- United States

- /

- Healthtech

- /

- NasdaqCM:ICAD

iCAD, Inc. (NASDAQ:ICAD) Looks Just Right With A 47% Price Jump

Despite an already strong run, iCAD, Inc. (NASDAQ:ICAD) shares have been powering on, with a gain of 47% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 59% in the last year.

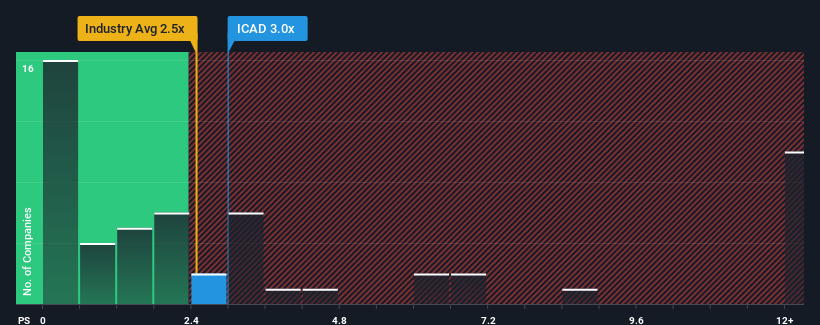

After such a large jump in price, given close to half the companies operating in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider iCAD as a stock to potentially avoid with its 3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for iCAD

How iCAD Has Been Performing

Recent times haven't been great for iCAD as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on iCAD will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, iCAD would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.4% last year. Still, lamentably revenue has fallen 45% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 8.9%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why iCAD's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From iCAD's P/S?

The large bounce in iCAD's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of iCAD's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - iCAD has 4 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if iCAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ICAD

iCAD

Provides AI-powered cancer detection solutions in the United States.

Flawless balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives