- United States

- /

- Medical Equipment

- /

- NasdaqGS:INMD

Positive earnings growth hasn't been enough to get InMode (NASDAQ:INMD) shareholders a favorable return over the last three years

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of InMode Ltd. (NASDAQ:INMD) investors who have held the stock for three years as it declined a whopping 75%. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 58% lower in that time. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

On a more encouraging note the company has added US$52m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for InMode

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, InMode actually managed to grow EPS by 2.1% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. However, taking a look at other business metrics might shed a bit more light on the share price action.

We note that, in three years, revenue has actually grown at a 14% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching InMode more closely, as sometimes stocks fall unfairly. This could present an opportunity.

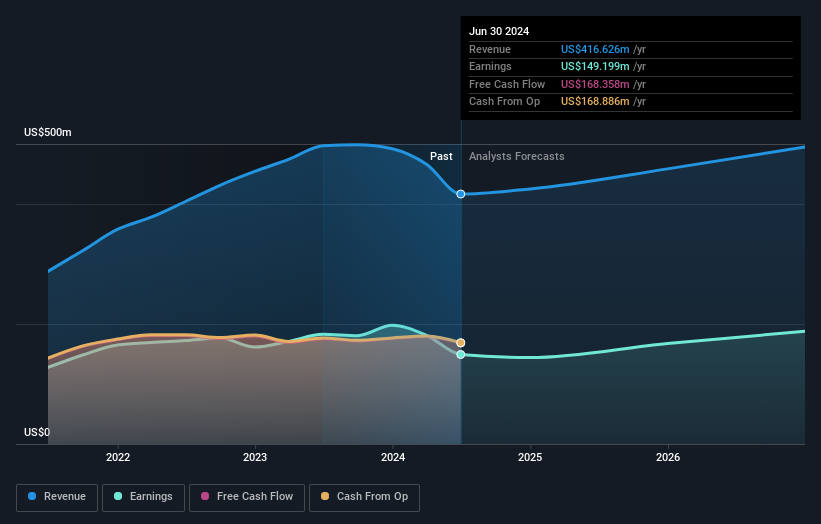

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at InMode's financial health with this free report on its balance sheet.

A Different Perspective

Investors in InMode had a tough year, with a total loss of 58%, against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before deciding if you like the current share price, check how InMode scores on these 3 valuation metrics.

We will like InMode better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:INMD

InMode

Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radiofrequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States and internationally.

Flawless balance sheet and undervalued.