- United States

- /

- Medical Equipment

- /

- NasdaqGS:IDXX

IDEXX Laboratories (IDXX) Margin Gains Reinforce Bullish Narratives Despite Slower Growth Outlook

Reviewed by Simply Wall St

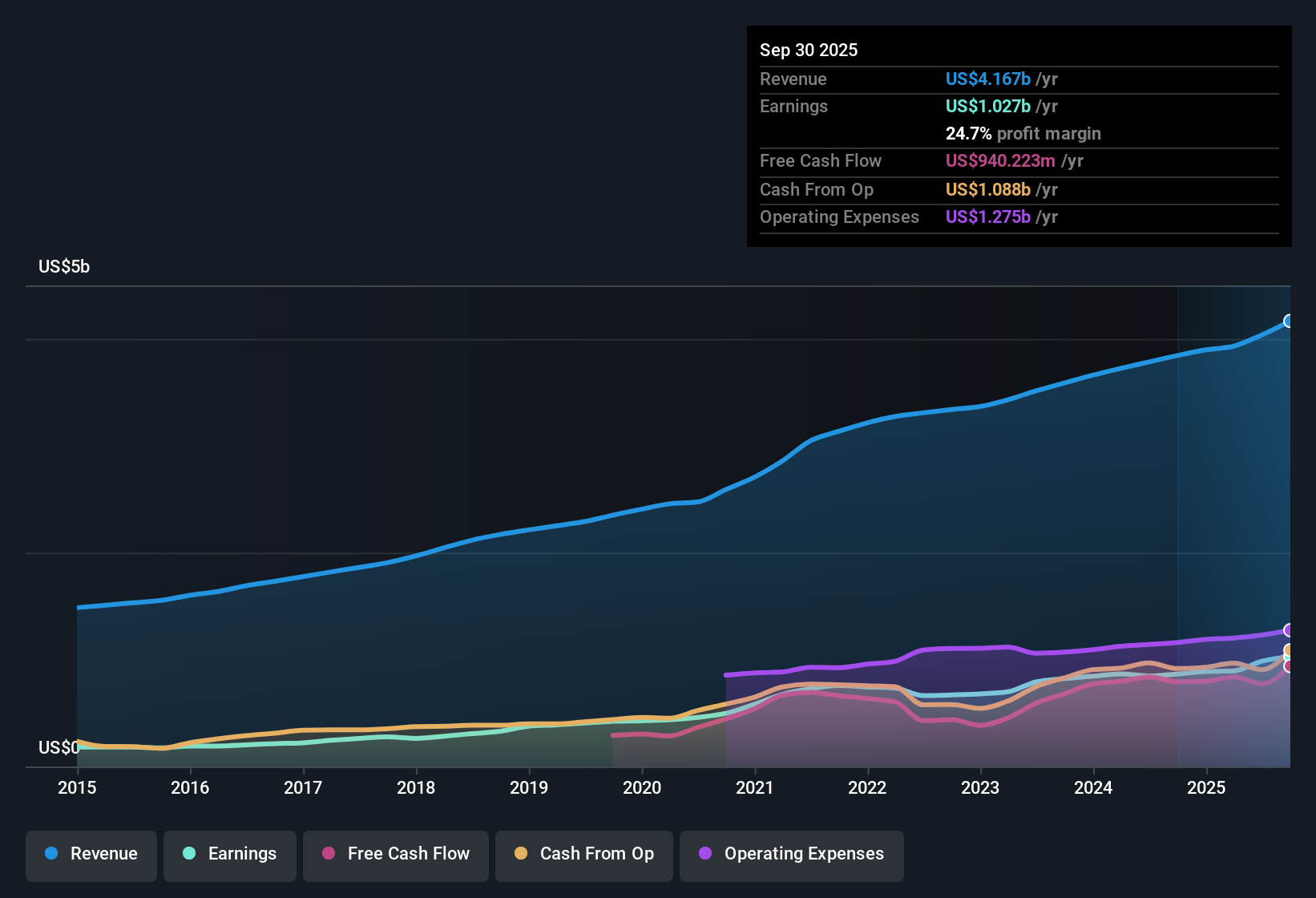

IDEXX Laboratories (IDXX) reported average annual earnings growth of 10.3% over the past five years, with a notable 16.6% rise over the most recent year. Net profit margins improved to 24.4% compared to 22.3% a year earlier, and earnings are expected to grow at a 9.2% annual pace, which is slower than the market average, while revenue growth is forecast at 8.2% per year, also trailing the broader US market’s 10.5% rate. Sustained margin gains point to ongoing financial strength, but the future growth outlook may give high-growth investors pause.

See our full analysis for IDEXX Laboratories.Next, we’ll see how these fresh numbers stack up against the dominant narratives. It is time to find out what holds up and what gets questioned.

See what the community is saying about IDEXX Laboratories

Recurring Revenue Powerhouse as Diagnostic Usage Expands

- International diagnostic revenue is growing at a double-digit pace outside North America, driven by expansion into underpenetrated markets and increased adoption of advanced platforms such as inVue Dx, Catalyst Cortisol, and Cancer Dx.

- Analysts' consensus view highlights that strong customer retention, a growing installed base of premium instruments, and pet owners’ willingness to spend on preventive care all support stable, high-margin recurring revenue streams.

- This recurring revenue is further strengthened by broader use of cloud-based practice management, which helps drive long-term earnings growth.

- Increasing frequency of advanced diagnostics per clinical visit is also boosting net margins and geographic diversification, tempering exposure to single-region market swings.

- With innovative products ramping up and broadening the menu, bulls point to IDEXX's ability to lock in recurring consumable sales and maintain upward pressure on profitability for future quarters.

Margin Expansion: Profits Outpace Sales Growth

- Profit margins have climbed to 24.4%, compared to 22.3% in the prior year, even as revenue growth comes in under the US market average at 8.2% versus 10.5%.

- Analysts' consensus view notes this margin expansion heavily supports long-term optimism:

- Despite topline growth below the broader market, IDEXX’s ability to grow margins indicates operational discipline and increasing operating leverage.

- Bulls argue that higher utilization of diagnostics and multi-product adoption are responsible for these impressive margin gains, which may offset slower revenue growth relative to peers.

Premium Valuation Sets a High Bar

- IDEXX trades at a price-to-earnings ratio of 53.2x, far above the US Medical Equipment industry average of 29.7x, and the current share price of $722.94 is just 1.6% above the analyst price target of $711.75.

- Analysts' consensus view cautions that at these valuation multiples, investor expectations for future revenue and earnings growth are already high:

- For today’s valuation to hold up, investors would need to believe that earnings can reach $1.3 billion by 2028, with margins rising to 25.3% and ongoing share count reductions of 2.3% per year.

- The relatively small gap between price and target suggests the stock is seen as fairly priced right now, but makes IDEXX vulnerable if growth, innovation, or adoption falters.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IDEXX Laboratories on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Wondering if your interpretation stands apart from the crowd? Take just three minutes to build your own narrative and share your outlook. Do it your way

A great starting point for your IDEXX Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

IDEXX Laboratories’ high valuation and slowing revenue growth compared to its peers mean that any setback in earnings or innovation could put pressure on its current price.

If you want to focus on stocks trading more attractively based on potential returns, check out these 839 undervalued stocks based on cash flows that could offer better value for your portfolio right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDXX

IDEXX Laboratories

Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives