- United States

- /

- Medical Equipment

- /

- NasdaqGM:IRMD

Assessing IRADIMED (IRMD) Valuation After Notable Share Price Gains in 2024

Reviewed by Simply Wall St

IRADIMED (IRMD) shares have caught the eye of investors recently, building on a solid stretch of gains. The company’s stock is up 17% over the past month and has climbed 68% so far this year. This reflects sustained interest in its performance.

See our latest analysis for IRADIMED.

After such a confident run, IRADIMED’s momentum is hard to miss. The share price has steadily advanced, with a 17% jump over the past month highlighting renewed optimism. Looking further back, its one-year total shareholder return of 77% and an impressive three-year total shareholder return of 248% show that long-term investors have been clearly rewarded. Recent gains suggest that investors are growing even more enthusiastic about IRADIMED’s growth potential, which is supported by solid fundamentals and ongoing positive sentiment.

As IRADIMED’s latest surge fuels fresh interest in growth stocks, now is an opportune time to broaden your search and discover See the full list for free.

With shares on a remarkable run, the big question for investors is whether IRADIMED’s recent gains signal further upside, or if the market has already priced in the company’s future growth potential.

Most Popular Narrative: 6.8% Undervalued

According to the most closely followed narrative, IRADIMED's fair value is set at $99, just above the last close price of $92.23. The gap suggests optimism about the company’s future business catalysts, operational achievements, and revenue trajectory.

The introduction and FDA approval of the new 3870 MRI-compatible IV pump, with significantly enhanced usability and technology compared to the legacy product, is expected to catalyze a major replacement cycle among hospitals and imaging centers. This could unlock large-scale, recurring device and consumable revenues, supporting a step-change in revenue growth as existing customers upgrade and potential new customers previously deterred by usability issues are attracted.

Curious about what drives this narrative upward? The valuation leans on bold growth assumptions, margin improvement, and a forward-looking earnings outlook that challenges recent historical trends. To see which numbers power these forecasts and why, you’ll want to catch the full story revealed in the narrative.

Result: Fair Value of $99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on a narrow product range and potential supply chain pressures could quickly challenge IRADIMED’s upbeat narrative if conditions change.

Find out about the key risks to this IRADIMED narrative.

Another View: Price Ratios Signal Caution

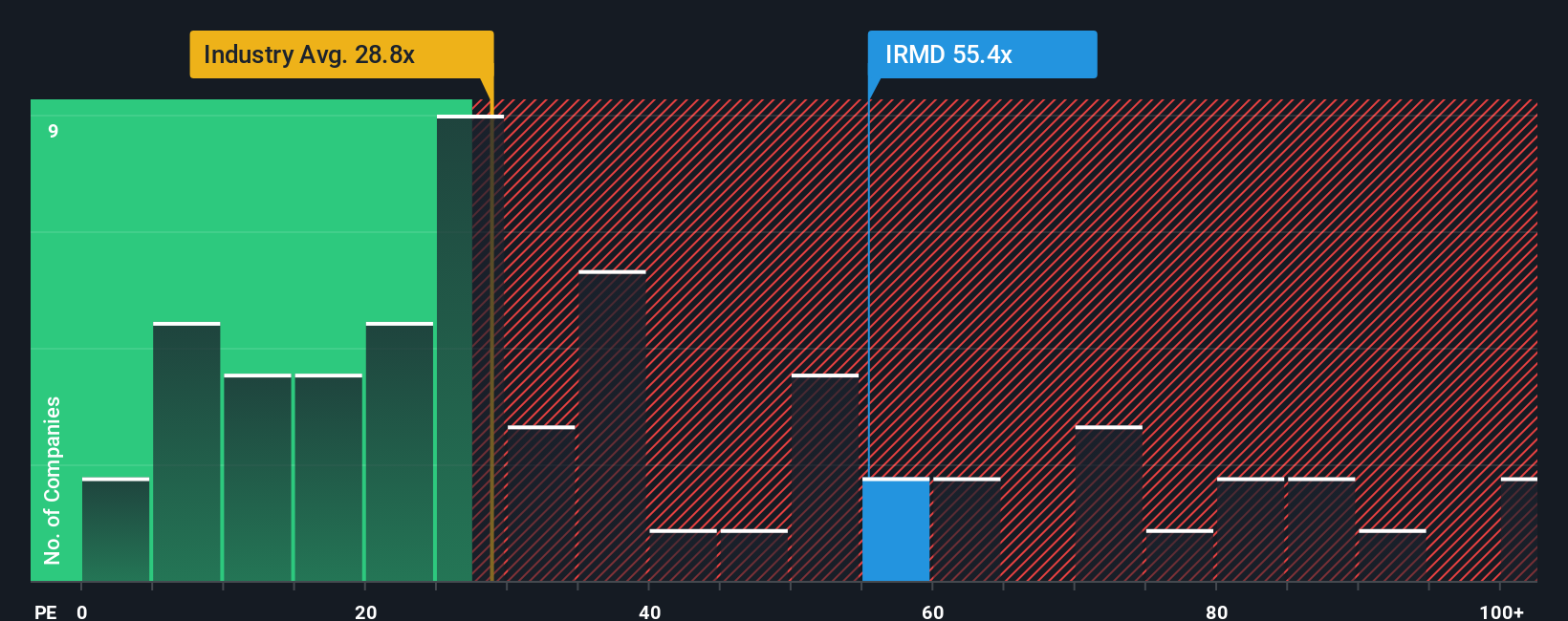

Taking a multiples approach, IRADIMED trades at a price-to-earnings ratio of 55.4 times, which is significantly higher than both the US Medical Equipment industry average of 28.2 times and the peer average of 36.4 times. The fair ratio is judged to be just 17.8 times. This wide gap suggests investors are paying a premium that could prove risky if growth does not accelerate as expected. Does the market have it right, or is optimism running a little too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IRADIMED Narrative

If you want to dig into the numbers yourself or see the story differently, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your IRADIMED research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Jump on fresh opportunities before they hit the mainstream by searching top stocks that fit your style. Let Simply Wall Street's screener put you ahead of the curve.

- Discover unbeatable growth potential by tracking these 924 undervalued stocks based on cash flows to see which stocks offer compelling value right now.

- Unlock steady cash flow by checking out these 14 dividend stocks with yields > 3% with dividend yields above 3% to boost your income portfolio.

- Capitalize on game-changing tech trends by following these 26 AI penny stocks that could transform industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRMD

IRADIMED

Develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success