- United States

- /

- Healthtech

- /

- NasdaqCM:ICAD

iCAD, Inc. (NASDAQ:ICAD) Stock Rockets 26% But Many Are Still Ignoring The Company

iCAD, Inc. (NASDAQ:ICAD) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 29% in the last twelve months.

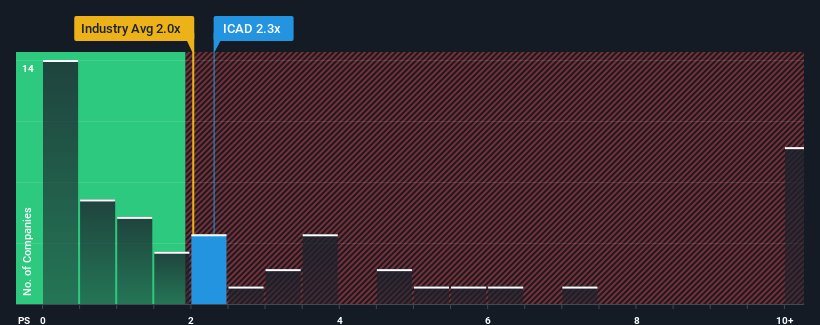

Although its price has surged higher, you could still be forgiven for feeling indifferent about iCAD's P/S ratio of 2.3x, since the median price-to-sales (or "P/S") ratio for the Healthcare Services industry in the United States is also close to 2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for iCAD

How iCAD Has Been Performing

Recent times haven't been great for iCAD as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think iCAD's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For iCAD?

In order to justify its P/S ratio, iCAD would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.4%. Still, lamentably revenue has fallen 45% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 15% over the next year. That's shaping up to be materially higher than the 9.5% growth forecast for the broader industry.

With this in consideration, we find it intriguing that iCAD's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does iCAD's P/S Mean For Investors?

iCAD's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, iCAD's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 3 warning signs for iCAD that you should be aware of.

If these risks are making you reconsider your opinion on iCAD, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if iCAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ICAD

iCAD

Provides AI-powered cancer detection solutions in the United States.

Flawless balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives