- United States

- /

- Medical Equipment

- /

- NasdaqGM:IRMD

IRADIMED (IRMD): Slower Earnings Growth Challenges Bullish Narratives as Valuation Stays High

Reviewed by Simply Wall St

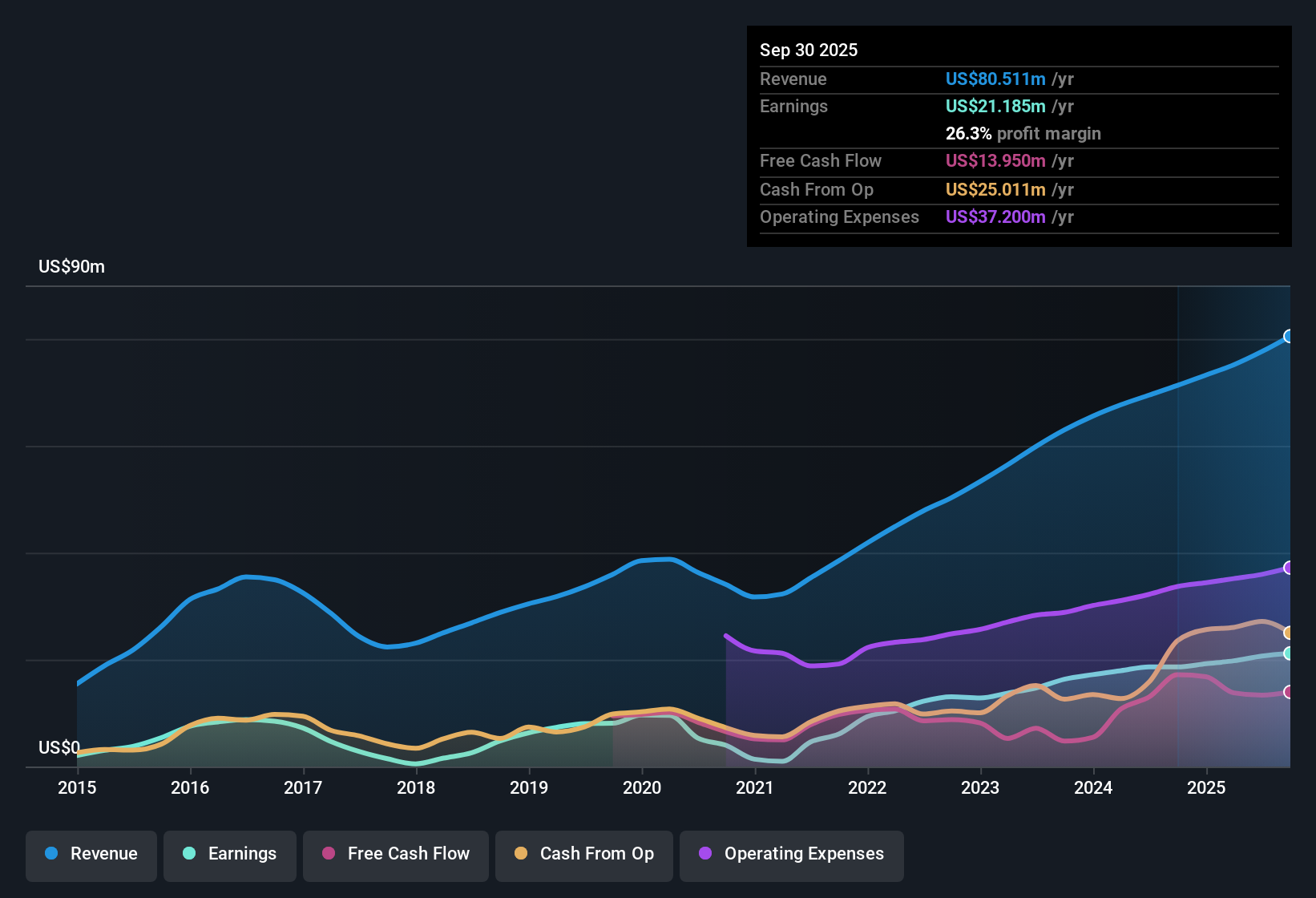

IRADIMED (IRMD) posted earnings growth of 10.8% over the past year, a step down from its strong five-year average of 32.3% per year. Net profit margin landed at 26.6%, slightly below last year’s 26.8%, and forecasts call for annual revenue and earnings growth of 8.5% and 9.18%, both trailing the broader US market. Investors focused on IRADIMED’s earnings track record now have to weigh slower growth forecasts and a premium valuation together as earnings season heats up.

See our full analysis for IRADIMED.Next, we’ll see how these latest numbers line up with the most widely held narratives around IRADIMED, and whether the story the market’s been telling still holds up.

See what the community is saying about IRADIMED

New IV Pump Boosts Revenue Visibility

- IRADIMED’s newly FDA-approved 3870 MRI-compatible IV pump, featuring enhanced usability, is driving a significant replacement cycle and is expected to unlock recurring device and consumable revenues as hospitals and imaging centers upgrade their equipment.

- Analysts' consensus view is that this expanded addressable market, thanks to the 3870’s advancements, should not only drive market share gains but also create incremental revenue expansion. This is occurring as an aging global population and rising MRI procedure volumes support durable multiyear growth.

- Consensus narrative notes that operational investments and stronger pricing power for the 3870 pump are expected to push up average selling prices by about 12%, providing a runway for higher gross margins and improved net margin leverage.

- With the company's gross margin holding around 78%, analysts see strong visibility into near-term cash flows and the capacity to fund further expansion, even as replacement demand ramps up.

- Given the company’s long-term growth signals and the potential for recurring revenue, see the key figures fueling analyst optimism in the full narrative: 📊 Read the full IRADIMED Consensus Narrative.

Margin Strength Faces Concentration Risks

- IRADIMED maintains a high net profit margin of 26.6% and robust gross margin around 78%, but faces concentration risks due to heavy reliance on just a few product lines.

- Consensus narrative highlights that while strong pricing power and expanded operational capacity support these margins, exposure to a narrow product portfolio increases vulnerability:

- If rivals introduce superior MRI-compatible infusion pumps or broader solutions, IRADIMED’s future earnings could be challenged, despite its margin leadership today.

- Additionally, domestic-driven growth and potential cost pressures in global healthcare markets may limit the international adoption of IRADIMED’s products, putting longer-term margin stability at risk.

Premium Valuation Demands Continued Outperformance

- IRADIMED trades at a Price-to-Earnings ratio of 47.3x, well above both the US Medical Equipment industry average of 27.7x and direct peers at 34.2x. The share price also sits above its analyst price target of $86.50 per share.

- Analysts' consensus view maintains that justifying this substantial premium will require IRADIMED to outpace slower growth forecasts, as margin and profit acceleration alone have not yet closed the gap with the broader sector:

- Forecasts project annual revenue growth of 8.5% and earnings growth of 9.18%, both lagging broader market rates, making it more challenging to warrant a premium multiple unless new wins materialize.

- The company’s share price of $84.11 offers only a slim 2.8% potential upside versus the analyst target, underlining how much future success is already “baked in” to valuation expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IRADIMED on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity others might have missed? Share your perspective and shape your independent view in just a few minutes. Do it your way

A great starting point for your IRADIMED research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While IRADIMED commands premium margins and growth signals, its slower forecasted earnings expansion and stretched valuation leave little room for disappointment.

If you want to target opportunities trading at more attractive prices relative to their prospects, consider screening for better value with these 840 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRMD

IRADIMED

Develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives