- United States

- /

- Medical Equipment

- /

- NasdaqGS:INMD

InMode (INMD) Profit Margin Surges to 44.5%, Reinforcing Bullish Narratives on Value and Growth

Reviewed by Simply Wall St

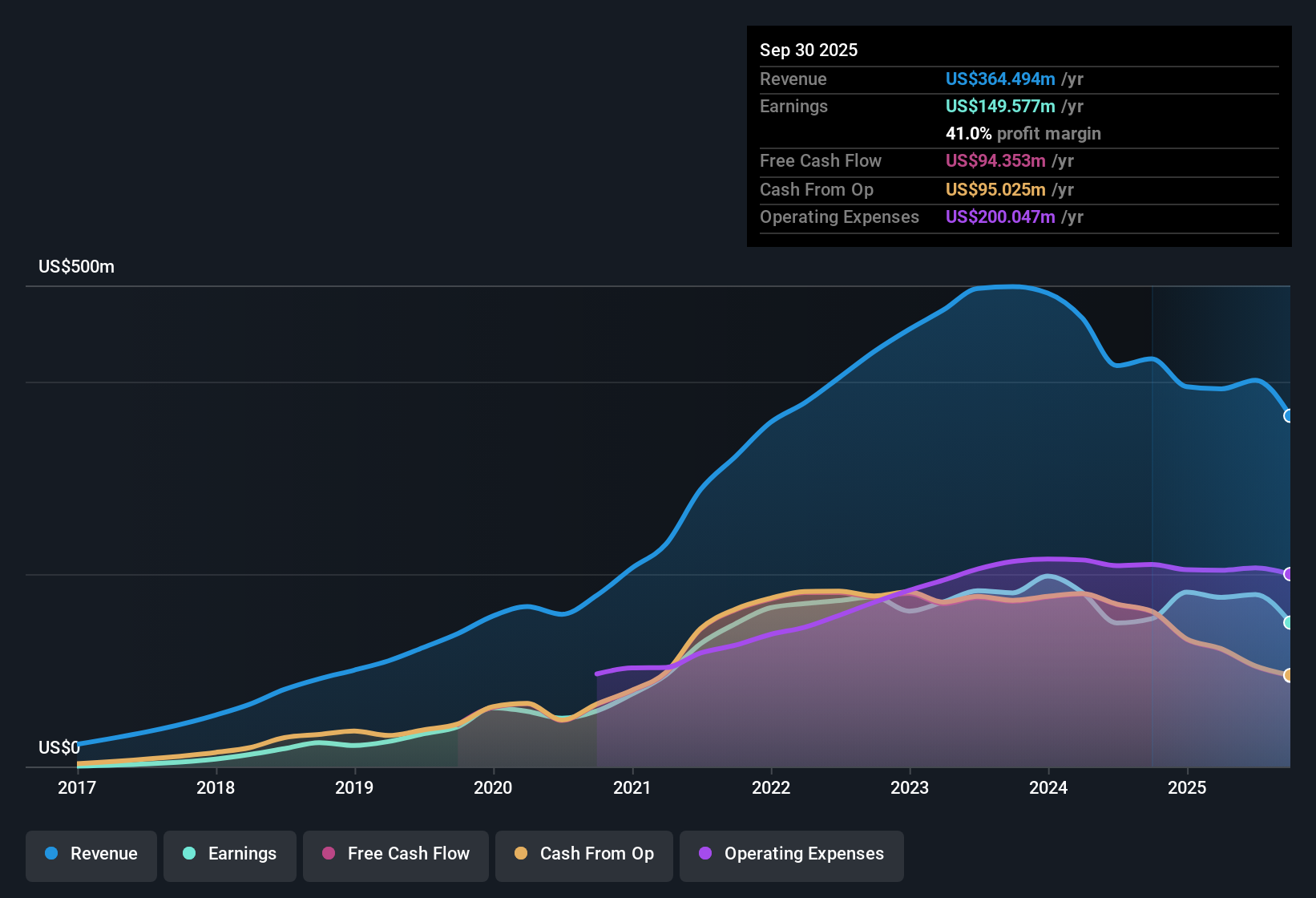

InMode (INMD) delivered net profit margins of 44.5%, up from last year’s 35.8%, while earnings for the year climbed 19.8%, outperforming its five-year annual average. The current share price sits at $14.53, significantly below the estimated fair value of $29.82, and the company’s Price-To-Earnings ratio of 5.1x stands well under industry and peer averages. With robust profitability, steady profit growth, and positive valuation signals, investors may find the current setup supportive, even though revenue and earnings forecasts are more modest than the broader market.

See our full analysis for InMode.The next section puts these headline numbers up against the most talked-about narratives. This is where the data and investor sentiment meet, and sometimes collide.

See what the community is saying about InMode

Analyst Margin Squeeze: 44.5% to 23% Forecast

- Analysts project a steep drop in profit margins from today’s 44.5% to just 23% over the next three years, while earnings are expected to fall from $178.7 million to $94.2 million by 2028.

- In the analysts' consensus view, this margin deterioration is tied to several headwinds:

- Ongoing macroeconomic challenges and rising marketing costs are expected to eat into profitability if revenue growth does not accelerate and expense control lags.

- Rising exposure to lower-margin, non-invasive treatments may further compress long-term earnings power, even as the core minimally invasive portfolio continues to grow.

- The number of outstanding shares is forecast to decline by 7% per year, which could soften the impact on per-share figures despite pressured overall earnings.

See how analysts are debating the sustainability of InMode’s margins and future profit trajectory, especially as macro headwinds and changing market mix come into play. 📊 Read the full InMode Consensus Narrative.

Strategic Expansions Offset Revenue Stagnation

- Revenue growth is expected to lag the broader US market, with analysts projecting just 5% per year for InMode versus a 10.5% market average, and even a modest 0.6% annual decrease over the next three years according to forecasts.

- According to the consensus narrative:

- Direct operations are expanding in emerging markets and Europe, and new launches in urology and ophthalmology are opening up new and diversified revenue streams.

- Sustained demand for minimally invasive procedures, along with investments in specialized sales teams, could stabilize or boost non-US sales even as US growth slows, helping offset weaker domestic performance.

Valuation Gap: Peer Discount Remains Wide

- At a Price-To-Earnings ratio of just 5.1x against industry and peer averages of 28.1x and 39.4x respectively, InMode trades at a deep discount; its $14.53 share price is well below both the $16.65 analyst target and the DCF fair value of $29.82.

- The consensus narrative notes:

- Analysts appear to believe the business is worth more than the current market price, despite forecasting revenue and margin declines, signaling there may be a margin of safety for value-focused investors.

- Bears may challenge whether the discounted valuation can hold up if profit compression and flat revenue persist as expected in the coming years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for InMode on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your unique perspective in just minutes and shape the story: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding InMode.

See What Else Is Out There

With analysts projecting sharp margin compression and weak revenue growth, InMode faces real uncertainty about sustaining its past profitability and expansion.

If you’re looking for more predictable results, seek out consistent compounders with steady upward trends using stable growth stocks screener (2074 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INMD

InMode

Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States, Europe, Asia, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives