive Surgical’s current stock price really reflects its long-term value? You’re not alone, and we’re about to dig into what the numbers say.

- Shares have rallied an impressive 22% over the last month, even though the one-year return stands at just 5.5%, which hints at renewed optimism or changing investor sentiment.

- Recent headlines highlight growing adoption of Intuitive’s surgical robots and expansion into new hospitals. Both of these help explain the surge in buying activity. Market-watchers are keenly focused on how these developments could shape future revenues and competitive positioning.

- When it comes to our valuation checks, Intuitive Surgical currently scores 0 out of 6 for being undervalued. This raises important questions about what’s built into the share price. Next, we’ll walk through several common ways investors size up a company’s value, and for the most holistic approach, we’ll share a better method before we wrap up.

Intuitive Surgical scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intuitive Surgical Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them to today's dollars. This approach captures what investors might reasonably expect to receive over time if they owned the business outright.

For Intuitive Surgical, analysts estimate that Free Cash Flow for the most recent year stands at roughly $1.90 billion, with forecasts projecting robust growth over the coming decade. By 2029, Free Cash Flow is expected to reach about $5.3 billion. Simply Wall St extrapolates this trajectory even further out, with forecasts continuing to rise through 2035.

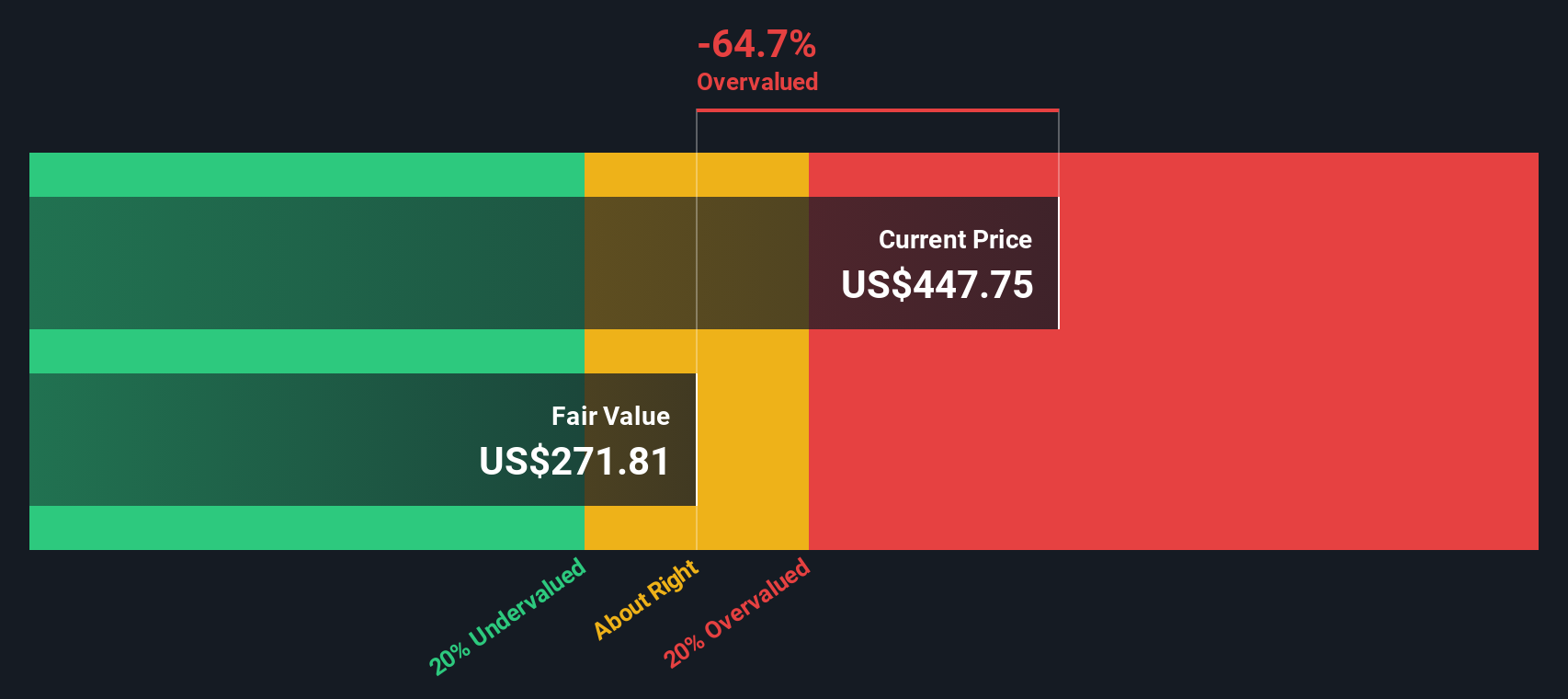

The DCF performed using a 2 Stage Free Cash Flow to Equity model produces an estimated intrinsic value of $336.86 per share. Compared to the current market price, this means the stock trades at roughly a 58.6% premium to its calculated fair value. This implies shares are significantly overvalued by DCF standards.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuitive Surgical may be overvalued by 58.6%. Discover 832 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intuitive Surgical Price vs Earnings

For profitable companies like Intuitive Surgical, the Price-to-Earnings (PE) ratio is a preferred valuation metric because it helps investors compare how much they are paying for each dollar of current earnings. A company’s PE ratio reflects what investors expect for future growth and how risky they believe those earnings are. Higher anticipated growth or lower perceived risk can justify a higher PE, while lower growth prospects or more uncertainty typically result in a lower PE being appropriate.

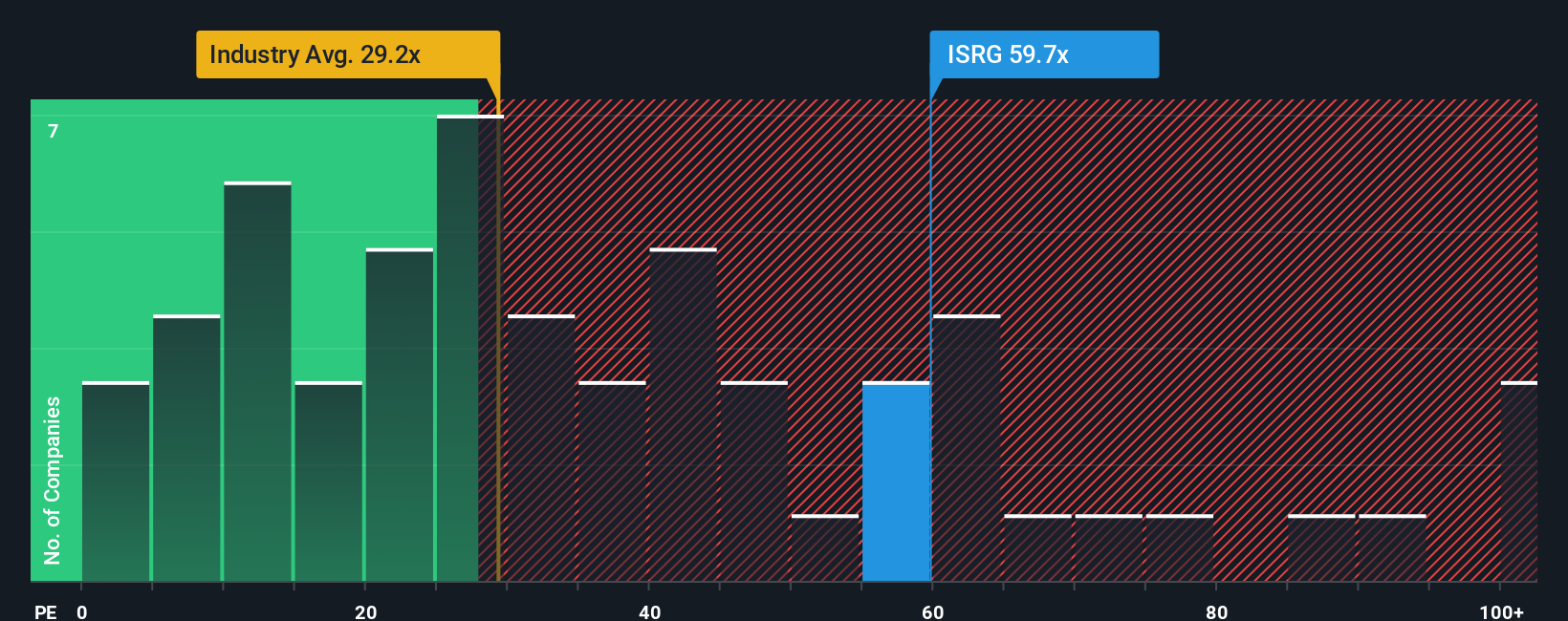

Intuitive Surgical currently trades at a PE ratio of 69x. For context, the average PE across the Medical Equipment industry is 28x, and the company’s peer average is about 35x. Clearly, Intuitive Surgical commands a premium over both benchmarks, a sign investors are expecting stronger growth or greater earnings reliability.

Simply Wall St calculates a “Fair Ratio” for Intuitive Surgical at 38.6x. This proprietary metric considers not just industry averages or peer comparisons, but a full basket of factors including projected earnings growth, profit margins, market cap, competitive position and company-specific risks. By weighing these elements, the Fair Ratio offers a more tailored view of what constitutes a fair multiple for Intuitive Surgical right now.

Comparing Intuitive Surgical’s actual PE of 69x with the Fair Ratio of 38.6x, the shares are notably higher than what the fundamentals and outlook would support using a holistic framework.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intuitive Surgical Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal “story” about a company’s future, combining your views on its prospects with specific forecasts for revenue, margins, and fair value. This approach makes your investment thesis visible and actionable.

Rather than relying solely on ratios or models, Narratives let you connect what you believe about Intuitive Surgical’s competitive edge, innovation pipeline, and industry trends directly to your projected numbers. On Simply Wall St’s Community page, millions of investors share and update their Narratives. This makes it easy for anyone to see exactly how different outlooks stack up, so you can sense check your own decisions and ideas.

Narratives are more powerful than static valuations because they tie your “why” and “how much” together. This helps you spot if current prices align with your expectations or if it might be time to act. Better yet, they automatically refresh when new data, such as breaking news or earnings, is released, keeping your analysis up to date with zero manual work.

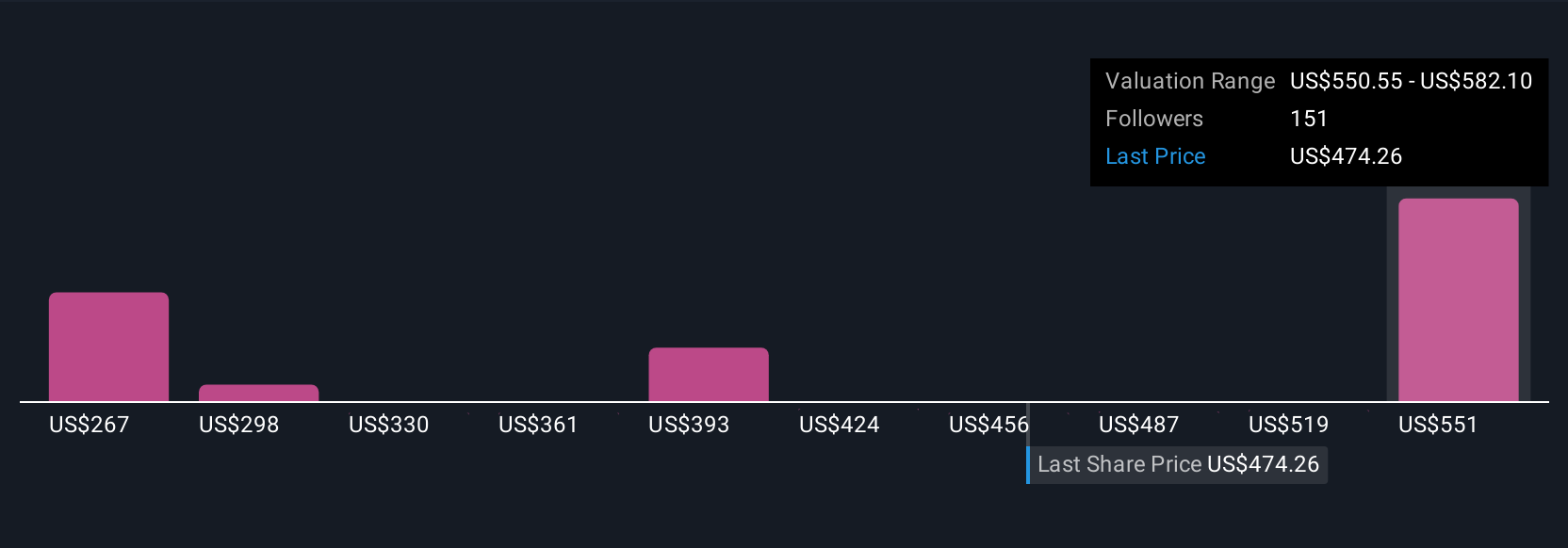

For example, some Intuitive Surgical Narratives use cautious growth assumptions and set a fair value as low as $325, while the most optimistic place fair value up near $685. This clearly shows the range of possible outcomes depending on your perspective.

For Intuitive Surgical, we will make it really easy for you with previews of two leading Intuitive Surgical Narratives:

🐂 Intuitive Surgical Bull Case

Fair Value: $594.29

Undervalued by 10.1%

Revenue Growth: 13.5%

- Strong global adoption and diversification are fueling recurring revenue, margin stability, and a durable competitive edge as Intuitive expands into new markets and surgical procedures.

- Growing regulatory and payer support, along with compelling clinical data, are lowering adoption barriers and underpinning robust revenue and earnings growth projections.

- Analysts expect Intuitive Surgical to deliver $3.7 billion earnings by 2028, but continued monitoring of international budget strains and evolving reimbursement policies is advised.

🐻 Intuitive Surgical Bear Case

Fair Value: $400.91

Overvalued by 33.3%

Revenue Growth: 12.0%

- Intuitive’s da Vinci surgical system commands a powerful recurring revenue model from a growing installed base, but the stock price rarely offers attractive value opportunities.

- The current share price means new investors may see very limited returns, about 1% annually, based on reasonable cash flow outlooks.

- While the company’s fundamentals are exceptional, buying opportunities are rare and patient investors may need to wait for meaningful price drops to secure strong long-term value.

Do you think there's more to the story for Intuitive Surgical? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives