- United States

- /

- Medical Equipment

- /

- NasdaqGS:IDXX

IDEXX Laboratories (IDXX): Assessing Valuation Following Strong Earnings Beat and Updated Growth Guidance

Reviewed by Simply Wall St

IDEXX Laboratories (IDXX) recently posted quarterly earnings and revenue that came in ahead of Wall Street forecasts, along with an updated full-year growth outlook. That strong performance has sparked fresh interest from investors.

See our latest analysis for IDEXX Laboratories.

The positive quarterly results and fresh full-year outlook from IDEXX Laboratories arrive on the heels of an important amendment to its major credit agreement earlier this month. Investors have taken note, driving a surge in momentum. IDXX boasts a remarkable year-to-date share price return of nearly 84% and a 1-year total shareholder return of 75%, signaling strong confidence in both recent execution and longer-term growth potential.

If IDEXX’s momentum has you exploring healthcare opportunities, you may want to see what else is out there. Discover See the full list for free.

With the stock delivering strong annual returns and currently trading just below analyst targets, the question now is whether IDEXX is still undervalued or if future growth has already been priced in by the market.

Most Popular Narrative: Fairly Valued

With IDEXX Laboratories closing at $752.14 and the most widely followed narrative assigning fair value at $754.83, markets are hovering right in line with consensus forecasts. This sets the stage for key strategic bets to shape sentiment ahead.

Expansion in innovative diagnostic platforms and international markets is driving recurring revenue growth, margin expansion, and enhanced geographic diversification. Strong customer retention and broader adoption of cloud solutions create stable, high-margin revenue streams and position the company for sustained long-term earnings growth.

Curious what underpins this razor-thin gap between price and fair value? The narrative rests on ambitious projections for revenue acceleration, margin expansion, and declining share count. Want to see which precise growth and profitability numbers anchor this storyline? Unlock the full forecast details driving this consensus.

Result: Fair Value of $754.83 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing U.S. clinical visit growth and intensifying competition could challenge IDEXX’s future revenue expansion and put pressure on its premium valuation outlook.

Find out about the key risks to this IDEXX Laboratories narrative.

Another View: Looking Beyond the Consensus

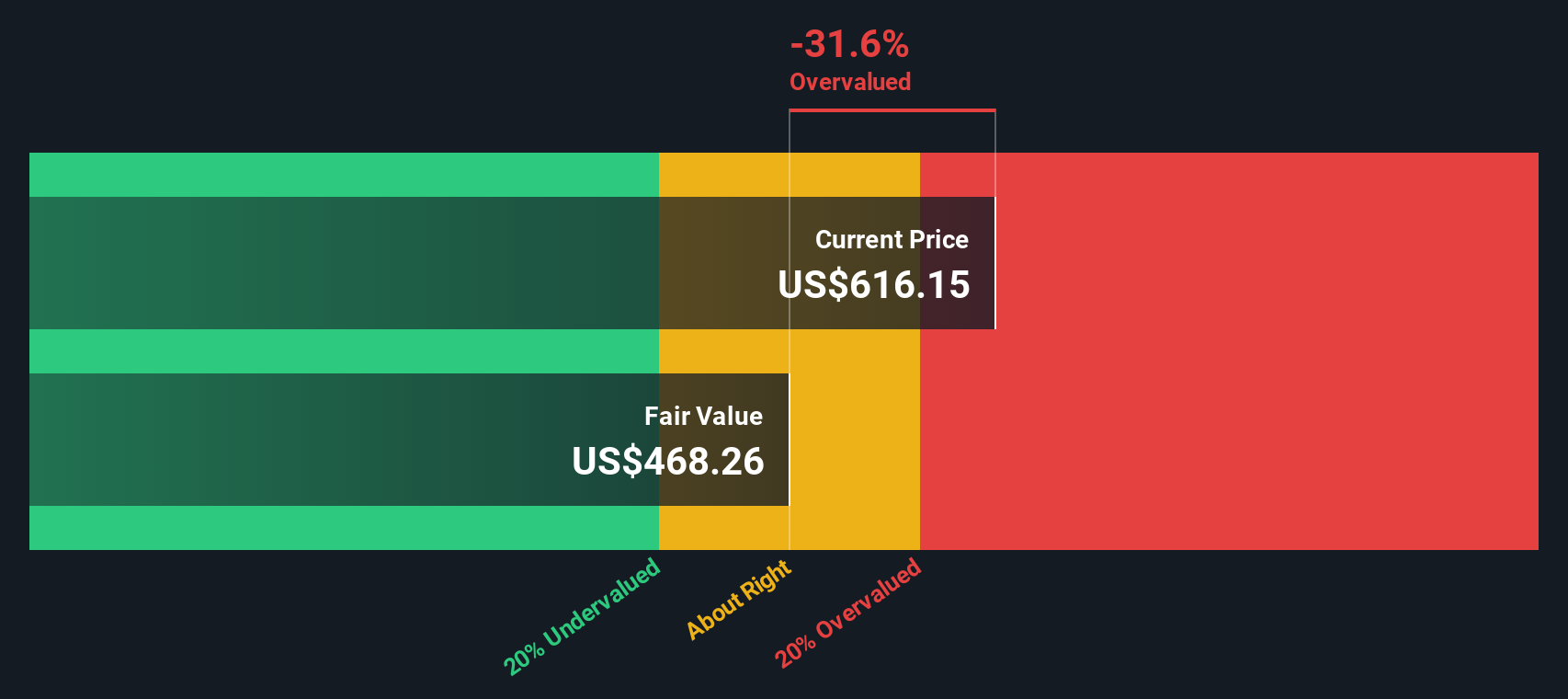

While analysts suggest IDEXX Laboratories is fairly valued based on future earnings growth and consensus price targets, our SWS DCF model tells a different story. According to this calculation, IDEXX’s current share price sits well above its estimated long-term fair value. This raises questions about whether the recent optimism has stretched too far.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own IDEXX Laboratories Narrative

If the prevailing narratives do not match your perspective or you prefer a hands-on approach, you have the tools to craft your own insights in just a few minutes: Do it your way.

A great starting point for your IDEXX Laboratories research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means acting on timely opportunities across different sectors and themes. If you want to uncover your next potential winner, don’t leave it to chance. Here’s where many investors are already finding strong ideas:

- Maximize income potential by checking out these 14 dividend stocks with yields > 3% offering yields above 3% that can boost your portfolio’s cash flow.

- Catalyze your exposure to exponential innovation and disruption with these 26 AI penny stocks riding the artificial intelligence megatrend.

- Get a head start in cutting-edge tech by reviewing these 26 quantum computing stocks positioned to benefit as quantum computing transforms entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDXX

IDEXX Laboratories

Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success